Posts Tagged "retirement"

June 25, 2013

401(k)s Stall, Post-Auto Enrollment

Seven years after Congress encouraged employers to automatically enroll their workers in the company 401(k), the retirement fix has run out of steam.

Corporate America rushed in to adopt the feature in their 401(k) plans after the Pension Protection Act (PPA) made auto enrollment more attractive by giving employers that used it a safe harbor from non-discrimination rules governing their benefits.

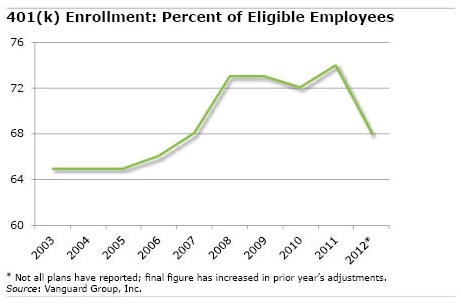

Immediately after the PPA provision became effective in December 2007, employee participation in 401(k)s increased. But since that initial bump, it’s been virtually flat for years.

In 2008, participation increased to 73 percent of all employees in workplaces that offered 401(k)s, up from 68 percent in 2007, according to Vanguard Group Inc.’s new “America Saves 2013” report, which provides a decade of participation rates for its large data base of clients.

Fast forward to 2011: participation was 74 percent. It has barely budged. (Last year, participation was 68 percent, but Vanguard said past experience indicates this figure will rise to roughly the same level when all of its clients turn in their data). …Learn More

June 20, 2013

Older Patients Tell Doctors, “Charge It!”

New research has uncovered one reason for the alarming rise in credit card use among older Americans: medical bills.

When people age 50 or older experience “health shocks” – newly diagnosed medical conditions – their credit card balances rise, according to research published in the Journal of Consumer Affairs. The worse the medical condition, the more they charge.

A mild, new medical problem, for example, adds $230 to credit card bills – that’s a 6.3 percent increase on a starting balance of $3,654. If the new condition is severe, balances increase by $339, or 9.3 percent.

Separately, the researchers looked at the effect of out-of-pocket medical costs, such as copayments for doctor visits and prescriptions not covered by private insurance or Medicare. For each $100 that those costs increase, about $4.50 winds up on the cards, according to Hyungsoo Kim at the University of Kentucky, WonAh Yoon at the Samsung Life Retirement Research Center in Seoul, Korea, and Karen Zurlo at Rutgers University.

Their findings shed new light on why more older Americans, who have the greatest medical needs, are becoming reliant on credit cards with their high interest rates. …Learn More

June 13, 2013

Retirement Tougher for Boomer Children

The financial media (including this blog) inundate baby boomers with articles cajoling, coddling, and counseling them about their every retirement concern.

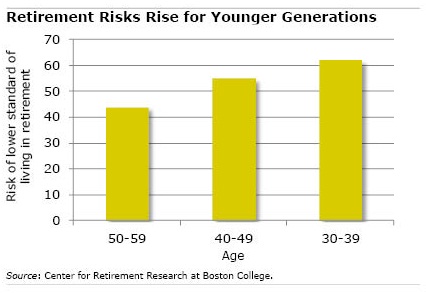

But members of the Me Generation might want to focus on their children: retirement is likely to be an even greater financial challenge for Generation X, now in their 30s and 40s.

Economists at the Center for Retirement Research, which supports this blog, recently produced this striking prediction: three out of five Americans in their 30s and well over half of those in their 40s are at risk of experiencing a decline in their standard of living after they retire.

Economists at the Center for Retirement Research, which supports this blog, recently produced this striking prediction: three out of five Americans in their 30s and well over half of those in their 40s are at risk of experiencing a decline in their standard of living after they retire.

This compares with 44 percent of baby boomers.

The reasons for Generation X’s poorer prospects are due to long-term trends like the rise of 401(k)s and less generous Social Security benefits for future generations. …Learn More

June 6, 2013

Nobel Winners Are Unsure Investors

A Los Angeles Times reporter once called up several Nobel laureates in economics to ask how they invest their retirement savings.

One of the economists was Daniel Kahneman, a 2002 Nobel Prize winner who would become more famous after writing “Thinking, Fast and Slow” about the difference between fast, intuitive decision-making and slow, deliberative thinking. Kahneman admitted to the reporter that he does not think fast or slow about his retirement savings – he just doesn’t think about it.

Kahneman’s confession in the 2005 article seems even more relevant in today’s 401(k) world. Americans are realizing the investment decisions imposed on them by their employers may be too complex for mere mortals. For example, three out of four U.S. workers in a 2011 Prudential survey said they find 401(k) investing confusing.

Readers might take comfort in learning that even some of the world’s great mathematical minds have admitted to wrestling with the same issues they do: How do I invest my 401(k)? Should I take some risk? How about international stocks?

Here are the Nobel laureates remarks, excerpted from the article, “Experts Are at a Loss on Investing,” by Peter Gosselin, formerly of The Los Angeles Times:

Harry M. Markowitz, 1990 Nobel Prize:

Harry M. Markowitz won the Nobel Prize in economics as the father of “modern portfolio theory,” the idea that people shouldn’t put all of their eggs in one basket, but should diversify their investments.

However, when it came to his own retirement investments, Markowitz practiced only a rudimentary version of what he preached. He split most of his money down the middle, put half in a stock fund and the other half in a conservative, low-interest investment. …Learn More

May 30, 2013

Layoffs After 50 Cause Severe Losses

For the average older worker who loses his job, his income a decade later is 15 percent lower than if he had escaped the layoff.

It gets worse: His pension wealth is worth 20 percent less, and his financial assets are 30 percent smaller.

The enormous financial hit delivered to older workers who experienced a layoff sometime during the 1990s was reported recently by researchers at the Center for Retirement Research, which supports this blog. First, the researchers pinpointed all workers in the data set who were over age 50 and lost a job between 1992 and 2000. They then examined their financial outcomes – earnings and assets – a decade later and compared them with outcomes for those who avoided layoffs during that time.

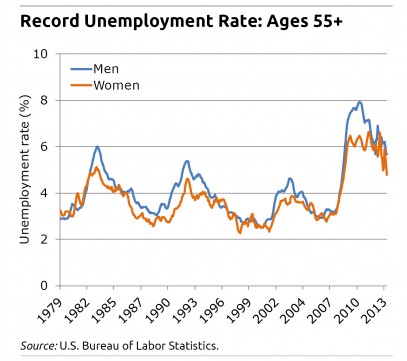

If the financial fallout during the 1990s was that dramatic for unemployed older workers, it will be even worse for many of the 3.2 million jobless baby boomers at the peak of the Great Recession, the longest downturn in post-war U.S. history.

If the financial fallout during the 1990s was that dramatic for unemployed older workers, it will be even worse for many of the 3.2 million jobless baby boomers at the peak of the Great Recession, the longest downturn in post-war U.S. history.

The Great Recession hit just as members of the biggest demographic bulge ever were either hitting retirement age or lining up on the runway. Record numbers of them sustained severe hits to their financial security, because the jobless rate for older workers reached record highs.

The research suggests that the recession’s effects may last into old age for many boomers. One key reason for their grim prospects is that older workers have more difficulty snaring new jobs than do young adults. Many boomers never found employment and are being forced to retire grudgingly, simply because they lack options. …Learn More

May 28, 2013

Aussie Employer Mandate Fuels Saving

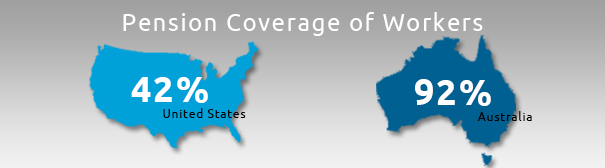

Consider this: 92 percent of Australian workers have 401(k)-style plans, while less than half of Americans have any kind of pension coverage on their current job.

This yawning disparity exists, because the Australian government requires employers to contribute 9 percent of each worker’s earnings to a personal account, which participants invest much like a 401(k). Under reforms to Australia’s system, employer contributions will rise gradually until 2020 – to 12 percent.

Even though Aussie employers are mandated to make the contributions, economists argue, the money ultimately comes from workers – through lower wages. But U.S. workers, left on their own, have proved to be poor savers, and the fact remains that putting the onus on employers to ensure that retirees have something in savings is working better than our catch-as-catch-can system.

“Australia has been extremely effective in achieving key goals of any retirement income system,” concluded a new report by the Center for Retirement Research, which supports this blog. …Learn More

May 21, 2013

Few Boomers Catch Up on 401(k) Saving

Only 13 percent of older workers take advantage of the “catch-up” contributions to their retirement accounts permitted by the IRS for anyone over 50, according to new data provided by Fidelity Investments.

This is hardly surprising, since prior research has estimated that only about 10 percent of all workers are contributing the maximum $17,500 per year that everyone, regardless of age, is allowed to contribute under IRS guidelines for 2013. Since the vast majority never reach that cap, the “catch-up” 401(k) contribution enacted to encourage people to save more when they hit their 50th birthday – an additional $5,500 per year – is largely irrelevant to them.

But the catch-up contribution data, which Fidelity culled from its 401(k) client database representing some 12 million workers, are yet another reminder of a fundamental problem with the U.S. retirement system: Americans simply are not saving enough to ensure their financial security in old age.

In short, members of the Me Generation don’t seem to be doing a great job of taking care of Me. …Learn More