Posts Tagged "retirement"

April 4, 2013

Webinar to Explain Social Security

In a webinar next Thursday, an official from the Social Security Administration will explain the fundamentals of calculating and claiming benefits.

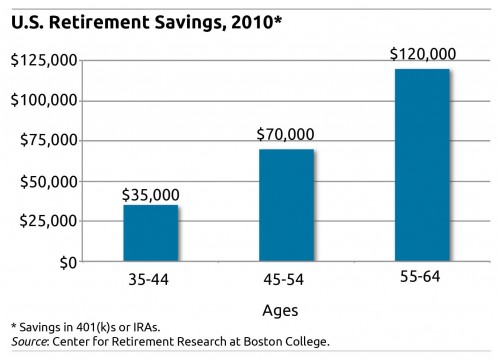

Social Security represents the largest single financial resource for most baby boomers, so deciding when to file for benefits is their single biggest retirement decision.

The value today of that future stream of monthly checks – $287,200 for the typical household aged

55-64 – far exceeds the value of home equity or 401(k)s for most people, according to 2010 data from the Federal Reserve Board. And it often exceeds the value of their traditional defined benefit pension plan – if they even have one. The lower one’s income, the more Social Security matters too.

The webinar was organized by the National Retirement Planning Coalition for financial planners, who are not always familiar with all the rules for the program. But anyone can participate, according to the coalition leader, the Insured Retirement Institute. (Full disclosure: the Center for Retirement Research, which hosts this blog, is a coalition member). Space is limited and going fast for the webinar, which will also be available online a few days after the webinar on this website.

To register for the April 11 webinar, click here.

The following topics, among others, will be covered in the webinar, including: … Learn More

April 2, 2013

Video: Why Stock Investors Defy Logic

The Standard & Poor’s 500 stock index has climbed steadily and surpassed its 2007 peak last week, and even sluggish European markets are showing signs of life as investors rush back in.

This interregnum between the collapse of global financial markets in 2008-09 and the next bubble – whenever and wherever that may occur – is a good time to reconsider investor behavior.

In this video, Ben Jacobsen, a finance professor at Massey University in New Zealand, discusses behavioral economics, market panics, and “strange” and inexplicable behavior.

“Most people,” Jacobsen concludes, “have a great difficulty assessing risk and what risk is.”

Check out another blog post about research confirming that people tend to rush in when the market is rising and pay dearly for stocks and then sell in a panic after experiencing large losses. Morningstar data also indicate that long-term investors have better returns if they buy and stay put.Learn More

March 26, 2013

Long-Term Care Needs Sneak Up On Us

As I sat in an orthopedist’s office last week watching the doctor poke and prod my mother’s legs – an irritated nerve may be causing her severe pain – this thought struck me: long-term care is often an unspoken topic but one of enormous magnitude.

I’ve always taken for granted that my active mother, who plays a killer game of bridge, wouldn’t need much medical attention for another 15 years. I have evidence of this, I’d convince myself: her mother lived to age 92 and some uncles lived even longer. The pain makes it difficult for my mother to walk her dog, though she gamely hobbles through her day and even insists on league bowling on Wednesdays.

It’s so much easier to shove aside worries about long-term care for the elderly – our own or our parents’ – than it is to contemplate the financial and deeply emotional issues required to care for an aging parent. The video below tells a true story about what happens when the requirements of care slam us hard, as they often do.

Violet Garcia is a single mother of Filipino descent living in Kodiak, Alaska, which is situated on an enormous island south of Anchorage. The public school worker cares for her elderly mother, who can’t be left alone. Garcia aspires to send her middle son away to college soon, but that will create a problem on Sundays, when he takes care of his grandmother so his mother can run errands. …

March 14, 2013

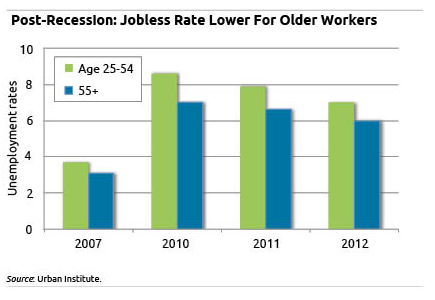

Unemployment Lower for Older Workers

A few more jobs reports like February’s might put a dent in the nation’s still-high unemployment rate. The Bureau of Labor Statistics said U.S. employment surged by 236,000 last month, nudging the jobless rate down to 7.7 percent.

But a summary of unemployment rates for various age groups, recently published online by the Urban Institute, showed variations in the rate, by age. Rates have been consistently lower over the past decade for older workers than for those in their 20s, 30s, and 40s – even during and after the Great Recession.

In a still-sluggish economy, one might wonder: are older workers who remain on the job somehow depriving younger adults of work?

There is “absolutely no evidence of such ‘crowding out’, ” concluded the Center for Retirement Research, which supports this blog, in a recent study analyzing the labor market from 1977 through 2011. To rigorously test this relationship, the researchers tried several statistical variations – even looking at the older-younger worker dynamic during the Great Recession. They kept getting the same result: no crowding out.

In fact, they noted that their own evidence and research by others suggests the opposite. When older people have jobs, they add to consumer demand and fuel the economy. The authors conclude that “greater labor force participation of older workers is associated with greater youth employment and reduced youth unemployment.”Learn More

March 7, 2013

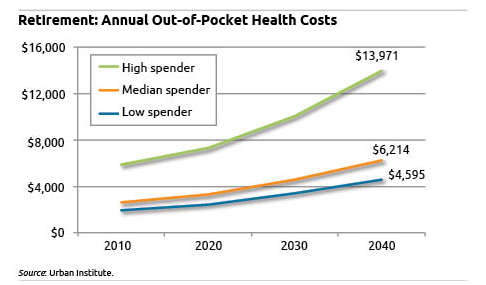

Future Retirees Don’t Grasp Health Costs

More than half of baby boomers and Generation Xers do not realize how much they are likely to pay out of their own pockets for medical bills after they retire.

Many “were seriously underestimating the amount of savings they would need to accumulate in order to cover health in retirement,” according to what may be the first comprehensive survey and analysis of what Americans expect to pay – and how far off their estimates are.

The good news is that Medicare pays roughly 60 percent of retirees’ total costs. The bad news is that they have to somehow cover the other 40 percent, which is particularly expensive for those who live longer (read women).

If this new study carries one big message, it is that boomers need to learn more about what will certainly be one of their biggest retirement expenses. For example, by 2020, the range of out-of-pocket spending is expected to vary from $2,453 per year for a typical person with low health care needs to $7,272 for the typical high spender. Boomers also may not be aware that the bite that Medicare premiums take out of their monthly Social Security checks will increase sharply by 2020.

The new analysis of the disparity between future retirees’ expectations and what they’re facing was conducted by law professors Allison Hoffman at the UCLA School of Law and Howell Jackson at the Harvard Law School. …Learn More

March 5, 2013

Video: Pension Problems Can Be Fixed

The Ontario Teachers’ Pension Plan has produced a terrific video that spells out how pension systems got into the trouble they’re in and proposes the outlines of what’s required to repair them.

The strength of this video is its broad sweep and perspective. It is worth watching for anyone interested in their children’s and grandchildren’s future financial security – as well as their own.

“Pension Plan Evolution” explains that U.S., Canadian, and other western retirement systems were built on the faulty assumptions that the future would keep producing enough younger workers to support retirees, 8 percent annual returns on investments, and economic growth that matched what the baby boom generation enjoyed in its prime.

Watch the entire video below. But if you only have time for the 1.5-minute trailer, click here.

To fix these systems’ finances will require shared sacrifices, the video concludes. The young should not pay for all of the mistakes of earlier generations who have resisted reforms to current pension systems – in other words, fairness matters. Solutions also require creativity in the design of systems that are able to adapt to future changes in the economy or circumstances.

February 28, 2013

The IRA Tax Deduction Beckons

At tax time, many Americans think, often fleetingly, about spending less and socking away more for retirement.

Until April 15, the IRS permits people who do not have a pension plan at work to deduct up to $6,000 for money placed in an IRA; taxpayers who do have an employer pension can also receive the IRA deduction if their earnings fall under the IRS’ income limits.

The tough question that trips people up is: How much will I need?

The easy way to think about this is in terms of the income necessary to maintain your current standard of living after the paychecks stop coming in. Click here for a tool that estimates both how much you’ll need and how much you’ll have if you continue on your current path.

The calculator, created by the Center for Retirement Research, which supports this blog, was designed for people over 50 and on the retirement runway. Younger people can also get a ballpark idea of how they’re doing using the calculator. Or click here for the percent of your wages to put into a tax-deferred retirement fund.

This is a beta website with a few kinks, and it works smoothly only on the Safari and Google Chrome browsers. But the results are sound and backed by academic research. Here’s how to read the results. …Learn More