Posts Tagged "retirement"

December 4, 2012

Long-Term Care Policies Unpacked

The typical, elderly couple spends about $260,000 on health care and long-term care services during retirement – for the unlucky ones, the amount can be double. No wonder sales of long-term care policies this year will increase nearly 10 percent, according to the American Association for Long Term Care Insurance. At the same time, major insurers are pulling out of the market in droves, and premiums are surging due to higher demand by aging baby boomers, record-low interest rates, and rising medical costs.

To help navigate this increasingly treacherous market, Squared Away interviewed Larry Minnix Jr., chief executive of LeadingAge, a non-profit consumer organization in Washington.

Q: Is there anyone for whom long-term care insurance does not make sense?

A: Not many. I’ve seen too much of the consequences for too many age groups and too many families – long-term care just needs to be insured for. A majority of the American public is going to face the need for some kind of long-term care in their family. The only people it doesn’t make sense for are poor people – they have Medicaid coverage, mostly for nursing homes. And for people who are independently wealthy, if they face a problem of disabling conditions they can pay for it themselves. You find out at age 75 you have Parkinson’s or Alzheimer’s, but it’s too late to insure for it. Think about it like fire insurance. I don’t want my house to burn down, and very few houses do. But if mine burns down, I do have insurance.

Q: The Wall Street Journal reported that GenWorth Financial next year will charge 40 percent more to women who buy individual policies. Why?

A: Among the major carriers, private long-term care insurers have either limited what they’re doing or backed out of the market entirely. You’d have to get GenWorth’s actuarial people [to explain], but let me venture a guess. I’ve had private long-term care insurance for 12 to 15 years, but my wife couldn’t get it. She’s got some kind of flaw in the gene pool, and she was denied coverage. She may be the bigger risk, because I’m more likely to stroke out and die, but she’s more likely to live with two to three conditions for a long period of time.

Q: Your wife wasn’t healthy enough to get coverage? …

Learn More

November 8, 2012

Women’s Pay Gap Explained

Lower pay for women came up – where else! – in the foreign policy debate between President Obama and Governor Romney. It affects women’s living standards, single mothers’ ability to care for their children, and everyone’s retirement – husbands and wives.

To understand why women earn 77 cents for every dollar earned by men, Squared Away interviewed Francine Blau of Cornell University, one of the nation’s top authorities on the matter. A new collection of her academic work, “Gender, Inequality, and Wages,” was published in September.

Q: How has the pay gap changed over the years?

Blau: For a very long time, the gender-pay ratio, which is women’s pay divided by men’s pay, was around 60 percent – in the 1950s, 1960s and 1970s. Around the 1980s, female wages started to rise relative to male wages. In 1990, the ratio was 72 percent – that was quite a change, from 60 to 72 in 10 years. We continued to progress but it is less dramatic. In 2000, it was 73 percent. Now it’s 77 percent – that’s the figure that came up in the debate.

Q: Why do women earn less?

Blau: There are two broad sets of factors: the first is human capital and the factors that contribute to productivity and the second is discrimination in the labor market. Women have traditionally been less well qualified than men. The biggest reason here is the experience gap between men and women. Traditionally, women moved in and out of the labor force, and that lowered their wages relative to men.

But when we do elaborate studies – my recent study with Lawrence Kahn in 2006, for example – we find that when we take all those productivity factors into account we can’t fully explain the pay gap. The unexplained portion is fairly substantial and is possibly due to discrimination, though it could be various types of unmeasured factors. So in the 1998 data used in our 2006 article, women were making 20 percent less than men per hour. When we take human capital into account, that figure falls to 19 percent. When we add controls for occupation and industry – men and women tend to be in different occupations and industries – we can get a pay gap of 9 percent. This unexplained gap of 9 percent is potentially due to discrimination in the workplace. …Learn More

November 6, 2012

Dicey Retirement: The Long Ride Down

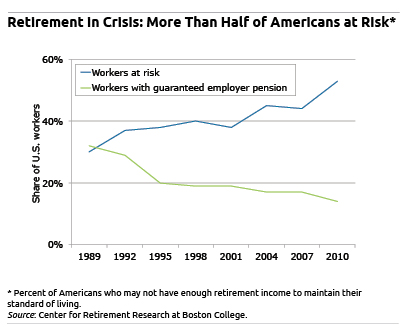

No one really needs confirmation of how tough the Great Recession was. But the Center for Retirement Research at Boston College has quantified the decline – and it’s brutal.

Investment losses and falling home prices placed 53 percent of U.S. households in danger of a decline in their standard of living after they quit working and retire, reports the Center, which funds this blog. That’s up sharply from 45 percent in 2004, prior to the financial boom, which created a strong – albeit fleeting – increase in Americans’ wealth.

The longer-term erosion in Americans’ retirement prospects is even more troubling and reflects deeper issues. The Great Recession just hammered the point home.

In 1989, just under one-third of Americans faced such dicey retirement prospects. The steady erosion since then coincides with the near-extinction of traditional employer pensions that guaranteed retirees a fixed level of income. It turns out that the DIY system that replaced them, a system reliant on Americans’ ability to save in their 401(k)s, is not working.

In 1989, just under one-third of Americans faced such dicey retirement prospects. The steady erosion since then coincides with the near-extinction of traditional employer pensions that guaranteed retirees a fixed level of income. It turns out that the DIY system that replaced them, a system reliant on Americans’ ability to save in their 401(k)s, is not working.

Older baby boomer households with 401(k)s have just $120,000 saved for retirement, according to the Center. That’s not even enough to pay estimated medical costs not covered by Medicare. Retirement savings for all older boomer households is a paltry $42,000 – that means a lot of people have no savings…Learn More

October 23, 2012

401(k)s “Top” Financial Priority. Really.

A large majority of people in a survey released last week identified saving for retirement as their top financial priority. If that’s the case, then why aren’t Americans saving enough?

Stuart Ritter, senior financial planner for T. Rowe Price, the mutual fund company that conducted the survey, has some theories about that. Squared Away is also interested in what readers have to say and encourages comments in the space provided at the end of this article.

But first the survey: about 72 percent of Americans identified saving for retirement as “their top financial goal,” with 42 percent saying that a contribution of at least 15 percent of their pay is “ideal.”

Yet 68 percent said they are saving 10 percent or less, which Ritter called “not very much.” The average contribution is about 8 percent of pay, according to Fidelity Investments, which tracks client contributions to the 401(k)s it manages.

The Internal Revenue Service last week increased the limit on contributions to 401(k) and 403(b) retirement plans from $16,500, to $17,000. The so-called “catch-up” contribution available to people who are age 50 or over remains unchanged at $5,500.

The question is: why do Americans give short shrift to their 401(k)s, even as people become increasingly aware that their dependence on them for retirement income grows? Ritter offered a few theories in a telephone interview last week:

- The financial industry is partially to blame. “We have done a really good job of conveying to people how important saving for retirement is,” he said, “but what we haven’t done as good a job of is telling them how much to save.”

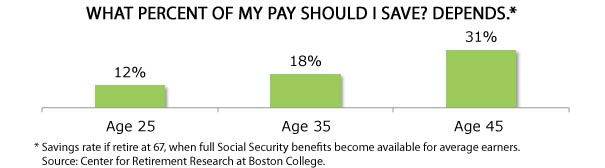

Employers may also share blame. Further confusing the issue, the savings rate depends on when the employee starts saving – the percent of pay is lower for those who start in their 20s than for someone who waits until they’re 45. …

October 16, 2012

20-Somethings Buck Pressure to Spend

Michael and Erin Gallagher are just 26 years old but have made a strong start financially, socking away $50,000 by maxing out their 401(k)s while honoring a $20,000 budget for their October 5 wedding in downstate Illinois.

Jennifer and John Lucido, both 32 years old, now have $250,000 in the bank and have built a 2,500-square-foot home near Detroit.

By comparison, the typical U.S. household had saved $42,000 for retirement in 2010, according to the Center for Retirement Research, which funds this blog.

Both couples are members of that rare species of 20-something super savers, spurning intense peer pressure to spend money on consumer items, go out for dinner a lot, and run up their credit cards. Neither couple got where they did the easy way either. They worked hard, but they were also quick to catch on to important lessons about being frugal and saving – from their parents or from each other.

“I have clients in their 30s and 40s who don’t even have $200,000 in their 401k,” said Naomi Myhaver, a financial planner at Baystate Financial Services in Worcester, Massachusetts.

An August article in The Journal of Consumer Affairs suggests one reason people like them are so hard to find. Young adults are extremely vulnerable to peer pressure to run up credit card debt so they can support a high lifestyle and social life.

In the study, 225 college students were asked questions such as whether they have “very strong” connections to their friends or “feel the need to spend as much as [friends] do on activities we do together.” College students have an average of 4.6 credit cards and $4,100 in debt…

Learn More

October 11, 2012

Boomer Moms, Here’s A Radical Idea

Research shows that when children leave the nest, married couples spend 50 percent more on discretionary spending like eating out and vacations. But whether you’re ready or not, retirement is bearing down hardest on women.

Here’s a radical concept for moms whose children have suddenly grown up: focus on your own financial needs. Women usually out-live their husbands and need to be on top of the situation. So getting a handle on your financial priorities should be at the top of your list.

Squared Away interviewed financial experts to come up with five priorities for baby boomer women whose kids have flown the coop.

Get Smart. If you haven’t had time to pay attention to the household finances, start simple. Financial expert Wendy Weiss, on her blog, Hot Flash Financial, said the first thing to do is track down and inventory the types of accounts and the financial institutions that hold your money: savings, retirement plans, insurance documents, your and your husband’s latest Social Security statements – add them up and determine what you’ve got. Then get a handle on the size of the credit card debts and mortgage.

“Just find out what you have,” Weiss says. “There are questions you can ask later.”

Talk to Your Kids. You’ve poured your heart into nurturing your offspring. So turn the tables and ask them to have a conversation about your needs once you retire.

Financial advisers swear by these wide-ranging discussions, the content of which reflects the diversity in families. The children will be reassured if you’ve saved enough or will share your concern if you haven’t. Perhaps they’ll have opinions about whether you should purchase long-term care insurance. They should also know the beneficiaries on your financial and pension accounts and insurance…Learn More

October 9, 2012

401(k) Education Missing A Target

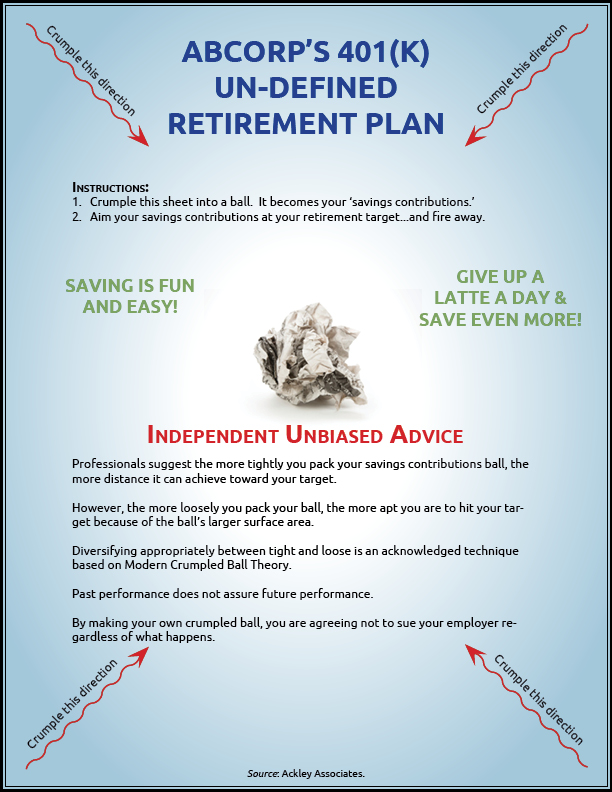

Dennis Ackley says he doesn’t get a lot of holiday cards from the mutual fund industry.

The Kansas City, Missouri, consultant has become a well-known critic of the 401(k) materials that funds provide to employers, which usually leave the complex job of retirement planning to the workers to figure out. When speaking to a room full of 401(k) plan sponsors, he has a unique way of getting his point across. Ackley hands out sheets of paper similar to what’s shown here and asks them to wad them up and throw them at the target.

The problem – for the plan sponsors in the audience – is that Ackley doesn’t give them a target.

“Most of them are just kind of befuddled by the whole thing.” Befuddlement, he tells is audience, “is what young employees experience sitting in a 401(k) meeting.” …Learn More