Posts Tagged "retirement"

May 24, 2012

Wanna Live Forever, Huh?

Mark Wexler (right), director of the documentary “How to Live Forever,” with fitness celebrity Jack Lalanne.

Immortality hasn’t been this hot since Ponce de Leon searched for the fountain of youth in 16th Century Florida.

The evidence: Captain Jack Sparrow (a.k.a. Johnny Depp) searched high and low for it in “Pirates of the Caribbean” Part IV last summer. Meanwhile, U.S. beaches were littered with the polka dot cover of “Super Sweet Sad Love Story” about a dystopian Manhattan, where longevity had to be earned. Mark Wexler’s documentary, “How to Live Forever,” was a bizarre-funny send up of baby boomers’ search for their fountains of youth. And time – not money – was the currency in the Justin Timberlake vehicle, “In Time.” Another Twilight vampire movie on the way…

This spring, Jane Fonda is promoting her new book, “Prime Time,” about what she calls the “third act” of life as more Americans are increasingly healthy into their 70s, 80s, even 90s. Not to put a damper on things, but can we afford our third act if we’re not Jane Fonda?

Noting the 30-year increase in U.S. longevity over the 20th century, she said it is ushering in a lifestyle “revolution.” But an index produced by the Center for Retirement Research, which funds this blog, indicates that we won’t have enough income to afford it. This regularly updated retirement index shows that nearly half of U.S. households with boomers in their early 50s are “at risk” of not having enough money for retirement.

Are you ready for your glorious third act? Or will it be more like the explorer’s quest? Pure myth.

Learn More

May 22, 2012

New Financial Tools Backed by Research

The Center for Retirement Research at Boston College has created a prototype personal finance website with tools and information on topics ranging from how to reduce spending or refinance a mortgage to the best way to draw down savings during retirement.

The website offers a comprehensive set of tools backed by impartial academic research – not sales pitches. Individuals can use each calculator, “Learn More” lesson, or “How To” guide individually or as the building blocks for an overall financial plan, which they can construct in a step-by-step process that begins on the homepage.

The website, also called Squared Away, was created by the Financial Security Project (FSP), a financial education initiative of the Center. It was funded (also like this blog) by the Social Security Administration.

The Center plans to distribute the site through various organizations, such as credit counselors, financial planners, employers, credit unions, and non-profits involved in helping low-income people build up their savings.

The website is still in the “beta” phase and will be improved over the coming months. We invite readers to try out the tools and comment on them by clicking “Learn More” below. All comments – good and bad – are welcome.Learn More

May 15, 2012

Financial Perils of the Single Woman

Being a single woman is serious stuff – financially that is.

One website recently published a humorous list of the advantages of being a single woman today. “You don’t have to be worried about not getting a special gift from Him on your special day because there is no Him.” Or: “There is no argument about where or when to go on vacation.” Toilet seats were also mentioned.

This may not amuse 30-something women with serious concerns about whether they’ll marry and have children. But face it: single women of all ages have more difficult money issues than their married friends. When two incomes are coming into the household, a couple shares the rent or mortgage. Fixed expenses can add up over a single woman’s life or during long bouts after, say, divorce.

“Single women are far more at risk,” said Wendy Weiss, a former financial adviser who writes a blog on her website, Hot Flash Financial. “If we make 77 cents on every dollar [men earn], men have 23 percent more discretionary income, and that’s usually the amount we advisers recommend you put away,” she said. Women also live longer and need more money to get through retirement, she said.

Prior to retirement, the rule of thumb is that single people need well more than half, possibly as much as 70 percent, of a childless couple’s combined income to afford the same lifestyle. It is higher for the poor (whose fixed expenses consume more of their total income) and for single mothers (for obvious reasons). …Learn More

May 3, 2012

Read That Social Security Statement!

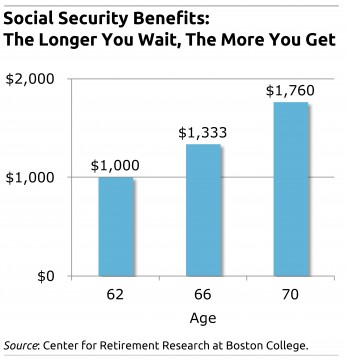

This week, the federal government put every worker’s Social Security statement online. But while most people look at their statements, research shows that more than one in three misses this major point: the longer one waits to file, the larger the monthly retirement check will be.

We’re talking big numbers: someone eligible to receive $1,000 a month at the popular retirement age of 62 can get $1,333 by waiting until 66 and $1,760 by waiting until 70. Of course, one’s health, financial resources, and life events may make filing later difficult or impossible. But getting the information is critical to making a smart decision, which plays a major role in one’s financial well-being in retirement.

We’re talking big numbers: someone eligible to receive $1,000 a month at the popular retirement age of 62 can get $1,333 by waiting until 66 and $1,760 by waiting until 70. Of course, one’s health, financial resources, and life events may make filing later difficult or impossible. But getting the information is critical to making a smart decision, which plays a major role in one’s financial well-being in retirement.

The Social Security Administration (SSA) put the statements online after creating a minor news flap last year when it stopped sending them via snail mail to workers. In February, SSA resumed the mailings to Americans age 60 and older. (Full disclosure: SSA funds this blog through the Center for Retirement Research at Boston College.)

Back to the point: The statements are now easily available on ssa.gov to individuals willing to provide some personal data – the site verifies the personal data they enter online against information held by the credit scoring company, Experian.

Here are a few other things about Social Security that might surprise you. According to various research papers that seek to understand how Americans view their benefits: …Learn More

April 17, 2012

Fewer Claiming Social Security Right at 62

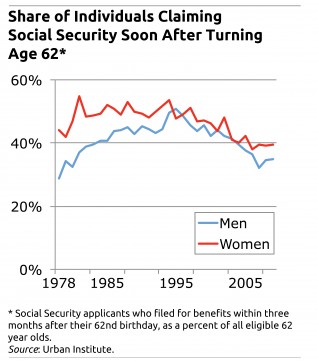

New research shows that the share of Americans who sign up to receive their Social Security pensions at age 62 has declined sharply over the past decade.

This trend is expected to continue despite a temporary spike in applications by 62-year-olds during the Great Recession, said Richard Johnson, a senior fellow who conducted this research at the Urban Institute, a Washington think tank. This is a major shift in retirement behavior, and it reflects sweeping cultural changes that range from more flexible employment options for older workers to the baby boomer health and fitness craze.

“Over the past 10 years, we saw the share of people claiming at 62 fall about 10 percent for men and 8 percent for women,” he said. “That’s a pretty big decline in 10 years’ time.”

Sixty-two year olds still constitute the largest single group of new applicants every year, regardless of age. That’s why the significant decline in their application rate is notable. Those who sign up for their Social Security checks when they first become eligible – within days or weeks of their 62nd birthday – are known as “early claimers.” People with physically demanding jobs are more likely to do so, because of health problems or unpleasant and exhausting work. …Learn More

April 10, 2012

I’ll Save More – Just Not Today Please

We know that not enough Americans save for retirement. Behavioral finance professor Shlomo Benartzi devised a way to fix it – quite awhile ago, in fact.

To ease the pain of saving money, Benartzi and economist Richard Thaler designed a now-famous program in which employees can commit to increase their 401(k)s savings when they get a raise.

Saving is painful because it requires sacrifice, but committing to save money that one doesn’t yet have synchs with human psychology. In 1998, Benartzi and Thaler tested their theory on blue-collar workers in a Midwestern manufacturing plant, and it worked.

The key to saving, Benartzi said, is “embarrassingly simple but extremely powerful.”

The finding was nothing short of ginormous, though employer adoption has been modest. David Wray, president of the Plan Sponsor Council of America, estimated that about 10 percent of U.S. employees with 401(k) plans at work have automatic savings increases, typically at raise time. It’s much more common among mega-employers, he said.

If you’ve heard about behavioral economics but haven’t had time to learn what it’s really about, this 15-minute TED video in which Benartzi explains is an excellent start.

March 13, 2012

Readers Express Views on Research

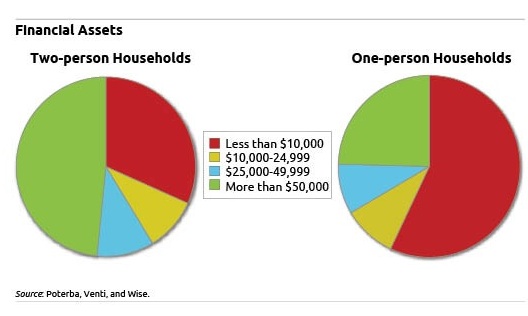

Squared Away readers responded strongly to a recent post, “For Elderly, Little Left as Life Ends.” New research showed that half of the elderly living alone and one-third of couples have less than $10,000 left in savings in the years before they leave this world.

A comment that came in from Susan Weiner, a Boston-area chartered financial analyst, said, “This study is disturbing no matter how you read it.”

John Graves added a skeptical note: “As always, it all depends on how you read the statistics. I read this as, ‘nearly 50 percent had more than $50,000 in assets when they died.’ ”

Do you read the glass as half empty or half full? What are the difficulties of making your savings last through all the phases of retirement? To read more comments, click here. Better yet, keep the conversation going by commenting below or on our Facebook page!