Posts Tagged "retirement"

June 7, 2018

Be Optimistic. You Might Live Longer!

People who have a college education are known to live longer. But could a sunny disposition also help?

Yes, say two researchers, who found that the most optimistic people – levels 4 and 5 on a 5-point optimism scale – live longer than the pessimists.

But this effect works both ways. The biggest declines in optimism have occurred among older generations of Americans who didn’t complete high school at a time when this was far more common. It’s no coincidence, their study concluded, that the white Americans in this less-educated group in particular are also “driving premature mortality trends today.”

The finding adds new perspective to a 2015 study that rocked the economics profession. Two Princeton professors found that, despite improving life expectancy for the nation as a whole, death rates increased for a roughly similar group: white, middle-aged Americans – ages 45-54 – with no more than a high school degree. They suggest that addiction and suicide play some role, both of which have something to do with the deterioration in the manufacturing industry that once provided a good living, especially for white men.

To make the link between mortality and optimism, Kelsey O’Connor at STATEC Research in Luxembourg and Carol Graham at the Brookings Institution examined whether heads of households surveyed back in 1968 through 1975 were still alive four to five decades later. They controlled for demographic characteristics and socioeconomic factors, such as education, which also affect longevity. …Learn More

May 31, 2018

Medicaid Now Critical to Aging Workers

For decades, the Medicaid program has subsidized health care for the poor, including retirees.

Yet, until recently, it largely excluded most working-age adults without disabilities due to a strict monthly income limit.

All that changed in the 32 states and the District of Columbia that accepted the Affordable Care Act’s (ACA) option to expand their Medicaid coverage to low-income working people.

All that changed in the 32 states and the District of Columbia that accepted the Affordable Care Act’s (ACA) option to expand their Medicaid coverage to low-income working people.

In 2010, the ACA increased Medicaid’s income limits for people to qualify for the insurance. Today, working baby boomers, as well as younger workers, can qualify if their income is below 138% of federal poverty levels – or $1,396 per month for a single person and $1,892 for couples.

This joint federal-state program now completely or partially insures about one in six people approaching retirement age, according to a new report citing U.S. Census Bureau data.

The expansion is at least partly responsible for a striking improvement in one statistic: the uninsured rate for adults between ages 50 and 64 fell from 15.5 percent in 2012 to 9.1 percent in 2016. …Learn More

May 24, 2018

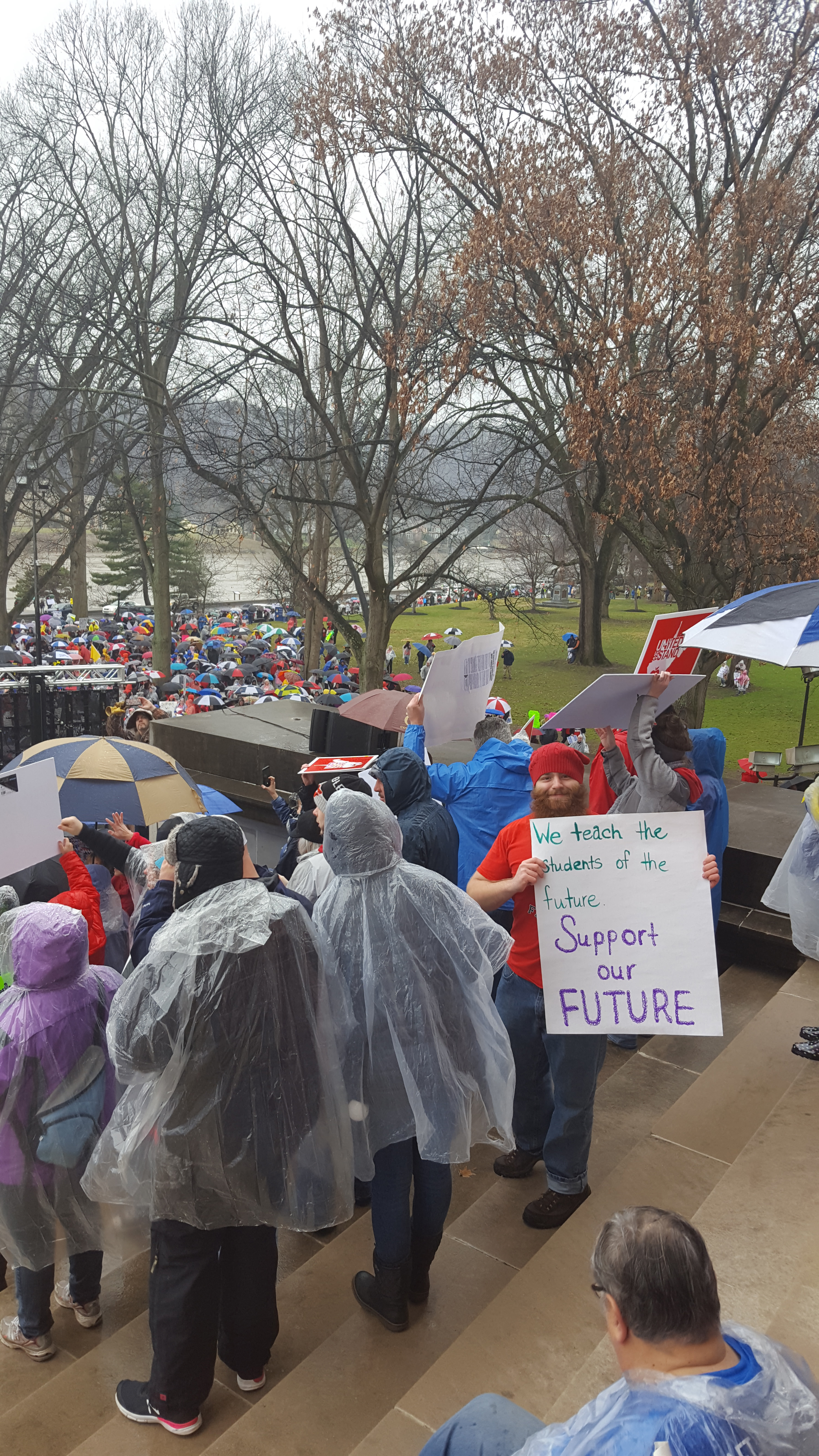

Public Pension Cuts Hit Recruitment

West Virginia teachers started the wave of strikes over pay.

Photo courtesy of Janet Bass, American Federation of Teachers

Teachers’ strikes and walkouts over inadequate pay – in Arizona, Kentucky, Louisiana, North Carolina, Oklahoma, and West Virginia – are making news this spring. In Oklahoma, half the people who’ve left teaching recently said pay was their top reason for moving on.

A wave of reductions in another significant form of compensation – pensions – also appear to be making state and local governments a less appealing place to work, according to researchers Laura Quinby, Geoffrey Sanzenbacher, and Jean-Pierre Aubry at the Center for Retirement Research, which publishes this blog.

Pensions have traditionally been the great equalizer for governments trying to recruit people from the higher-paying private sector. But benefit cuts, which had been fairly uncommon, gained momentum after the 2008 stock market crash that battered pension funds’ already declining finances.

The pace of cost-cutting reforms peaked in 2011, when 134 state and local government plans made some type of cuts that year. They run the gamut from increasing the tenure requirement or retirement age applied to new employees’ future pensions to trimming the cost-of-living adjustment on all pensions. …Learn More

May 22, 2018

Squared Away at Year 7

Seven years ago this month, this personal finance and retirement blog debuted. How things have changed.

For one thing, back in 2011, a lot more people were reading blogs and newspapers on their clunky desktop computers. In recognition of the now-ubiquitous smart phone – more accurately, a computer that happens to have a phone – we just redesigned how Squared Away looks on phones to enlarge the type and make the articles easier to read. Our older readers will appreciate this update.

Year 7 is also an opportunity to restate the blog’s mission, which, frankly, was not fully refined in the early years. In some ways, our mission has not changed: we continue to emphasize retirement security and personal finance, with a bent toward the evidence-based research that provides a clearer understanding of the financial, economic, and behavioral issues that are critical to a high quality of life.

We regularly report on research by scholars around the country, including studies produced by members of the U.S. Social Security Administration’s Retirement Research Consortium: the NBER Retirement Research Center in Cambridge, Mass., the University of Michigan Retirement Research Center, and the Center for Retirement Research at Boston College, which also is the blog’s home.

But it’s natural for a new publication to find its sweet spot over time, and Squared Away is no different. One theme that has emerged very clearly is that the threads of retirement saving are shot through the fabric of our financial lives.

The predicament of Millennials is an obvious example. Immediately after beginning their careers, 20- and 30-somethings – so much more than their parents and grandparents – are under the gun to save for retirements that no longer are likely to include a pension. …Learn More

May 17, 2018

Target Date Funds are on a Roll

For the sheer simplicity they bring to 401(k) investment decisions, retirement experts have been big fans of target date funds for years.

Now, their popularity is soaring with the people who really count: employees.

Last year, 401(k) participants poured a record $70 billion into target date funds (TDFs), an investment option that automatically shifts the asset allocation in the portfolio to reduce risk as employees approach a designated retirement date. TDFs have become the first choice for people who, rather than go it alone and pick their own mutual funds, like having their employer’s mutual fund manager do it.

According to a new report by Morningstar, the Chicago research firm, the new money flowing in has averaged $66 billion annually over the past three years, a 28 percent increase over the prior three-year period. The inflows exclude new money from investment returns.

The surge in new invested money has been more about the intensity of baby boomers’ efforts to save for an impending retirement, Morningstar said, than the fact that strong returns usually pull investors into the stock and bond markets.

In another major development, TDFs invested in passive index funds are now investors’ predominate choice. This is a full reversal from a decade ago, when most TDFs were invested by stock pickers. (Although more money is now flowing into passively invested TDFs, actively managed TDFs still hold more in total assets.) …

Learn More

May 15, 2018

Why Retirement Inequality is Rising

Just as the wealth and income gap between the well-to-do and working people is growing, so, too is retirement inequality.

Researchers increasingly want to know what’s behind this phenomenon. They’ve uncovered reasons ranging from low-income workers’ greater difficulty saving to the well-to-do’s longer life spans – which means they’ll get more out of their Social Security benefits.

Researchers increasingly want to know what’s behind this phenomenon. They’ve uncovered reasons ranging from low-income workers’ greater difficulty saving to the well-to-do’s longer life spans – which means they’ll get more out of their Social Security benefits.

Having a low income doesn’t necessarily mean a retiree can’t live comfortably. What matters is how much of their earnings they will be able to replace with Social Security and any savings.

Even by this standard, lower-income workers come up short: 56 percent are at risk of having a lower standard of living when they retire. The decline is slightly less for middle-income workers – 54 percent – but the risks fall sharply, to 41 percent, for the people at the top.

The roots of this inequality span Americans’ lives from cradle to grave:

- In our 401(k) system, financial security in retirement increasingly hinges on how much people can save in their 401(k)s as they work. But it’s harder for low-income workers to save, mainly because their employers are less likely to offer a savings plan, according to a 2017 study by The New School for Social Research. The study also found that basic living expenses gobble up more of their paychecks, and they experience more financial disruptions from layoffs and divorce, leaving less for savings.

- Some research assesses inequality trends for specific groups of people. Incomes tend to rise over time, even after being adjusted for inflation, but they rise more slowly for people near the bottom of the earnings scale. Lower earnings translate later to lower retirement incomes. For example, the future retirement income of well-heeled members of Generation X, relative to today’s retirees in the high-income bracket, is estimated to be two times more than it will be for low-income Gen-X retirees, according to an Urban Institute study. …

May 8, 2018

Social Security Mistakes Can be Costly

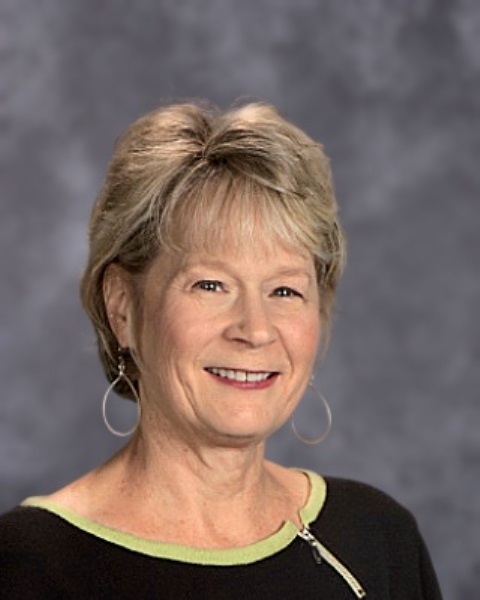

Kay Dobson is 68, and it’s time to retire from her job as the jack of all trades at the Augusta Circle Elementary School in Greenville, South Carolina.

But she isn’t quite as ready for her June retirement as she could’ve been. She recently learned that an admitted unfamiliarity with Social Security’s arcane rules cost her about $31,000 for two years of foregone spousal benefits based on her husband’s earnings.

“I had not the vaguest idea that I would be eligible for that,” she said.

Dobson is hardly the first person to make a painful mistake like this. People have all kinds of misconceptions about Social Security, or they lack a basic understanding of how it works – that the government calculates benefits using their 35 highest years of earnings, that the size of the monthly checks depends on the age the benefits start, and that working women, like Dobson, are often entitled to a spousal benefit based on their husband’s work record and earnings.

Two years ago, Dobson could have applied for this benefit, because she’d reached her full retirement age – 66. But since she didn’t know this at the time, Social Security recently sent her a check for $7,800 for only six months retroactively – typically the maximum period for retroactive spousal benefits.

Her $1,300 monthly checks are starting to come in now too. When she turns 70, she’ll start collecting a larger benefit based on her own earnings from a long-time career in the school system.

This particular strategy – file for spousal benefits and delay your own – is now available only to people who turned 62 prior to Jan 2, 2016. The unintended loophole was eliminated, because it subverted the original intent of the spousal benefit, which was designed with an eye to retired households with a low-earning or non-working spouse. (The spousal benefit, in and of itself, remains intact and can be a big help to older households in which a working wife earned less than her husband. If that’s the case, her Social Security benefit would be increased until it is equal to half of his full retirement benefit if she claims at or above her own full retirement age.)

The central point here is that ignorance of program rules can mean substantial losses for retirees. For low- or middle-income retirees, the consequences can be especially dire since they’re already scraping by. …

Learn More