Posts Tagged "retirement"

March 4, 2015

Some Spouses Shun Retirement Planning

Retirement is a joint project for married couples, but remarkably only 43 percent of couples plan for it together.

Are wives to blame?

Some husbands expressed frustration that their wives don’t engage in planning during a focus group conducted by Hearts & Wallets. One man reported that his wife “is not interested in investing,” and another said “all my wife cares about is if we’re going to have the money.”

A San Francisco man volunteered this worst-case scenario: “If I were to get hit by BART on the way home, she would be clueless about what to do with whatsoever there is or how to handle anything.”

Hearts & Wallets cofounder Laura Varas calls it the issue of the “uninvolved spouse.” In a new analysis of its 2013 survey data on 5,400 US households, the financial research firm found that 80 percent of these uninvolved spouses are wives among couples approaching retirement age. The good news is that younger wives are more engaged, Varas said. In early- and mid-career couples, fewer than 60 percent of uninvolved spouses were women.

Yet it’s hard to imagine how anyone can avoid this conversation, given the myriad issues to resolve: Will you stagger your retirement dates, especially if your ages are far apart? If saving and paying off the mortgage are twin retirement goals, are you both still contributing enough to your 401(k)s to ensure you get the full employer match? Have you coordinated your strategies for claiming Social Security? Will you be financially secure if your spouse dies first? …Learn More

February 19, 2015

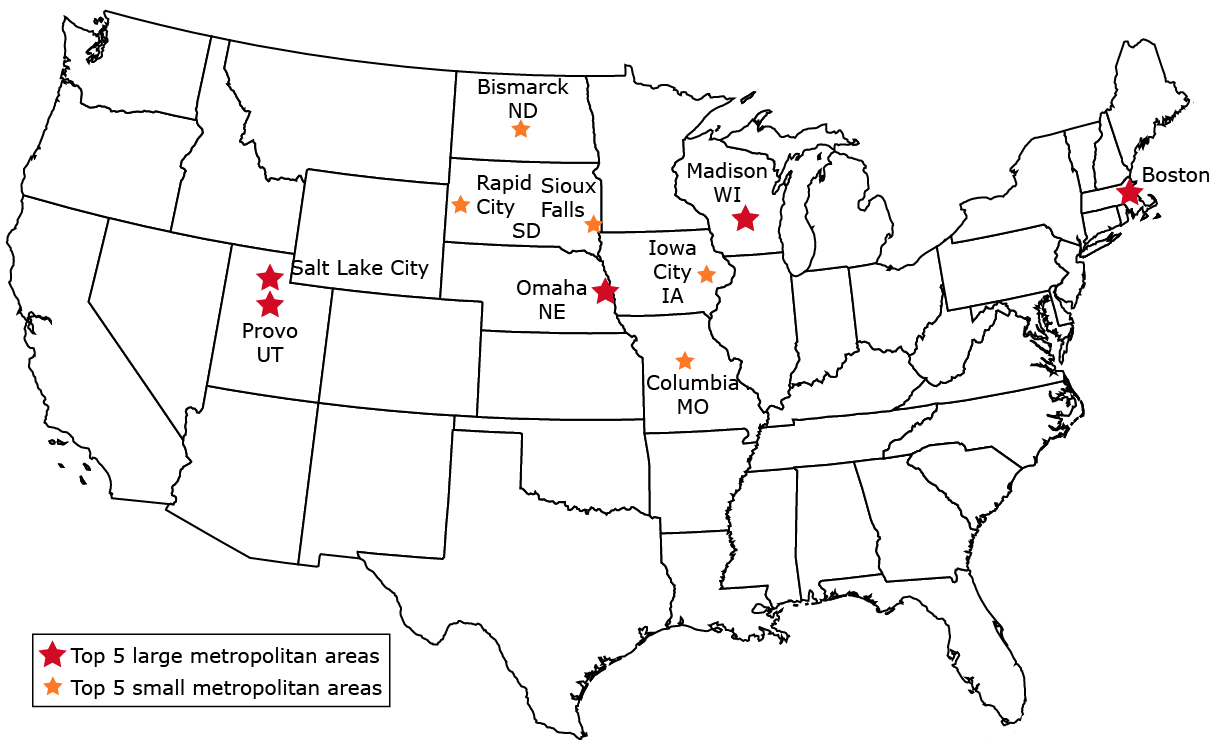

Ranking: Top Cities for Successful Aging

With snowstorms hammering the eastern United States, some baby boomers may be looking for a permanent escape when they retire.

Yet Southern cities did not come out on top in the Milken Institute’s new ranking of the Best Cities for Successful Aging, a ranking based on a fairly comprehensive set of factors important to seniors. Take frigid Iowa City, the No. 1 small city: it gets credit for its transportation and the affordability of its assisted living and adult day care services.

Milken Institute economist Anusuya Chatterjee saw common themes among the top-ranked metro areas. They tended to have vibrant economies, quality healthcare services, opportunities for intellectual stimulation and active lifestyles, and easy access to amenities like grocery stores, transit, and culture.

University towns often fill these requirements, she said. Madison, Wisconsin – home of the University of Wisconsin – was the top-ranked large metropolitan area.

Financial considerations also influenced the rankings, such as living costs and the cost of day services for the elderly or assisted living. Convenience amenities have financial implications too – a monthly subway pass is cheaper than owning a car.

The methodology, explained in more detail later, was more rigorous than what’s typically found in city rankings. Here are other surprising results: …Learn More

February 12, 2015

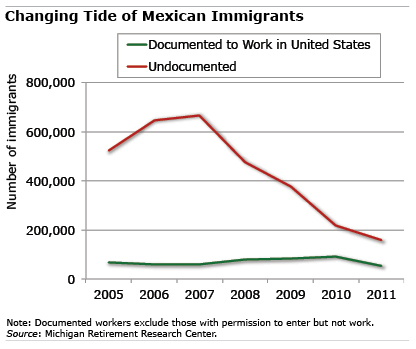

Immigrant Flows Impact Social Security

Manuel Carvallo immigrated from Mexico at age 40 and became a U.S. citizen at 51. The Georgia pension consultant just reached another milestone, accumulating the 10 years of U.S. work experience required to receive a small Social Security pension when he retires.

Millions of immigrants from around the world who work here illegally could get the same opportunity as Carvallo under President Obama’s executive actions on immigration, which propose to give many of them temporary legal work papers and Social Security numbers. Great uncertainty remains about where U.S. immigration policy is heading as Congress actively seeks to reverse the president’s administrative actions

What is clear is that when undocumented immigrants – farm workers, hotel workers, and household and restaurant staff lacking green cards or other legal status – do pay into Social Security, they often have little prospect of ever receiving benefits. In 2010, some 3 million such workers with fake or expired Social Security numbers added a $12 billion bonus to the Social Security Trust Fund, the U.S. Social Security Administration estimated. …Learn More

February 3, 2015

The Impact of Taxing Health Premiums

Excluding the health insurance premiums paid by employers and employees from workers’ taxable earnings is the federal government’s largest single tax expenditure, amounting to some $250 billion a year in lost revenue.

Eliminating the exclusions – as some in Washington have proposed – would sharply increase how much is taken out of workers’ paychecks for payroll taxes and for income taxes. But any such proposal would also put more money in their pockets when they retire by increasing the earnings base on which their Social Security benefits are calculated.

Urban Institute researchers Karen Smith and Eric Toder recently estimated the policy’s impact on workers’ taxes and benefits and found that it varied widely for different income groups and among people born in five different decades, the 1950s through the 1990s.

Their analysis took into account the myriad idiosyncrasies of the U.S. tax code, including a regressive payroll tax, a progressive income tax, Earned Income Tax Credits paid to the lowest-wage workers, and the cap on payroll taxes for the highest earners. To evaluate the proposals’ impact, the researchers added the premium amounts paid by both the employer and employee to workers’ taxable incomes – just as the deficit reduction proposals would do.

The resulting tax bite would be largest for the middle class. That’s because middle-income workers are more likely to have employer-provided health insurance than lower-income workers, and their insurance premiums are a larger share of their income than they are for higher-income groups. Under the proposal, middle-income workers’ federal income and payroll taxes would rise by an amount equal to 3.5 percent of their lifetime earnings. …Learn More

December 23, 2014

What Readers Liked in 2014

Since you are the best judges of what financial information is most useful, it’s a holiday tradition to feature readers’ favorite articles published during the year.

Please spread the word among family and friends about the most popular 2014 blogs, listed below, by “liking” Squared Away’s Facebook page. Readers can also sign up for emails of each week’s headlines.

The articles are ranked in the order of their total page views:

- Retirees Live on Less. People who’ve already retired say adjustments are required to live on a smaller income.

- Retirement Delayed to Pay the Mortgage. Paying off the house tilts many baby boomers’ decisions.

- Retirement: a Good State of Mind. New research tries to resolve the conflicting evidence about whether retirement is good for you.

- How Much For the 401(k)? Depends. Saving is critical in a 401(k) world. The sooner Millennial workers start, the less painful saving will be.

- Parents’ Longevity Sways Plans to Retire. If a parent dies suddenly, retirement becomes a higher priority. …

December 16, 2014

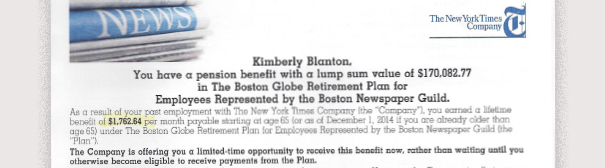

Evaluating a Pension Buyout Offer

Like many baby boomers, I’ve received an offer from a former employer that’s meant to entice: “The Company is offering you a limited-time opportunity to receive this benefit now, rather than waiting until you otherwise become eligible to receive payments from the Plan.”

My 17-year employment as a Boston Globe reporter entitles me to a $1,762 monthly pension for life, starting at age 65. I’m 57 now. But a few weeks ago, the company put two alternatives on the table: take a smaller pension that starts now or trade my pension for a lump sum of $170,000 in cash. The deadline for accepting the new offer: the day after Christmas.

The New York Times Co., which used to own the Globe, has no doubt made this offer to employees for the same reason most companies do: to reduce burdensome pension liabilities and create financial certainty. But what’s in it for me? And how should other boomers think about similar offers coming over the transom?

My first thought was this: I’m working now and don’t want or need a pension right away. This money is for my retirement. I view my decision as choosing between the remaining two options: my original pension at 65 or the new lump sum offer.

A senior economist here at the Center for Retirement Research, Anthony Webb, helped me compare these two options: …Learn More

December 11, 2014

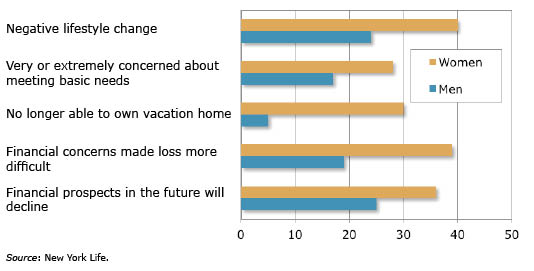

Widows Face More Financial Adversity

Two times more widows than widowers say their spouse’s death carried significant negative financial consequences during the first year after their loss.

This sharp contrast recurred in numerous financial questions recently posed to widows and widowers by New York Life. The contrast also seemed to persist across various income levels, in questions revolving around both essential needs and luxuries. Here’s a sampling of answers given by nearly 900 Americans whose spouses have died sometime in the past decade:

Their answers beg the question: Why the divergence?

One reason is certainly that two-thirds of the widows surveyed reported their income was under $35,000, while a majority of the widowers earned more than that. Adults over age 18 were canvassed, so working women’s lower earnings no doubt contributed to the income and lifestyle disparities.

Pension survivor policies also play a role, since two out of three of the people surveyed were over age 65. …Learn More