Posts Tagged "saving"

May 13, 2014

Spending Cut When Job Threats Rise

A new study provides important insights into American workers’ household budgets.

The study found that when workers sensed a growing likelihood they might lose their jobs, they quickly pared their spending on a large and diverse basket of discretionary consumer goods. These included both standard purchases and big-ticket items, from gardening supplies and vacations to cars and dishwashers.

The analysis was based on a survey of some 2,500 workers who were asked about their spending patterns and also asked to estimate their own chances of becoming unemployed over the coming year. The survey was conducted between 2009 and 2013, when the U.S. jobless rate at one point approached 10 percent. …Learn More

May 6, 2014

Half Say Retirement Saving Is Top Goal

Half of all American adults view their top financial goal as making sure they have enough money to retire, finds a survey conducted in early April and released last week by the National Endowment for Financial Education (NEFE).

That’s barely changed from 47 percent who said so in NEFE’s 2011 survey. These figures are unimpressive if one considers that most everyone eventually retires. Further, fewer than one in five U.S. workers has the luxury of a traditional defined benefit plan that will send them a pension check every month.

Saving for retirement hasn’t gotten any easier either: two of three adults in the NEFE survey identified an inability to save enough as a major financial obstacle. That sentiment may be one reason why only about half of private-sector U.S. workers participate in a retirement savings plan at work. …Learn More

April 22, 2014

Job Quality Matters

The nation’s job market regained some of its momentum in March. But it’s not just getting a job that’s key to gaining financial security – it’s about getting and keeping a quality job.

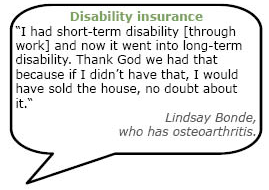

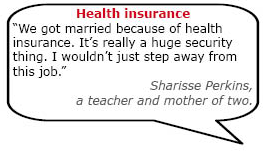

In a recent report, the Institute on Assets and Social Policy at Brandeis University used interviews with workers around the country to identify three aspects of a job – beyond the size of the paycheck – that help people save money and bolster their financial security. [Excerpts from some of the interviews are shown.]

The report also gave some indications of how common it is for workers to go without them:

Benefits – Employer health care, disability insurance, a 401(k) retirement plan with an employer savings match, tuition credits – these benefits help workers save more, shield them against risk, and protect their paychecks by subsidizing some living costs. But the service sector, one of the largest segments of the U.S. labor force, is particularly poor in providing such benefits.

Benefits – Employer health care, disability insurance, a 401(k) retirement plan with an employer savings match, tuition credits – these benefits help workers save more, shield them against risk, and protect their paychecks by subsidizing some living costs. But the service sector, one of the largest segments of the U.S. labor force, is particularly poor in providing such benefits.

Flexibility – Without sick days and similar arrangements, workers risk losing their jobs due to an illness or unanticipated event. …Learn More

April 17, 2014

Social Security 101

As a young adult starting my career in Chicago in the 1980s, I didn’t have a clue how Social Security worked or why money was being taken out of my scrawny paycheck.

But trust me on this: the Social Security retirement program becomes a lot more interesting to workers as they age and their retirement horizon comes into sharp focus. It affects just about every American – and most of us pay into it.

It is not only the bedrock of retirement for millions of Americans and their spouses, but it’s also a source of income for their survivors, including children, and workers who become disabled.

In this video, officials from the U.S. Social Security Administration explain what its programs do and why they matter. Learn More

April 15, 2014

Marching to Retirement Without a Plan

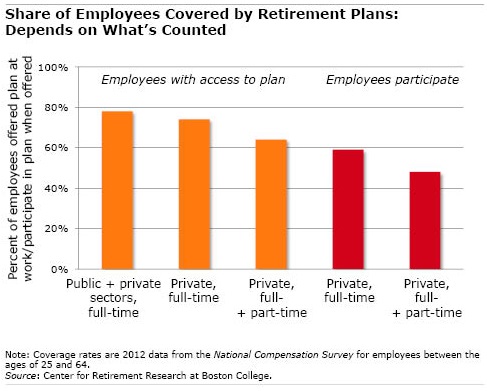

Only about half of all U.S. workers in the private sector participate in retirement savings plans at their current places of employment, according to a new report by the Center for Retirement Research.

Only about half of all U.S. workers in the private sector participate in retirement savings plans at their current places of employment, according to a new report by the Center for Retirement Research.

Pension coverage in this country “remains a serious problem,” concludes the Center, which also sponsors this blog.

The goal of the Center’s report is to make sense of the myriad estimates of how many Americans are covered at work. One prominent source of data is the federal government’s survey of employers, the National Compensation Survey. The NCS shows that 78 percent of full-time workers, ages 25 through 64, have some type of defined benefit or defined contribution plan available to them at work.

But that’s the rosiest way to slice the data.

The share of employees who are covered slides to 48 percent when public-sector, often unionized, workers are stripped out of the NCS; when part-time, private-sector workers are added in; and when one counts only the share who actually participate in an employer plan when it’s offered to them. …Learn More

March 27, 2014

Post Recession: Strugglers vs Thrivers

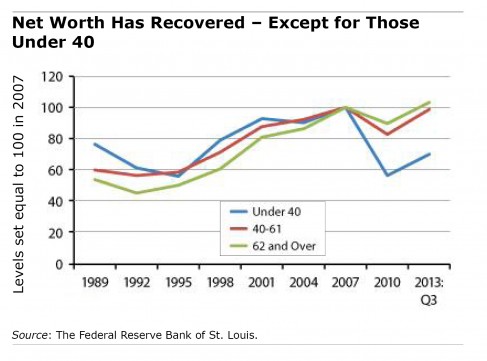

The Federal Reserve Bank of St. Louis, based on its analysis of data from the Survey of Consumer Finances, estimates that the recession has ended for only about one-quarter of the U.S. population – the thrivers, who have paid down their debts and restored their savings. That would leave three out of four Americans who are still struggling. Squared Away interviewed Ray Boshara, director of the Center for Household Financial Stability at the bank; Bill Emmons, senior economic adviser; and Bryan Noeth, policy analyst, for their insights into why most Americans’ net worth – their assets minus debts – hasn’t recovered.

Q: You distinguish “thrivers” from “strugglers.” Who are these two groups?

Boshara: The thrivers versus strugglers construct is a simple way to make the point that some demographically defined groups are doing better, on average, than others in terms of net worth – what you save, own, and owe, or your entire balance sheet. We found that age, race, ethnicity and education levels are pretty strong predictors of who lost wealth and who’s recovered wealth over the past few years, as well as over a longer period of time.

Q: Describe the typical thrivers.

Emmons: Whites and Asians with a college degree who are over 40 – that’s the typical thriver. Remember, this is a construct, and it’s not 100 percent foolproof. But you would tend to say these groups are more likely to have outcomes consistent with recovering.

Q: How about the typical strugglers?

Emmons: By age – they’re younger – and they’re African-American or Latino. They also do not have a college degree, and they have too much debt. They’re the other three-fourths of the population. They are not holding enough liquid assets, so they’re just one paycheck away from a crisis. They do not have a diversified portfolio and aren’t benefitting from the stock market gains. They’ve got too much in the house, which has declined in value.

Q: What have you learned about young adults and their wealth – or lack of it?

Q: What have you learned about young adults and their wealth – or lack of it?

Emmons: It jumps off the page in our analysis: It doesn’t matter if you’re white or college educated. If you’re young, you’re vulnerable, and you’ve made the same portfolio mistakes as people with less education: low levels of liquid assets, too much in the house, an issue that is related to portfolio diversification, and more leverage. …Learn More

February 20, 2014

Minimum Wage Workers: Who are They?

Whether or not you agree that the minimum wage should be raised, there are very real financial strains on the 5 percent of U.S. hourly workers who earn no more than $7.25 per hour, the current federal minimum wage.

This video, produced by Bloomberg TV, puts a human face on a few of these 3.5 million workers. Data from the U.S. Bureau of Labor Statistics provides more information about who they are:

- Nearly half are over age 25.

- Two-thirds are women, and one-third are men.

- About three-fifths of minimum-wage workers are in service occupations, such as food preparation and food service.