Posts Tagged "retirement"

July 30, 2013

Social Security and Two-Income Couples

The decades-long march of women into the nation’s workplaces may be the most enduring trend in the labor force – and a signature of American progress.

But it is also one more reason that Social Security benefits today replace a smaller share of the lifetime earnings of married couples than they did in the past, when far fewer women worked for pay.

Other reasons include the gradual increase in the age at which U.S. workers can claim their full retirement benefits, from age 65 for the oldest retirees to 67 for Generation X. Medicare premiums are also taking more out of the monthly Social Security check, and more retirees are being taxed on a portion of their benefits over time.

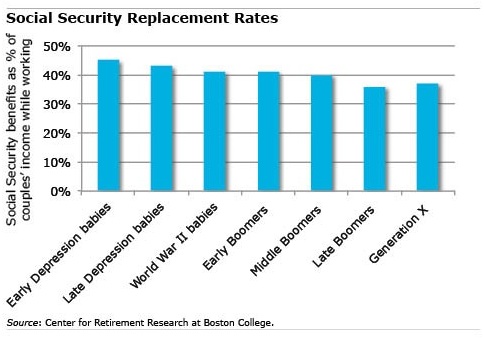

But for married couples, the sharp increase in the ranks of working wives has reduced the share of their joint earnings during their working years that is replaced by Social Security when they retire. For the typical couple born in the Depression, Social Security benefits cover 45 percent of their prior earnings, but that falls to 41 percent for baby boomer couples retiring today, according to new research by the Center for Retirement Research, which supports this blog.

These Social Security “replacement rates” – benefits as a percent of employment earnings – will continue to decline, to just 37 percent for Generation X couples born between 1966 and 1975. …Learn More

These Social Security “replacement rates” – benefits as a percent of employment earnings – will continue to decline, to just 37 percent for Generation X couples born between 1966 and 1975. …Learn More

July 25, 2013

Reverse Mortgages Get No Respect

Bob and Fran Ciaccia could not be happier with their reverse mortgage, which unlocked some of the equity in the house they purchased in 1966 for $12,500.

Reverse mortgages are federally insured loans available to U.S. homeowners over age 62. The loan is made against the equity in the house, and the principle, plus interest and some federal insurance fees, are not repaid until the homeowners or their children sell the house.

“I cannot find a downside,” Fran Ciaccia, a retired high school cafeteria cook from Levittown, Pennsylvania, said in an interview. “We have told so many people about it.”

Although the Ciaccias may be big fans, reverse mortgages are unpopular, despite historically low interest rates that make them a good deal for retirees right now. AARP has estimated that only 1 percent of older Americans use them.

In 2012, the average loan size was $158,228, and 54,676 Americans got one. That is less than half the loans made in the peak year, 2009, according to the U.S. Department of Housing and Urban Development, which insures and sets standards for reverse mortgages. …Learn More

In 2012, the average loan size was $158,228, and 54,676 Americans got one. That is less than half the loans made in the peak year, 2009, according to the U.S. Department of Housing and Urban Development, which insures and sets standards for reverse mortgages. …Learn More

July 23, 2013

The Aging Mind and Money

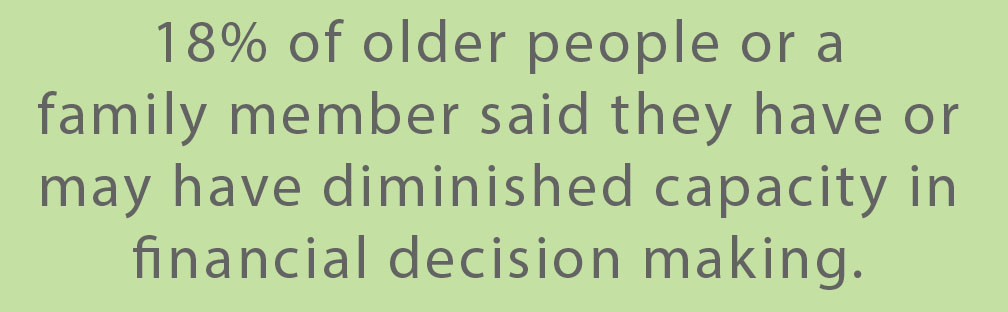

As we age, the things we forget are at first laughed off as “senior moments.” But when forgetting to send a birthday card becomes forgetting to pay the mortgage, the natural cognitive decline that accompanies aging becomes a serious financial issue.

With Americans living longer and an estimated 10,000 baby boomers turning 65 every day, a spate of fresh research has examined how and whether older brains can handle the challenges of modern financial life. But what the researchers have found out so far about the aging mind and money is somewhat of a mixed bag.

First, the bad news. Diminished cognition is an increasingly important concern in the financial arena, because the choices faced by retirees are getting ever more complex. One recent survey of people either experiencing cognitive decline themselves or observing it in a family member pinpointed the kinds of financial decisions that older people find difficult.

Among those surveyed, 41 percent said they or their family member forgot to pay their bills and 14 percent paid the same bill twice, according to the National Endowment for Financial Education and Harris Interactive. More than one-third had trouble with simple math or made rash purchases.

Among those surveyed, 41 percent said they or their family member forgot to pay their bills and 14 percent paid the same bill twice, according to the National Endowment for Financial Education and Harris Interactive. More than one-third had trouble with simple math or made rash purchases.

Retirees today face bigger financial challenges than that if they have to juggle their 401(k) investments and withdrawals. This is a change from the days when an employer simply issued a check every month from the defined-benefit pension plan, said Laura Bos, AARP’s acting vice president of financial education and outreach. …Learn More

July 11, 2013

Retiree Paralysis: Can I Spend My Money?

Financial planner J. David Lewis can rattle off stories in his Tennessee drawl about trying to persuade clients to spend their retirement savings – now that they’re retired.

One couple wouldn’t tap into a $100,000 account dedicated to the travel they always dreamed they’d do after they stopped working. It took another retired couple well into their 70s before they’d spend a bit of their ample savings on a car – their first new car ever, in fact.

What are they afraid of? “That something is going to take it all away from you, or you’re going to run out,” said Lewis, president of Resource Advisory Services in Knoxville. Spending money “is a big bridge to cross” for retirees.

But there’s another explanation for their paralysis: the decision about how much to spend, and how fast to spend it, is one of the most complex financial decisions an individual will make. It requires people who were lucky enough or diligent enough to save to suddenly juggle complex math and countless variables, some of them unknowable:

- How long will I live?

- How much money do I need?

- Where’s the stock market going? …

July 9, 2013

Aging U.S. Workers: The Fittest Thrive

By the time people reach their mid-60s, two out of three have retired, either voluntarily or because they’re unable to keep or find a job. By age 75, nine out of ten are out of the labor force.

But the minority who do continue working aren’t just survivors – they’re thrivers. Think novelist Toni Morrison, rocker Neil Young, or the older person who still comes into your office every day.

The earnings of U.S. workers in their 60s and 70s are rising faster than earnings for people in their prime working years, according to a new study. Defying the stereotype that they’re marking time, today’s older workers are also just as productive as people in their prime working years.

Driving these trends is education: far more older Americans now have a college degree than they once did.

There’s a “perception that the aged are less healthy, less educated, less up-to-date in their knowledge and more fragile than the young,” but this does “not necessarily describe the people who choose or who are permitted to remain in paid employment at older ages,” Gary Burtless, a senior fellow at the Brookings Institution, concluded in his study.

The experience of age 60-plus workers is becoming increasingly important, because there are more of them in this country than there ever have been – a rising trend that will continue. …Learn More

July 2, 2013

Readers Call Gen-X to Action

A recent blog article, “Retirement Tougher for Boomer Children,” did not elicit much sympathy for Generation X.

Many readers who commented expressed a sentiment something like this: Yes, things are tougher for young adults. So deal with it.

Members of Generation X, as well as Millennials, are largely on their own with their 401(k)s, in contrast to their parents and grandparents who may’ve had a guaranteed pension at work. But the evidence indicates young adults are not preparing for retirement: well over half of 30- and 40-somethings are on financial path to a lower standard of living once they retire, according to an analysis cited in the article.

They need to find “the discipline to save for retirement through all the means available,” said a Squared Away reader named Paul. …Learn More

June 27, 2013

62YO Men File Social Security; Wives Pay

My father was never more in love with my mother than on the day he died in 2004, days before their 50th anniversary.

But he made one bad financial decision that she lives with today: he started up his Social Security benefits at age 62.

He felt he needed the money sooner than later. He had an inadequate pension from his first career, as an Air Force flyboy, and none from his Rust Belt business that went bust. But waiting to claim his Social Security would’ve increased the size of his check – and, after he died at 70, the money that’s still deposited into my mother’s bank account every month.

This happens to a significant share of couples, because almost 40 percent of all Americans claim their benefits the same year they turn 62. But a husband who waits until age 65 can increase his widowed wife’s future benefits by up to $170 a month, according to new research by Alice Henriques, an economist with the Federal Reserve Board in Washington.

What’s interesting about this study of nearly 14,000 older couples is that she teased out how much the husband’s decision was determined by the filing date’s impact on his own benefits, versus the financial impact on his wife’s spousal and, later, her survivor benefits. Similar research in the past had examined the impact of a filing date on their combined benefits during all their years of retirement.

Henriques was able to show that the husbands, when they made their decisions, took into account the impact on themselves of the claiming date they selected. But they showed virtually “no response to the large incentives” of having the ability to provide their widowed wives with more income in the future, she said. …Learn More