Posts Tagged "retirement"

March 10, 2020

Hypertension, Arthritis? Keep Working!

The growing list of effective medications available for managing a variety of chronic conditions seem to be changing the way we work and retire.

For example, older workers at one company who suffer from arthritis and high blood pressure – two relatively easy conditions to treat – are able to keep working just like their healthier co-workers, according to a new study from a research consortium funded by the U.S. Social Security Administration.

In fact, the two specific groups in this study – employees with hypertension or a combination of arthritis and hypertension – actually worked an average of four to 10 months longer, respectively, than the healthy workers. This counterintuitive finding might owe to the fact that people with chronic conditions are motivated to work longer to maintain their employer health insurance. Another possibility is that, because of their condition, they pay closer attention to their overall health and take better care of themselves.

The researchers, who are from Stanford University’s Medical School and Princeton University, had the advantage of access to nearly 4,700 employees’ detailed medical records, which allowed them to track how their health progressed over an 18-year period, until they retired.

A limitation of the study is that the employees aren’t representative of the general working population. They were mainly white men employed in Alcoa smelters and fabrication plants around the country. And because it was very common for them to join the company in their 20s and qualify for a 30-year pension, their average retirement age was only 58.

But older workers in a wide variety of professions are reckoning with the need to work longer than they might have planned so they can afford to retire.

A chronic medical condition doesn’t have to be a barrier to working as long – or even longer – than everyone else. …Learn More

March 3, 2020

Pre-Retirement Debt is Rising Over Time

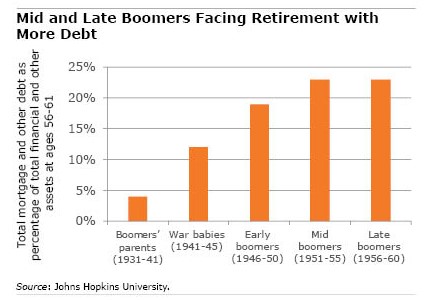

Baby boomers have a lot more debt than their parents did.

Baby boomers have a lot more debt than their parents did.

By all accounts, the parents were in pretty good shape for retirement because they held their debt levels down to a mere 4 percent of their total assets in the years immediately before retiring – ages 56 to 61 – according to a new study.

At those same ages, the typical baby boomers’ debt has ranged from 19 percent to 23 percent of their assets, thanks in large part to the 2008 drop in stock portfolios and in the housing market.

Generational trends in debt levels are difficult to analyze, and the issue is far from settled among researchers. This study notes, for example, that the situation might not be as grim as the rising debt indicates.

The broad numbers hide the positive step boomers have taken – just as earlier generations did – to reduce their debt as they moved through their 50s. And although the younger boomers have fewer assets than older boomers had at that stage of life, the younger boomers are also working to improve their finances by paying down their mortgages at an accelerated pace.

But the analysis also uncovered another troubling trend for the baby boomers born in the middle of the demographic wave: about 10 percent of them had more debt during their late 50s than their assets were worth. When their parents were that age, some of the most indebted of them still had more assets than debts.

In his study, Jason Fichtner of Johns Hopkins University compared debt-to-asset ratios for five different age groups, starting with the boomers’ parents, who were born during the Great Depression, and running through the people who were born toward the tail end of the baby boom. The chart above is a financial snapshot of rising debt-to-asset ratios for each group when they were between ages 56 and 61. …Learn More

February 27, 2020

Retirement is Liberating – and Hard Work

Most baby boomers find the first weeks of retirement liberating. But it takes some work to ensure the feeling lasts.

“Almost everyone is just thrilled with the first days of retirement, and the big thing is: ‘I do not have to set my alarm,’ ” said Harvard Business School professor Teresa Amabile. Eventually, another thought dawns on a new retiree: “I don’t want to turn into one of those people who sits around in their jammies half the day. I need more of a routine.”

That’s when they start investigating what they’ll do with their time, said Amabile, who, with a team of researchers, interviewed 83 older professionals during their pre- or post-retirement years (or both) to understand the transformation from worker to retiree.

For a smooth transition, the planning should start well before leaving your job, as you process the question of how and when to retire. A critical part of the retirement decision is making sure you can afford it. But the psychological preparation is just as important.

This work, which boils down to four essential tasks, can take several years before and after the retirement date to complete. The first task – the decision to retire – was covered in last Thursday’s blog. Here are the remaining three:

Detach from work. Some people already have one foot in retirement while they’re still working. This can happen organically as an older worker starts to feel marginalized, or it can be a self-directed detachment as he or she becomes psychologically more distant in preparation for leaving. Amabile said completing the process of detaching from work can take weeks or years after retirement day. …Learn More

February 25, 2020

Have You Misplaced a Retirement Plan?

Wouldn’t it be nice to find some money sitting in a long-forgotten retirement account somewhere?

It’s not hard for workers to lose track of an old account as they move from employer to employer, often across state lines. Each state government keeps a repository of unclaimed property – most have been doing this since the 1980s – and residents and former residents can check online through a simple name search in the state’s unclaimed-accounts database.

But not everyone takes the trouble to search for the money or is even aware it exists. So billions of dollars have accumulated nationwide in various types of unclaimed accounts, including retirement plans, insurance policies, trusts, and brokerage and bank accounts – so much so that firms have sprung up that will do the legwork required for individuals to claim their money. But little has been known about how much sits idle in unclaimed retirement accounts.

A new study estimates conservatively that about $38 million, accumulated over many years in some 70,000 retirement savings plans nationwide, had not yet been claimed in the states’ property accounts as of 2016. Most of these are 401(k)-style plans but they also include IRAs and pension checks.

The average account value is only about $550. But the largest ones are anywhere from $5,000 to $13,000, which could be meaningful to retirees who are struggling financially. …Learn More

February 20, 2020

Mapping Out a Fulfilling Retirement

One might say that baby boomers on the cusp of retiring come in two varieties. Some cannot wait to retire and already have a plan. For others, the unknowns fill them with dread.

How will I occupy my days? Should I do something meaningful, or is the goal just to have fun? And how do I figure this out? At 62, this writer really has no idea.

For the other boomers who are feeling this way, take some comfort in knowing you are in good company.

“I can’t say this strongly enough. There are some people who seem to literally not think about what their retirement might look like before they retire,” says Harvard Business School professor Teresa Amabile, whose research team interviewed 83 professionals in their pre- or post-retirement years (or both) to study how they navigate the transition years.

A big part of retiring is letting go of what can be a strong identification with work, and people are reluctant to give that up, she said. This identity might be attached to one’s profession – doctor, professor, carpenter – or to an employer, a specific experiment, or the team on your current project. For others, identity is tied to being the family breadwinner. For many people entering retirement, the basis of that identity is “profoundly shaken,” Amabile said.

Of course, not everyone confronts an identity crisis. Older people who are eager to start a new chapter of their life or are simply burned out by work may find that it’s liberating to shed that old identity and move on.

But, according to Amabile, a more arduous process is common. Many older workers begin to realize, “My identity as a person and my work are really bound up together, so I need to work through that.” A crucial part of planning for retirement is determining “what life is going to be like without work, because work structures your life,” she said.

Amabile described the problems one couple in the study encountered because they didn’t have a solid plan. After retiring, they moved out of the community they’d lived in for 25 years and relocated near some family members. But two years later, they still hadn’t settled comfortably into their new life and “felt at loose ends all the time,” she said.

To prevent this from happening to you, consider that boomers typically must go through four tasks as they transition to a satisfying retirement; Amabile and her team members – Lotte Bailyn, Douglas Hall, Kathy Kram, Marcy Crary, and Jeff Steiner – saw these four tasks in many of their interviews with baby boomers.

The tasks – described below and in a follow-up blog – don’t have to happen in any particular order, though the most common sequence is: Decide to retire. Detach from work. Explore a new life structure. Consolidate a new life structure. …Learn More

February 11, 2020

Most Older Americans Age in their Homes

Retirees are apparently unpersuaded that it’s a good idea to convert their substantial home equity into some retirement income.

One way to tap this home equity is through state programs that defer older homeowners’ property taxes. The programs are offered in many states, but very few people take advantage of them. Retirees are also skeptical about the benefits of converting their equity into income using a federally insured reverse mortgage: only about 50,000 older homeowners, on average, get them every year.

A big concern is that if they ever sell the house, the back taxes or the reverse mortgage must be paid back – with interest.

But a new study by the Center for Retirement Research finds that this is an unlikely scenario for the majority of retirees, because they rarely move or don’t move at all.

The researchers constructed a picture of how Americans’ living situations change between their 50s and the end of their lives by combining the data for two separate age groups. They matched the households in one group, who were between age 50 and 78, with similar but much older households in the second group and then followed the second group through most of their 90s.

The researchers found that 53 percent of this constructed sample of homeowners never moved out of the house they owned when they were in their early 50s.

Another 17 percent relocated around the time they were retiring and then generally stayed put. Although the households in this group tended to be more educated and better off financially than the people who never moved, both groups ended up with substantially more housing wealth than the people who moved frequently. …Learn More

February 6, 2020

Can’t Afford to Retire? Not All Your Fault

Three out of four members of Generation X wish they could turn back the clock and get another shot at planning for retirement. One in three baby boomers say don’t think they’ll ever be able to retire.

“Overwhelmingly, Americans are stressed about their current – and future – financial situation,” the National Association of Personal Financial Advisors said about these new survey results.

Regrets about not planning and saving enough are enmeshed in our thinking about retirement. But it is really all your fault that you’re not getting it done?

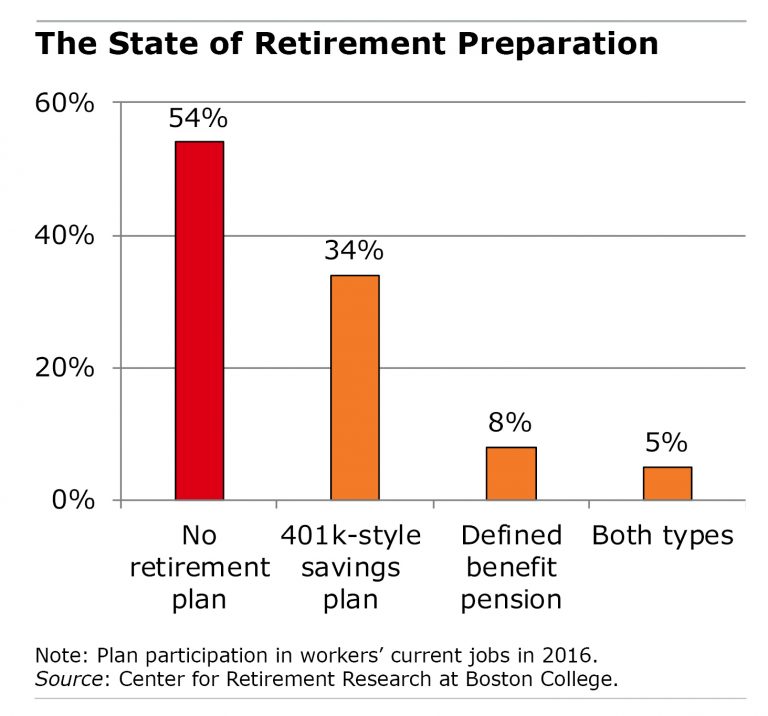

The honest answer to that question is “no.” There are big gaps in the U.S. retirement system that make it very difficult for many to carry the responsibility it places on workers’ shoulders.

I predict some of our readers will send a comment into this blog saying, “I worked hard and planned and am comfortable about my retirement. Why can’t you?”

Granted, we should all strive to do as much as possible to prepare for old age, and many people have made enormous sacrifices in preparation for retiring. The hard truth is that some people are much better-positioned than others. Obvious examples include a public employee with a pension waiting for him at the end of his career, or a well-paid biotechnology worker with an employer that contributes 10 percent of every paycheck to her retirement savings account. These workers frequently also have employer-sponsored health insurance, which limits their out-of-pocket spending on medical care. This leaves more money for retirement saving than someone who pays their entire premium and has a $5,000 deductible.

Sure, we could all do a better job of planning out our careers when we’re first starting out. But my husband, as a Boston public school teacher, started accruing pension credits before he could’ve imagined ever getting old. He recently retired, and his pension, accumulated during 27 years of teaching, is making our life a lot easier.

Sure, we could all do a better job of planning out our careers when we’re first starting out. But my husband, as a Boston public school teacher, started accruing pension credits before he could’ve imagined ever getting old. He recently retired, and his pension, accumulated during 27 years of teaching, is making our life a lot easier.

But pensions are on the wane in the private sector, and more than half of U.S. workers have neither a pension nor a 401(k) in their current job – this makes it pretty hard to save. IRAs are an option available to anyone, but human inertia makes that an imperfect solution to the problem, because people tend to procrastinate and don’t set them up. Further, working couples in which only one spouse has a 401(k) aren’t saving enough for both of them, one analysis found. …Learn More