Posts Tagged "retirement"

May 6, 2014

Half Say Retirement Saving Is Top Goal

Half of all American adults view their top financial goal as making sure they have enough money to retire, finds a survey conducted in early April and released last week by the National Endowment for Financial Education (NEFE).

That’s barely changed from 47 percent who said so in NEFE’s 2011 survey. These figures are unimpressive if one considers that most everyone eventually retires. Further, fewer than one in five U.S. workers has the luxury of a traditional defined benefit plan that will send them a pension check every month.

Saving for retirement hasn’t gotten any easier either: two of three adults in the NEFE survey identified an inability to save enough as a major financial obstacle. That sentiment may be one reason why only about half of private-sector U.S. workers participate in a retirement savings plan at work. …Learn More

April 22, 2014

Job Quality Matters

The nation’s job market regained some of its momentum in March. But it’s not just getting a job that’s key to gaining financial security – it’s about getting and keeping a quality job.

In a recent report, the Institute on Assets and Social Policy at Brandeis University used interviews with workers around the country to identify three aspects of a job – beyond the size of the paycheck – that help people save money and bolster their financial security. [Excerpts from some of the interviews are shown.]

The report also gave some indications of how common it is for workers to go without them:

Benefits – Employer health care, disability insurance, a 401(k) retirement plan with an employer savings match, tuition credits – these benefits help workers save more, shield them against risk, and protect their paychecks by subsidizing some living costs. But the service sector, one of the largest segments of the U.S. labor force, is particularly poor in providing such benefits.

Benefits – Employer health care, disability insurance, a 401(k) retirement plan with an employer savings match, tuition credits – these benefits help workers save more, shield them against risk, and protect their paychecks by subsidizing some living costs. But the service sector, one of the largest segments of the U.S. labor force, is particularly poor in providing such benefits.

Flexibility – Without sick days and similar arrangements, workers risk losing their jobs due to an illness or unanticipated event. …Learn More

April 17, 2014

Social Security 101

As a young adult starting my career in Chicago in the 1980s, I didn’t have a clue how Social Security worked or why money was being taken out of my scrawny paycheck.

But trust me on this: the Social Security retirement program becomes a lot more interesting to workers as they age and their retirement horizon comes into sharp focus. It affects just about every American – and most of us pay into it.

It is not only the bedrock of retirement for millions of Americans and their spouses, but it’s also a source of income for their survivors, including children, and workers who become disabled.

In this video, officials from the U.S. Social Security Administration explain what its programs do and why they matter. Learn More

April 15, 2014

Marching to Retirement Without a Plan

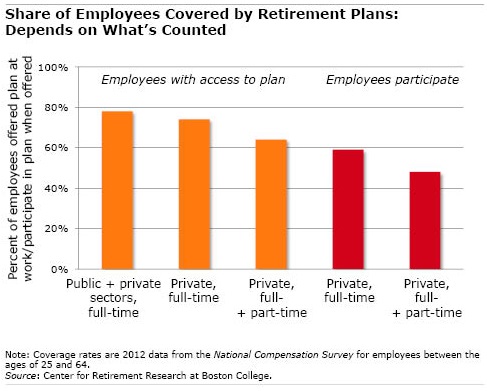

Only about half of all U.S. workers in the private sector participate in retirement savings plans at their current places of employment, according to a new report by the Center for Retirement Research.

Only about half of all U.S. workers in the private sector participate in retirement savings plans at their current places of employment, according to a new report by the Center for Retirement Research.

Pension coverage in this country “remains a serious problem,” concludes the Center, which also sponsors this blog.

The goal of the Center’s report is to make sense of the myriad estimates of how many Americans are covered at work. One prominent source of data is the federal government’s survey of employers, the National Compensation Survey. The NCS shows that 78 percent of full-time workers, ages 25 through 64, have some type of defined benefit or defined contribution plan available to them at work.

But that’s the rosiest way to slice the data.

The share of employees who are covered slides to 48 percent when public-sector, often unionized, workers are stripped out of the NCS; when part-time, private-sector workers are added in; and when one counts only the share who actually participate in an employer plan when it’s offered to them. …Learn More

April 10, 2014

Downturns Fuel Bridge Jobs, Retirement

Older workers may have every intention of deciding when they’ll retire, but economic conditions can undermine their well-laid plans.

A new study investigating whether macroeconomic events “leave workers with less control over their retirement timing” found that various transitions from career jobs into retirement sharply accelerated during periods when more Americans, including more older workers, were losing their jobs.

The researchers analyzed whether periods of rising unemployment over the past 50 years have affected three specific retirement transitions made by older workers: 1) from full-time work to “bridge jobs,” which pay less; 2) from bridge jobs to full retirement; and 3) from full-time work to full retirement.

These transitions were tracked based on changes in individuals’ employment earnings documented in U.S. Social Security Administration data from 1960 through 2010. An individual was considered to have shifted to a bridge job after he experienced at least a 50 percent decline in his earnings with an existing or new employer – the earnings floor on this group was $5,000 per year. When earnings fell below $5,000, the worker was considered fully retired.

The researchers said that they focused on white men between the ages of 55 and 75, because their labor force participation patterns were more stable during the period studied than those of women and minorities.

They found that a 1-percentage-point rise in the U.S. unemployment rate increased the number of men moving each year from full-time work to bridge jobs by 7 percent.

Rising unemployment also pushed more men into full retirement. A 1-percentage-point rise in the unemployment rate increased the number of men who retired – either from full-time work or from a bridge job – by 5 percent each. …Learn More

April 1, 2014

Many with Dementia Manage Finances

When dementia enters an elderly couple’s home, it can bring financial mismanagement with it.

But since both spouses don’t usually become cognitively impaired at precisely the same time, couples have the option of turning over the household financial responsibilities to the person who’s not yet impaired. The question is whether this transfer of control happens quickly enough.

Most couples are waiting until after cognition is very low to make this change, according to a new study.

Economists Joanne Hsu with the Federal Reserve Board and Robert Willis with the University of Michigan found that 80 percent of married older Americans who had been in charge of their household finances continued to manage them after a test revealed they were approaching or already experiencing dementia. …Learn More

March 18, 2014

Seniors Describe Their Lives in Poverty

About 15 percent of Americans age 65 and over are poor, according to the federal government’s alternative definition of poverty, known as the Supplemental Poverty Measure, a yardstick that takes into account seniors’ out-of-pocket medical expenses, as well as income and tax effects not included in the standard measure of poverty.

A compelling new video profiles poor older Americans who live in Baltimore, rural West Virginia, and Los Angeles. In the video, produced by the Kaiser Family Foundation, a non-profit research and policy organization focused on health care, the seniors identify rising rents and medical expenses as major explanations of financial hardship, which can mean lacking enough money for food.

Squared Away also has interviewed seniors living in a Boston housing complex for low-income seniors. To hear their stories, click here. Learn More