Posts Tagged "retirement"

September 11, 2014

Life Spans Not Falling for Less Educated

A September 2012 article on page one of The New York Times reported “disturbingly sharp drops” in life expectancy between 1990 and 2008 for Americans who do not complete high school – five years less for white women and three years less for white men.

This flatly contradicted past studies documenting rising longevity throughout the developed world. Much was also at stake in this dramatic new finding for U.S. retirement experts concerned about the growing financial pressures on retirees from what they’d assumed were virtually uninterrupted gains in longevity

Everyone wants to live longer, but it’s expensive. So who’s right?

In reaction to the 2012 study, a new group of researchers, funded by the U.S. Social Security Administration, took another run at calculating life spans and found that life expectancy is not on the decline for Americans with the least education.

The researchers, from the University of Michigan and Urban Institute, used the same data as in the 2012 study – U.S. Census data and National Vital Statistics. But they refined the statistical technique. One criticism of the prior paper had been its blunt measure of Americans with the least education, defined simply as those who had not graduated high school.

Yet the segment of the U.S. population that doesn’t graduate high school has shrunk dramatically, becoming an increasingly selective – and disadvantaged – group. That’s a change from the experience of people born a century ago for whom leaving high school to begin working or marry was the norm. …Learn More

September 9, 2014

How Much For the 401(k)? Depends.

How much must 30-somethings save in their 401(k)s to prevent a decline in their living standard after they retire?

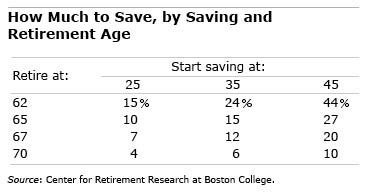

No two people are alike, but the Center for Retirement Research estimates the typical 35 year old who hopes to retire at 65 should sock away 15 percent of his earnings, starting now. Prefer to retire at 62? Hike that to 24 percent. To get the percent deducted from one’s paycheck down into the single digits, young adults should start saving in their mid-20s and think about retiring at 67.

These retirement savings rates are taken from the table below showing the Center’s recent estimates of how much workers of various ages should save to achieve a comfortable retirement; they represent the worker’s contribution plus the employer’s contribution on their worker’s behalf. Expressed as a percent of their earnings, they also vary depending when a worker retires.

To derive these savings rates, the Center’s economists assumed that a retired household with mid-level earnings needs 70 percent of its past earnings. They then subtracted out the household’s anticipated Social Security benefits. The rest has to come from employer retirement savings plans, which determine the percent of pay required to reach the 70 percent “replacement rate.” …Learn More

August 19, 2014

Retirees Live on Less

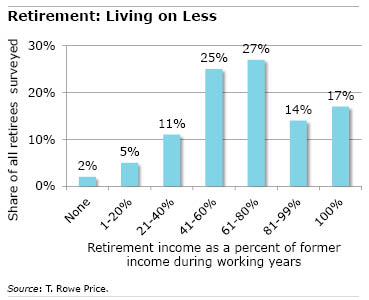

Many recent U.S. retirees in a new survey receive less than two-thirds of what they earned during their working years, and they’ve made significant adjustments along the way.

That finding for baby boomers who’ve retired in the past five years is contained in a larger national survey conducted by T. Rowe Price, the Baltimore mutual fund company. The full survey covered some 2,500 working and retired individuals, age 50 and over. All of them have at least some savings in a 401(k) account.

The majority of the recent retirees reported their annual income is between $25,000 and $100,000. Social Security is the largest single source of that income, and smaller but equal shares come from defined benefit pensions and from retirement savings plans.

Many of the retirees report their households are managing to get by on less than the 70 percent to 80 percent of their pre-retirement income that most financial planners and retirement experts estimate they need. And four out of 10 are living on 60 percent or less.

The retirees surveyed said they’ve had to lower their living standards, and four out of 10 described their situation as adjusting “a great deal.” …Learn More

August 7, 2014

An Anti-Retirement Advocate

At 89 years old, retirement is one of the few things that has not made it onto Robert E. Levinson’s vita.

Levinson almost single-handedly seems to be trying to start an anti-retirement movement. He feels so strongly that he once wrote a book titled, “The Anti-Retirement Book.”

Levinson almost single-handedly seems to be trying to start an anti-retirement movement. He feels so strongly that he once wrote a book titled, “The Anti-Retirement Book.”

“I just feel very strongly that one should never retire, or if they’re forced to retire they should try to find something productive to do,” he said.

Though not wealthy, Levinson is one of the lucky Americans. The long-time businessman and fund-raiser for a Florida college is college educated and said he is comfortable financially. But when he looks around his luxury senior community in Delray Beach, he sees pain and regret. Many residents seem idle. For example, a retired physician sits in the lobby waiting for people to drop by and consult him on their ailments. …Learn More

July 24, 2014

Retirement Research Sessions: Aug. 7, 8

Which idiosyncrasies affect the decision to retire? What’s driving the widening longevity gap between high- and low-income Americans? Are workers’ retirement savings really falling short, and is working longer good for your well-being?

These are among the research topics that will be presented two weeks from today at the 16th annual meeting in Washington D.C. of the Retirement Research Consortium, which receives support from the U.S. Social Security Administration. The agenda and details about the Aug. 7 and 8 meeting can be found here. Register to attend in person – it’s free – or view the meeting online in real time.

The consortium’s members are the Center for Retirement Research at Boston College (which supports this blog), the University of Michigan Retirement Research Center, and the NBER Retirement Research Center.

In coming weeks, the Squared Away Blog will cover some of the studies presented at the meeting. …Learn More

July 22, 2014

Summer Reading: Retirement

For those who want to use these lazy summer days to catch up on their reading about retirement, Squared Away has compiled some of the blog’s most popular articles this year.

The articles, which are listed below, were among readers’ top 20 from January through June, based on an analysis of Squared Away’s Internet traffic. Many of the articles were about research sponsored by the Retirement Research Consortium, which includes the Center for Retirement Research at Boston College, a sponsor of this blog.

A link to each article is provided at the end of the following headlines:

- Retirement Delayed to Pay the Mortgage

- Why Some Retire, Others Persevere

- Parents’ Longevity Sways Plans to Retire

- Delay Retiring: A ‘Smart’ Decision

- Many with Dementia Manage Finances

- Test Yourself for Dementia

- 1 in 4 Seniors Have Meager Savings …

July 15, 2014

Target Date Funds Keep Growing

The number of employers offering target date funds as an option in their 401(k) plans, and the number of workers using these funds, continue to increase.

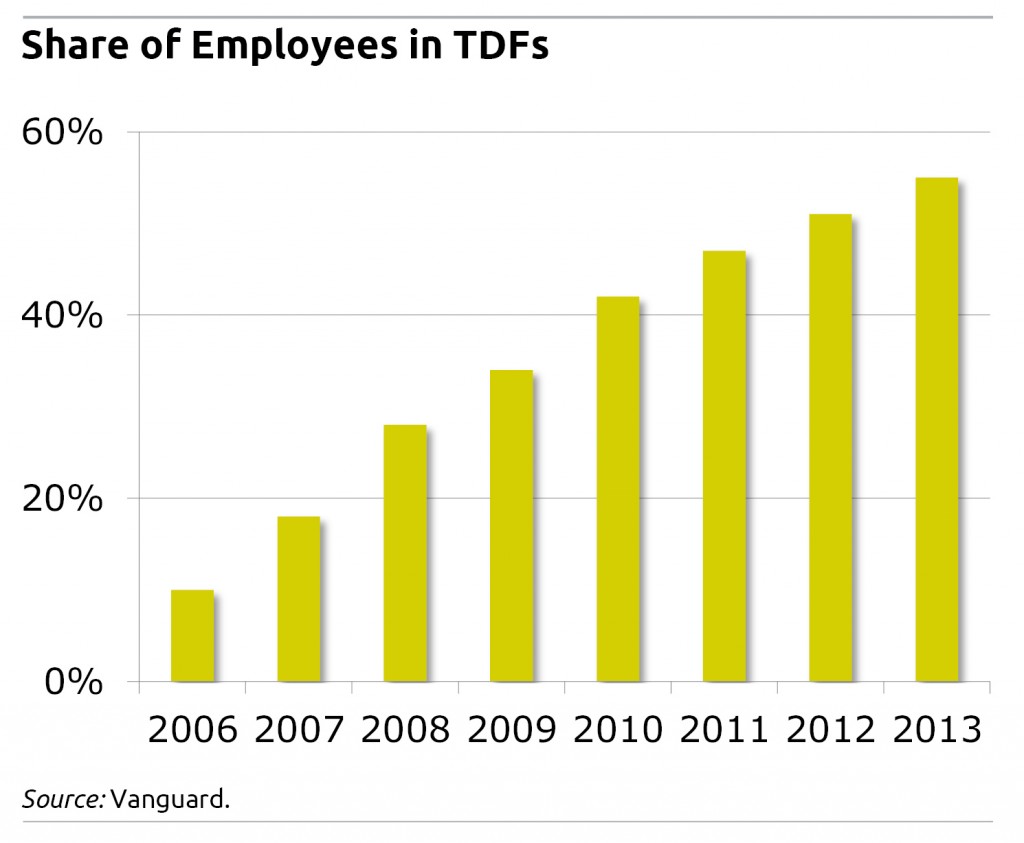

In 2013, 86 percent of all employer plans offered target date funds (TDFs) – double the share of plans offering them in 2006 – according to Vanguard’s annual report on defined-contribution plans, “How America Saves 2014,” released in June.

Vanguard data also support TDFs’ growing popularity among employees: more than half of plan participants now have some or all of their retirement accounts in TDFs, compared with just one in 10 in 2006.

Vanguard data also support TDFs’ growing popularity among employees: more than half of plan participants now have some or all of their retirement accounts in TDFs, compared with just one in 10 in 2006.

TDFs eliminate the need for employees to wade in and make complex investment decisions about choosing and updating their asset allocations. A TDF initially invests largely in stocks, but the portfolio becomes more conservative and the allocation to stocks declines as the individual approaches the targeted retirement date he selected. …Learn More