Posts Tagged "retirement"

February 21, 2013

Corporate Match Falls in Auto Enrollment

Enrollment in 401(k)s is higher in companies that use auto-enrollment than in companies that don’t. But the innovation falls short of an ideal solution to the nation’s low retirement savings.

That’s because corporations using it contribute less of their workers’ earnings to the plan than do companies without it, according to a revised paper by Urban Institute researchers Barbara Butrica and Nadia Karamcheva.

“Firms are profit-maximizers, so we’d expect that, if there is some cost to providing these benefits, they may reduce their match rates to control their costs,” Butrica said.

The researchers found that employers that automatically enroll employees in their plans match their employee contributions up to 3.2 percent of earnings, which is lower than the 3.5 percent average match by employers in their study without auto enrollment. Their statistical analysis shows that it has a significant effect.

Americans are saving very little for their retirement, and news and reports often focus on what individual employees are or are not doing right. Why don’t they save enough? Do they properly invest their 401(k) savings?

This research adds a different perspective: the conflict corporations face between providing better benefits to employees – so they can recruit and retain talent – and maximizing profits to satisfy Wall Street or investors seeking higher profits.

Corporate motivations and decisions can “substantially affect future retirement security,” the authors wrote in an executive summary of their paper funded by the Retirement Research Consortium, which supports this blog. …Learn More

February 19, 2013

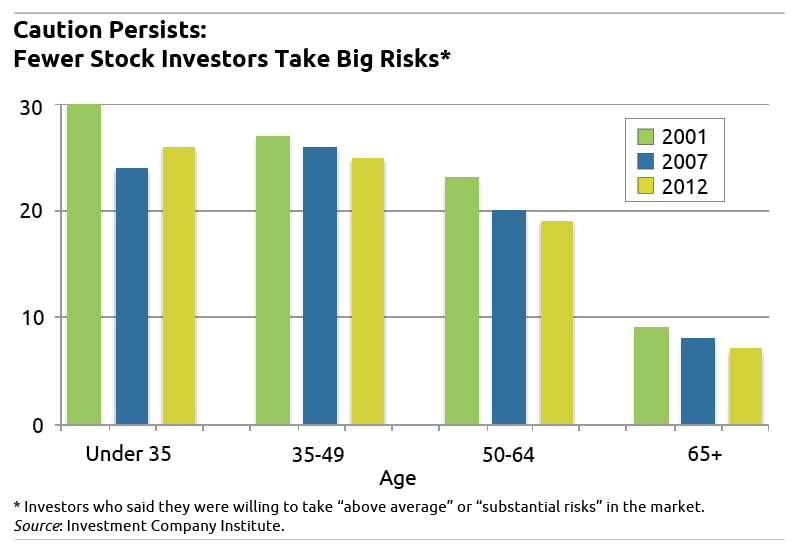

Boomers Still Cautious About Stocks

Mutual fund investors poured some $17 billion into domestic equity funds in January, reversing 2012’s trend, according to the Investment Company Institute (ICI), an industry trade group.

But it’s too early to declare that fund investors have fully recovered from the 2008 market collapse, even as the bullish S&P500 stock market index flirts with its 1,565 all-time high reached on October 9, 2007.

Fund investors surveyed by ICI still remain less willing than they were prior to the big bust to take what the survey questionnaire calls “above-average or substantial risks” in their investments.

This trend cuts across most age groups, from 40-somethings to retirees. The exception is the under-35 crowd: 26 percent identified themselves as being in these higher-risk categories, slightly more than the 24 percent who did back in 2007.

This trend cuts across most age groups, from 40-somethings to retirees. The exception is the under-35 crowd: 26 percent identified themselves as being in these higher-risk categories, slightly more than the 24 percent who did back in 2007.

But boomers nearing retirement and current retirees burned in the 2008 market collapse keep paring back their risk profiles. Older investors are moving “from capital appreciation to capital preservation,” said Shelly Antoniewicz, an ICI senior economist. Even 35-49 year olds, who still have two to three decades of investing ahead of them, are not quite back to where they were earlier in the decade when they were more willing to take risks in the stock market.

“What we have seen historically is that there is a relationship between stock market performance and inflows into equity funds. When the stock market goes up, we tend to get larger inflows into equity funds,” she said. “What we’ve noticed in the past two to four years is this historical relationship has gotten weaker.” …Learn More

February 7, 2013

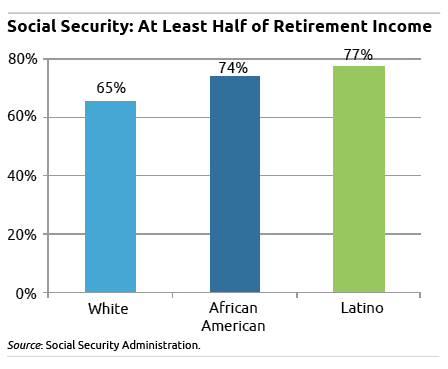

Why Minorities Need Social Security More

The U.S. population is in the midst of a transition from predominantly white to one in which “minorities” will one day be the majority.

A Social Security Fact Sheet recently published by the Center on Budget and Policy Priorities in Washington throws a fresh perspective on the program, which provides the financial bedrock for most retirees. It shows that the program is even more important to African-Americans and Latinos than it is for white Americans.

Seventy-three years after Ida May Fuller became the first person to receive a Social Security check, on Jan. 31, 1940, Social Security provides more than half of the retirement income received by about two out of three elderly white Americans. But many more – about three out of four – African-American and Latino retirees rely on Social Security for more than half their income.

Seventy-three years after Ida May Fuller became the first person to receive a Social Security check, on Jan. 31, 1940, Social Security provides more than half of the retirement income received by about two out of three elderly white Americans. But many more – about three out of four – African-American and Latino retirees rely on Social Security for more than half their income.

The obvious reason is that minorities earn lower incomes on average while they are working, according to Kathy Ruffing, a senior fellow at the Center, and that has “hampered their ability to save for retirement.”

Congress intended Social Security to be a progressive program that benefits lower-income individuals more. The Social Security Administration’s (SSA) formula for calculating the monthly check is designed to replace a larger share of the employment income of, say, a maintenance worker who has retired than it does for a retired corporate executive. …Learn More

January 31, 2013

Tally Your Mutual Fund Fees Here

Those mutual fund fees sure add up fast.

“The average person has no idea” how much fees and expenses sap from their investments, said Ted Leber, a retiree who was a staffer with the Chief of Naval Operations and a financial adviser to service members.

The career Navy man said he was a failure after retiring to become an adviser, because he kept steering clients to low-fee mutual funds that replicate index returns, such as the S&P 500 or NASDAQ tech-stocks. The index funds helped his clients but not his firm’s profits.

Squared Away interviewed Leber after he emailed a nifty fee calculator, which was put online as a public service by AHC Advisors Inc.’s president, Craig Larsen, in St. Charles, Illinois.

Larsen and Leber join a growing number of academics, financial planners, and investors balking at the high fees middle-income investors pay for mutual funds that are actively managed by stock pickers. Fees are “costly for the average employee” and “can take a substantial toll on their retirement,” according to a study by the Center for Retirement Research at Boston College, which supports this blog.

Test the employee calculator yourself. First, look at the conservative assumptions Squared Away used to calculate fees on three portfolios, as shown in the above chart…Learn More

January 29, 2013

Working Over 70: Still the Exception

For Vita Needle Company’s elderly employees, work is the essence of the fulfillment they feel in their lives.

Howard Ring, a 78-year-old engineer – like many of his coworkers – initially went back to work after retiring, because he needed more money. And Vita Needle would hire him.

“What I found there was more than just a job,” he says. In this video, Ring and his elderly coworkers talked about what they derive from work during an October panel discussion at the Newton (Mass.) Free Library.

Is Vita Needle a window into the future? Will growing ranks of retired but still-vigorous boomers return to work after a couple of years, when they grow bored with golf or bridge?

Returning to work – or remaining employed – has proved extremely difficult in the wake of the 2008-2009 stock and housing market collapses. More late-career workers lost their jobs in the Great Recession than in previous downturns, and their jobless spells lasted longer, according to a forthcoming study by the Center for Retirement Research, which funds this blog. Now that the economy is growing, it isn’t generating enough jobs for the elderly who do want to work, the study found.

Vita Needle’s heavy reliance on older employees is “unique,” said Marcie Pitt-Catsouphes, director of the Sloan Center on Aging & Work, which is also at Boston College. …Learn More

January 24, 2013

Boomers Delay Retirement, Earn More

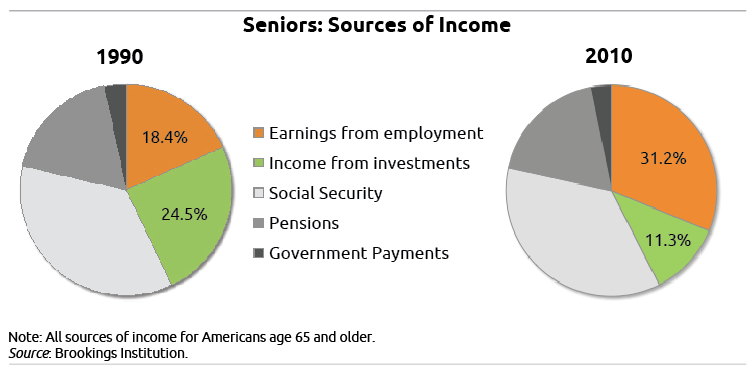

Reflecting the sea change in lifestyles for the over-65 set, the share of their total income that America’s elderly earn from working has almost doubled over the past two decades.

That’s a central conclusion of research by the Brooking Institution’s Barry Bosworth and Kathleen Burke, who compared the 1990 and 2010 sources of income for the nation’s age 65-plus population in a paper funded by the Retirement Research Consortium, which supports this blog.

Some things haven’t changed. The share of the elderly’s income that comes from Social Security, employer pensions and – for the poor – government aid such as welfare has hardly budged over the past two decades.

But the earnings the elderly derive from employment soared from 18 percent of their total income in 1990 to 31 percent currently. The primary reason is that more Americans are working longer and delaying retirement, a multifaceted response to better health, more education and – at least for some – growing financial insecurity. …Learn More

January 22, 2013

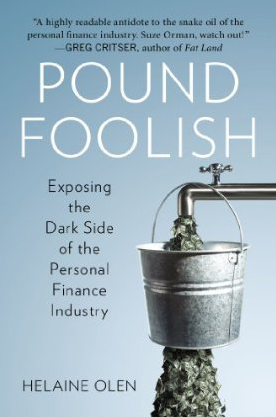

Olen Explains ‘Pound Foolish’

New York journalist Helaine Olen lit up Twitter last week with her new book, “Pound Foolish: Exposing the Dark Side of the Personal Finance Industry.” She has attracted high praise – from The Economist, The New York Times, and others – and a few critics, in the online community and at Business Week: “Financial professionals,” Business Week wrote, “are not responsible for knitting the safety net, though Olen makes it sound as though they are.”

New York journalist Helaine Olen lit up Twitter last week with her new book, “Pound Foolish: Exposing the Dark Side of the Personal Finance Industry.” She has attracted high praise – from The Economist, The New York Times, and others – and a few critics, in the online community and at Business Week: “Financial professionals,” Business Week wrote, “are not responsible for knitting the safety net, though Olen makes it sound as though they are.”

Squared Away asked Olen to explain her thinking behind the book.

Squared Away: Let’s get this out of the way. What do you have against financial planners?

Olen: I don’t have anything against all financial advisers, but a lot of people are selling themselves as experts in things they are not expert in. I believe that their commissions are almost inherently conflicted. I also believe that the minute you start selling things as, “I can protect you. I can do better than…,” you’re getting into dangerous territory, because it’s simply not true.”

Are there situations in which financial planning services are useful?

I would never want anyone to think I don’t believe a good, non-conflicted financial planner or coach isn’t useful. They are, very much so. I think very few of us actually see ourselves honestly, and we could all use an objective eye looking over things like our money and investing strategies at least occasionally. But consumers need to know how their chosen advisers are compensated and if that method of compensation can influence their recommendations and strategies.

You say, “No amount of savvy or money management can fully protect” people from a punishing economy that pummels wages and erodes high-quality employment. Are average individuals blamed for troubles that are larger than they are?

Olen: I absolutely think this sort of sentiment – the idea that we will all be okay if only we learn proper money management – is an excuse to blame people for their troubles. Since the late 1970s, a massive inequality issue has opened up. We have very little class mobility in our country. We know that our net worth plunged by 40 percent in 2007-2010. To turn around and tell people that their issues are all their fault is naïve at best and it’s an outright lie at worst. …Learn More