Posts Tagged "retirement"

December 5, 2013

Laid-off Boomers: Retirement as Default

The natural reaction to losing a job is to get a new one. But when older people become unemployed, some view it as a dilemma: look for work or just retire?

The presence of a financial safety net significantly increases the likelihood that an older, unemployed person will retire. And that decision often comes quickly after they lose their job, concluded a new study by Matt Rutledge, an economist for the Center for Retirement Research, which supports this blog.

“The brevity of [their] jobless spells suggests that older individuals have little tolerance for a job search” and will “make a quick exit” if they have financial resources backing them up, Rutledge wrote in a recent summary of his research.

His findings get to the heart of the difficult choices facing older workers when they are laid off, no more so than amid the Great Recession when the jobless rate among people over age 55 hit a record 7.3 percent. Rutledge tracked individuals between 55 and 70 who lost their jobs between 1990 and 2012. …Learn More

November 19, 2013

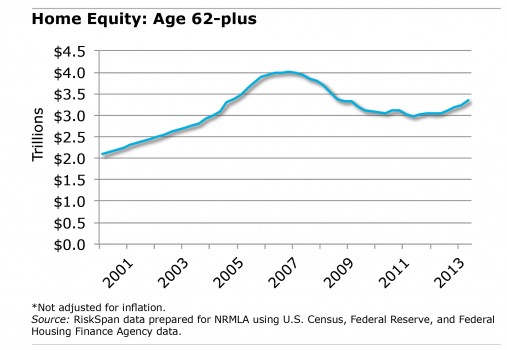

Housing Market Adds to Seniors’ Equity

The equity in older Americans’ homes has risen smartly over the past year, fueled by the housing market rebound. But whether retirees will tap these gains to pay their bills remains in doubt.

Equity values for homeowners who are 62 or older was $3.34 trillion in the second quarter of this year – nearly 10 percent above its $3.05 trillion value a year earlier – according to new data released by the National Reverse Mortgage Lenders Association (NRMLA), a trade organization.

Equity values for homeowners who are 62 or older was $3.34 trillion in the second quarter of this year – nearly 10 percent above its $3.05 trillion value a year earlier – according to new data released by the National Reverse Mortgage Lenders Association (NRMLA), a trade organization.

Rising house prices are restoring equity even in places like Florida devastated by the housing market bust. Seniors’ home equity has surged 14 percent there over the past year, to $241 billion in the second quarter of 2013, though it remains far below the levels reached during the bubble.

The equity gains are not being propelled by homeowners paying off their home loans. U.S. seniors owed $1.07 trillion on their mortgages in the second quarter, compared with $1.09 trillion a year earlier, the trade organization said.

The housing market rebound is a reminder that equity is the largest single asset that older Americans hold – it’s worth more than their savings in their 401(k)s and IRAs. But the question remains: does this help them? …Learn More

November 14, 2013

Will Millennials Be Ready to Retire?

As he logged on to his online 401(k) retirement account, Jordan Tirone, a 25-year-old insurance underwriter, explained the mental accounting behind his 5 percent contribution.

He pays $300 a month to live with his mother so he can pay off student loans. Nevertheless, a regular paycheck from his Hartford, Conn., employer is finally giving him some financial stability. “I’m feeling like I’m gaining some traction,” he said.

Spontaneously, he clicks his mouse and increases his contribution to 6 percent of his salary.

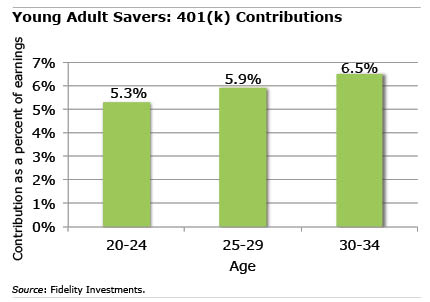

Although it can be difficult to focus on a retirement that is still 40 years away, many young adults like Tirone try very hard to save. But are they doing enough? A lot of evidence suggests they’re not, either because they can’t afford to, refuse to, or don’t know what to do.

Adults in their 20s and early 30s, in a recent survey of 401(k) participants by Brightwork Partners LLC, predicted they would have to rely on their personal savings for half of their income in retirement.

Adults in their 20s and early 30s, in a recent survey of 401(k) participants by Brightwork Partners LLC, predicted they would have to rely on their personal savings for half of their income in retirement.

Their 401(k) contributions don’t square with their expectations. Data on retirement plans administered by Fidelity Investments show that adults in their late 20s contribute 5.9 percent to their 401(k)s; by their early 30s, that increases to 6.5 percent.

But a typical 25-year-old who wants to retire at age 67 should contribute anywhere from 10 percent to 12 percent of his pay, according to various estimates. … Learn More

October 8, 2013

Got a 401k? A Guide for New Retirees

Upon retiring, you suddenly have access to a chunk of money that’s been accumulating in your 401(k). It’s easy to make a move that incurs unfamiliar tax consequences or otherwise jeopardizes your hard-earned savings.

Based on interviews with financial planners, as well as experts at the Center for Retirement Research, which funds this blog, Squared Away assembled the following check list for imminent and new retirees:

- At least one year before retiring, collect information from:

- Social Security – how does your monthly check vary, depending on the filing age you select, and how can you and your spouse determine the best strategy for getting the benefits you’ll need?

- Your employer – is an annuity an option in your 401(k) plan, or how much can you expect to receive per month from a defined benefit pension?

- A fee-only planner or other financial resources – what are your priorities and options; how much retirement income do you need; do your Social Security, 401(k) savings, and employer pensions generate enough income, and with how much risk; should you delay Social Security to increase your total monthly income; and should you purchase an annuity to cover your fixed expenses?

“Make sure before you stop working that you’re financially prepared to do so,” said John Spoto, owner of Sentry Financial Planning in Andover, Mass., near Boston. …

October 1, 2013

Dementia Prevention

There are now two reasons to postpone retirement.

The financial reason has been covered repeatedly in this blog: working longer increases a retiree’s savings and monthly Social Security income, while shortening the number of retirement years that their savings will have to fund.

If that doesn’t convince you, here’s the other reason: working longer may prevent dementia.

That’s the conclusion of a study on nearly 430,000 French retirees. After analyzing their health and insurance records, the researcher determined that each additional year an older worker remained in the labor forced further reduced the risk of being diagnosed with various forms of dementia, including Alzheimer’s disease. …Learn More

September 26, 2013

Social Security Claiming and Psychology

It’s common for people to begin collecting their Social Security benefits soon after they turn 62, ignoring the financial planners and retirement experts urging them to postpone and increase the size of their monthly checks.

A new study has uncovered four powerful psychological traits that influence this decision: the individual’s expected longevity, his fear of loss, whether he perceives the Social Security system as fair, and patience.

The study surveyed some 3,000 people, primarily in their 40s and 50s. This is a good age to ask about Social Security, because claiming the benefit is a few years away, “but they’re thinking more about it,” researcher Suzanne Shu said when presenting the findings at an August meeting of the Retirement Research Consortium in Washington.

In an online survey, Shu, who is from the University California at Los Angeles, and John Payne, from Duke University, posed a series of questions designed to understand the psychology of the individuals they were studying. They also asked when they planned to claim their Social Security and then determined which psychological traits were linked to those who said they planned to file early.

Four influences on claiming came out of their preliminary findings:

Fear of loss. People who have a stronger aversion to financial loss also tended to say they would claim earlier. To them, the researchers said, a delay in receiving their benefit checks “looks like a potential loss.” …Learn More

September 24, 2013

Nearly Retired, Lugging a Mortgage

Traditionally, the picture-perfect retirement included a paid-off house. But the Me Generation isn’t sticking to the script.

Snapshots of three generations of U.S. households on the cusp of retirement – people born in the Depression, at the beginning of World War II, and after the war – show that more of the most recent generation, the baby boomers, are still carrying mortgages as they head into their retirement years.

About 40 percent of households who were between the ages of 56 and 61 in 1992 – the Depression-era parents of baby boomers – held mortgages at that age. This share had increased to 48 percent by 2008, as the front wave of baby boomers were reaching their late 50s and early 60s

“The current generation has bought larger, more expensive homes, and they arrive at retirement with more mortgage debt,” concluded George Washington University business professor Annamaria Lusardi, who presented the findings of her study with Olivia Mitchell of the Wharton School during an August meeting of the Retirement Research Consortium. …Learn More