Posts Tagged "retirement"

December 18, 2018

Holidays with Dementia in the Family

When my grandmother was spirited away by dementia and no longer recognized me, I stopped visiting her in the nursing home.

I didn’t understand this at the time but now think that I just wanted to remember her baking lemon cream pies or waving at me as she rode around on her lawnmower cropping the lot next to her Indiana farmhouse.

I wish I could get another chance and do things better this time. Regret is hard to live with.

Psychologist Ann Kaiser Stearns views the holidays as a precious time of year to make elderly family members feel they are loved and included in the festivities.

“People respond for as long as they live to smiles, to touch, to music, to kindness, to sitting in the sun, to pumpkin pies,” Stearns, a professor of behavioral science, said in an interview.

“We just need to remember that all of that nourishes an elderly person to whatever degree they have impairments,” said Stearns, who also wrote “Redefining Age: A Caregiver’s Guide to Living Your Best Life.”

Stearns encourages people to make an extra effort to connect with a loved one over the holidays and provides some tips:

Be patient. Take the extra time to sit down with your parent, aunt, or uncle and talk to them. Encourage them to reminisce. “Don’t do something if you don’t have the time,” Stearns said.

Be present. If grandma doesn’t remember you or something that happened in the past, do not argue with her or ask, “Why don’t you remember?!” She advised that it’s better to say, “Remember grandma, it’s your granddaughter from Baltimore.” When an elderly person repeats or forgets, connect with them where they are now, even if it means going through the same conversation again.

Stir sweet memories. Stearns said that her friend’s father, a former minister, has Alzheimer’s but the friend brings him to church anyway. When Stearns’ parents were old, they used to sit happily watching the squirrels in their yard while her father smoked cigars. It’s important to repeat rituals that are uplifting and have always brought meaning to their lives. …Learn More

December 13, 2018

Reducing Poverty for Our Oldest Retirees

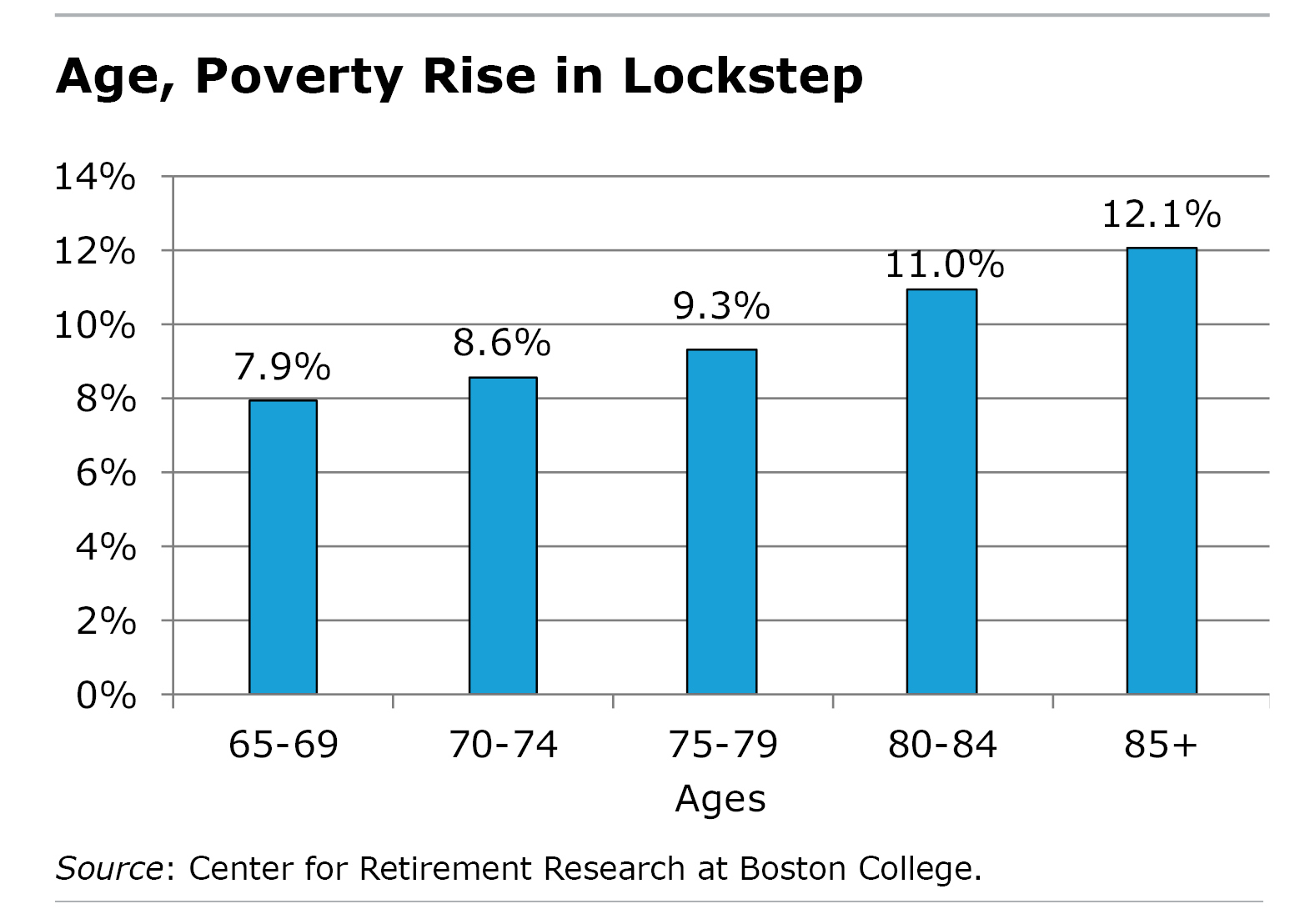

With more Americans today living into their 80s and beyond, the elderly are becoming more vulnerable to slipping into poverty.

To reduce the poverty risk facing the oldest retirees, some policy experts have proposed increasing Social Security benefits for everyone at age 85. Under one common proposal analyzed by the Center for Retirement Research in a new report, the current benefit at this age would increase by

5 percent.

The poverty rate for people over 85 is 12 percent, compared with 8 percent for new retirees. But more elderly people may actually be living on the edge, because the income levels that define poverty for them are so low: less than $11,757 for a single person and less than $14,817 for couples.

One reason the oldest retirees are especially vulnerable is that their medical expenses are rising as their health is deteriorating, yet they’re too old to defray the expense by working. This is occurring at the same time that the value of their employer pensions – if they have one – has been severely eroded by inflation after many years of retirement.

One reason the oldest retirees are especially vulnerable is that their medical expenses are rising as their health is deteriorating, yet they’re too old to defray the expense by working. This is occurring at the same time that the value of their employer pensions – if they have one – has been severely eroded by inflation after many years of retirement.

Further, elderly women are more likely to be poor than men, because wives usually outlive their husbands, which triggers a big drop in income that is generally not fully offset by a drop in their expenses.

Limiting the 5 percent benefit increase to the oldest retirees would ease poverty while containing the cost. …Learn More

December 4, 2018

Home Equity Offers Big Boost to Retirees

Retirees’ primary sources of income are the usual suspects: Social Security and employer retirement plans. They rarely use a third option: the equity locked up in their homes.

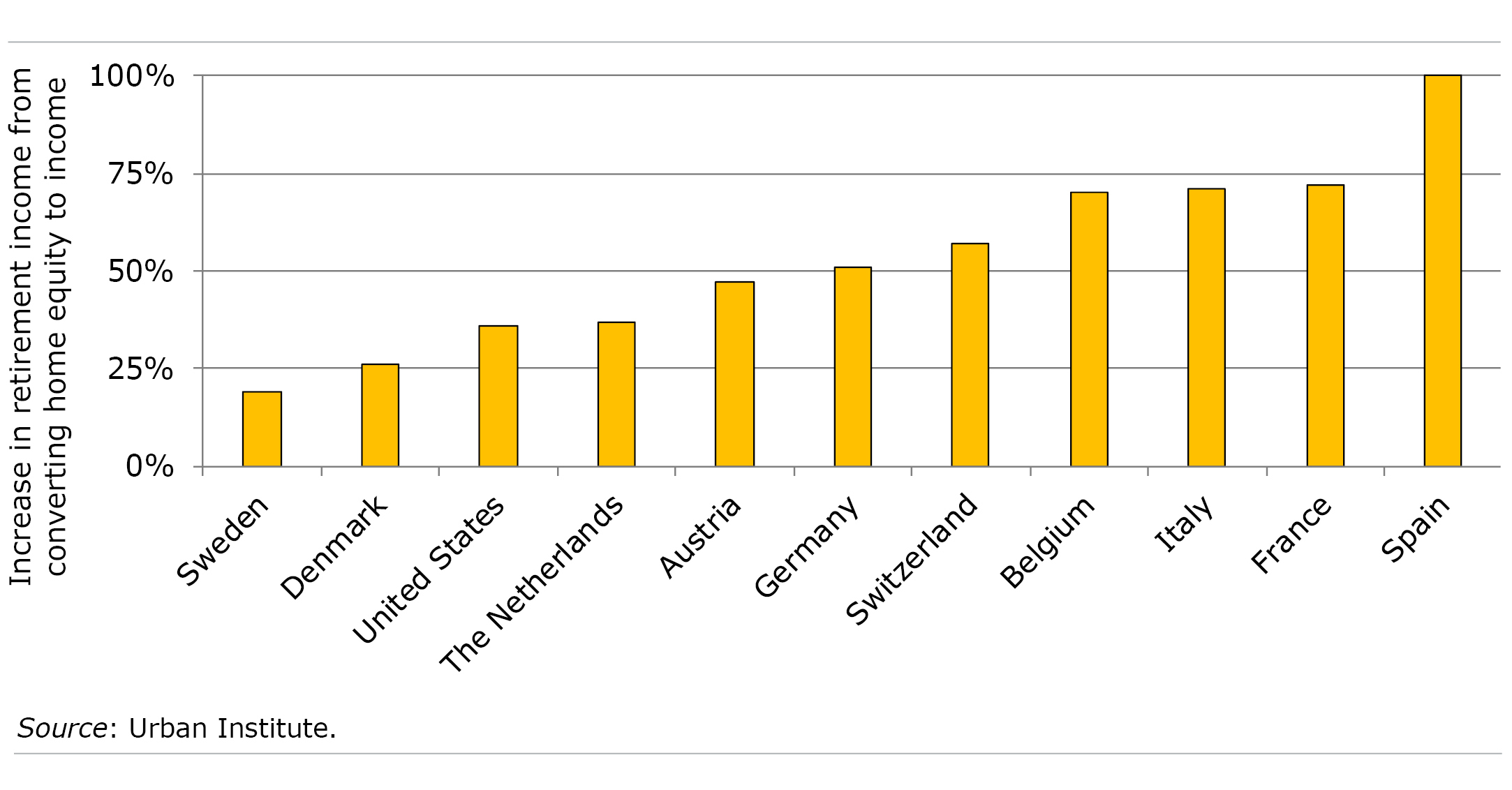

The Urban Institute recently quantified how much this untapped equity could be worth to seniors in the United States and 10 European countries if it were converted to income – and the amounts are significant.

The typical retired U.S. household has the potential to increase its retirement income by 35 percent, researchers Stipica Mudrazija and Barbara Butrica estimate. In Europe, using home equity would add anywhere from 19 percent in Sweden to 100 percent in Spain.

…Learn More

…Learn More

November 21, 2018

Holiday is Time to Recognize Our Readers

It’s the time of year to appreciate our readers. Thank you for supporting our blog on Twitter and Facebook too.

Squared Away, a retirement and personal finance blog, is sponsored by the Center for Retirement Research at Boston College. To stay current on our latest blog posts, sign up for our free, weekly email alert with links to that week’s two blog posts.

Have a lovely holiday. …Learn More

November 15, 2018

Why Couples Retire Together – or Don’t

Married couples don’t necessarily know what the other spouse is thinking about retirement.

This insight came out of a new Fidelity Investments survey that asked some 1,600 people if they knew when their significant other planned to retire. Only 43 percent answered the question correctly. This disconnect reveals just how few couples are talking about retirement, said Fidelity spokesman Ted Mitchell, who worked on the survey.

Fidelity’s survey went out to adults of all ages, so the younger ones no doubt felt they’re too young to be thinking – much less talking – about what their lives will be like decades from now.

But things change as couples age. When retirement comes into sharper focus, it’s natural to start talking through the options – mine, yours, and ours.

One option is to retire around the same time, and prior research has shown that roughly half of older couples do so.

New research takes a more nuanced look at how couples retire and finds a more complicated picture. Mixed arrangements are common in the pre-retirement years. Perhaps one spouse continues working full-time, even though their partner has retired, or one spouse might shift down to part-time work while the other is either still in a full-time job or has already retired.

Two sentiments are usually in conflict when older workers are trying to decide whether to retire: a longing for more leisure time and a need to bank more in savings, Social Security, and pensions.

Spouses often influence one another’s retirements for a variety of reasons, including their health, their relative ages, and how much each one likes their job. But financial security is usually a major consideration. …Learn More

November 8, 2018

A Proposal to Reduce Widows’ Poverty

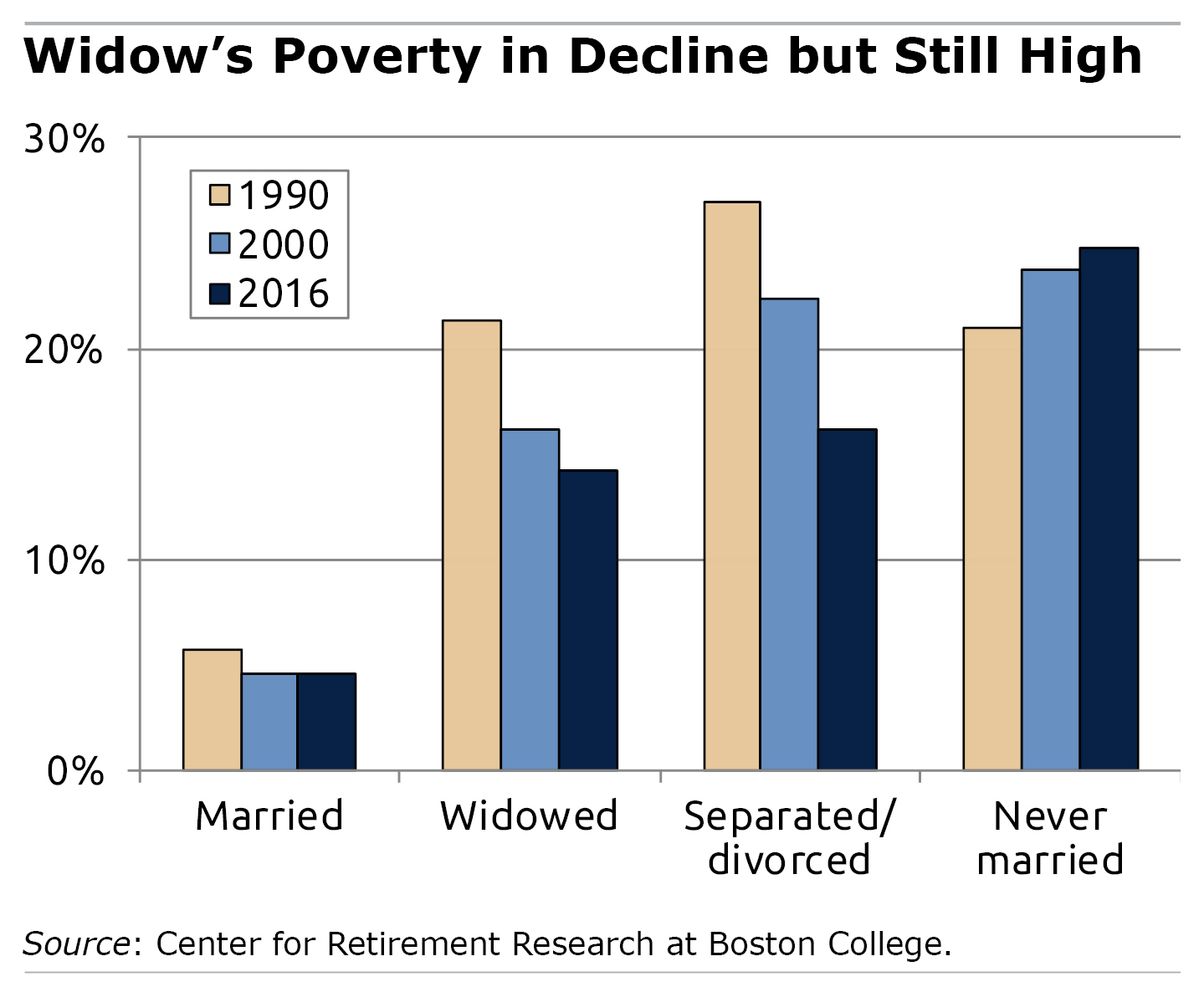

A dramatic decline in widow’s poverty over a quarter century has been a positive outcome of more women going to college and moving into the labor force.

Yet 15 percent of widows are still poor – three times the poverty rate for married women.

Yet 15 percent of widows are still poor – three times the poverty rate for married women.

A new study by the Center for Retirement Research takes a fresh look at Social Security’s widow benefits and finds that increasing them “could be a well-targeted way” to further reduce poverty.

Widows are vulnerable to being poor for several reasons. The main reason is that the income coming into a household declines when the husband dies. The number of Social Security checks drops from two to one, and any employer pension the husband received is reduced, or even eliminated if the couple didn’t opt for the pension’s joint-and-survivor annuity.

While one person can live more cheaply than two, the drop in income for new widows often isn’t accompanied by a commensurate drop in expenses.

Another issue begins to develop as much as 10 years before a husband dies. Prior to his death, his declining health may increase the couple’s medical expenses and reduce his ability to work, depleting the couple’s – and ultimately the widow’s – resources.

The irony today for wives who worked is that their decades in the labor force generally improve their financial prospects when they become widowed. Yet, under Social Security’s longstanding design, they receive less generous benefits than housewives – relative to the household’s benefits prior to the husband’s death. …Learn More

October 30, 2018

Retire in Boston or in Naples, Florida?

My husband is newly retired, and we’ve spent hours talking about where we might want to live after I retire in a few years. Our imagined scenarios are always changing.

But I’m clear on one thing: I do not want to buy a house in Naples, Florida, where a couple we know did recently. No offense to Naples, which has lots to recommend it – no shoveling! But the typical resident is 65 years old. In fact, Naples is older than the state of Florida, where retirement communities are so pervasive that they distinguish between the “young-old” (ages 60-75) and the “old-old” (over 75).

Boston, where my husband and I live now, couldn’t be more different. It is swarming with college students and young people, including his two sons and daughter-in-law. Boston’s young people work in rapidly changing industries like high-tech or environmental engineering, and I like it that way. Boston’s median age is 32 – half of Naples.

As I get closer to retiring and am faced with change, I think to myself, “Who wants to live in the midst of a bunch of old people like me?”

But that’s precisely what many retirees do. There are many examples of cities that have moved dramatically in the direction of one or the other extremes – Boston or Naples; Madison, Wisconsin, or Scottsdale, Arizona. The Wall Street Journal reported that new retirement communities are popping up in places that weren’t traditional resting places for snowbirds: retired baby boomers’ net migration to the Appalachian region where Georgia, North Carolina, and Tennessee converge has quadrupled since 2011.

This age segregation is a relatively new area of interest to demographers. Almost 60 percent of the neighborhoods and other subdivisions within U.S. counties have moderate or high levels of segregation, which is similar in degree to the level of segregation between the U.S. Hispanic and white populations, Richelle Winkler found in a 2013 study of federal Census data.

Age segregation also occurs in rural areas, as younger people leave for jobs and older people move in. In some rural parts of the Great Plains, Winkler writes, there are two times more seniors than young adults. …Learn More