Posts Tagged "saving"

July 2, 2013

Readers Call Gen-X to Action

A recent blog article, “Retirement Tougher for Boomer Children,” did not elicit much sympathy for Generation X.

Many readers who commented expressed a sentiment something like this: Yes, things are tougher for young adults. So deal with it.

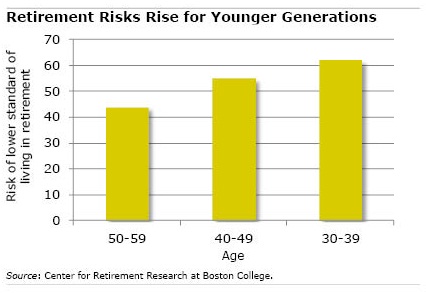

Members of Generation X, as well as Millennials, are largely on their own with their 401(k)s, in contrast to their parents and grandparents who may’ve had a guaranteed pension at work. But the evidence indicates young adults are not preparing for retirement: well over half of 30- and 40-somethings are on financial path to a lower standard of living once they retire, according to an analysis cited in the article.

They need to find “the discipline to save for retirement through all the means available,” said a Squared Away reader named Paul. …Learn More

June 13, 2013

Retirement Tougher for Boomer Children

The financial media (including this blog) inundate baby boomers with articles cajoling, coddling, and counseling them about their every retirement concern.

But members of the Me Generation might want to focus on their children: retirement is likely to be an even greater financial challenge for Generation X, now in their 30s and 40s.

Economists at the Center for Retirement Research, which supports this blog, recently produced this striking prediction: three out of five Americans in their 30s and well over half of those in their 40s are at risk of experiencing a decline in their standard of living after they retire.

Economists at the Center for Retirement Research, which supports this blog, recently produced this striking prediction: three out of five Americans in their 30s and well over half of those in their 40s are at risk of experiencing a decline in their standard of living after they retire.

This compares with 44 percent of baby boomers.

The reasons for Generation X’s poorer prospects are due to long-term trends like the rise of 401(k)s and less generous Social Security benefits for future generations. …Learn More

June 4, 2013

Earnings Growth: Better at the Top

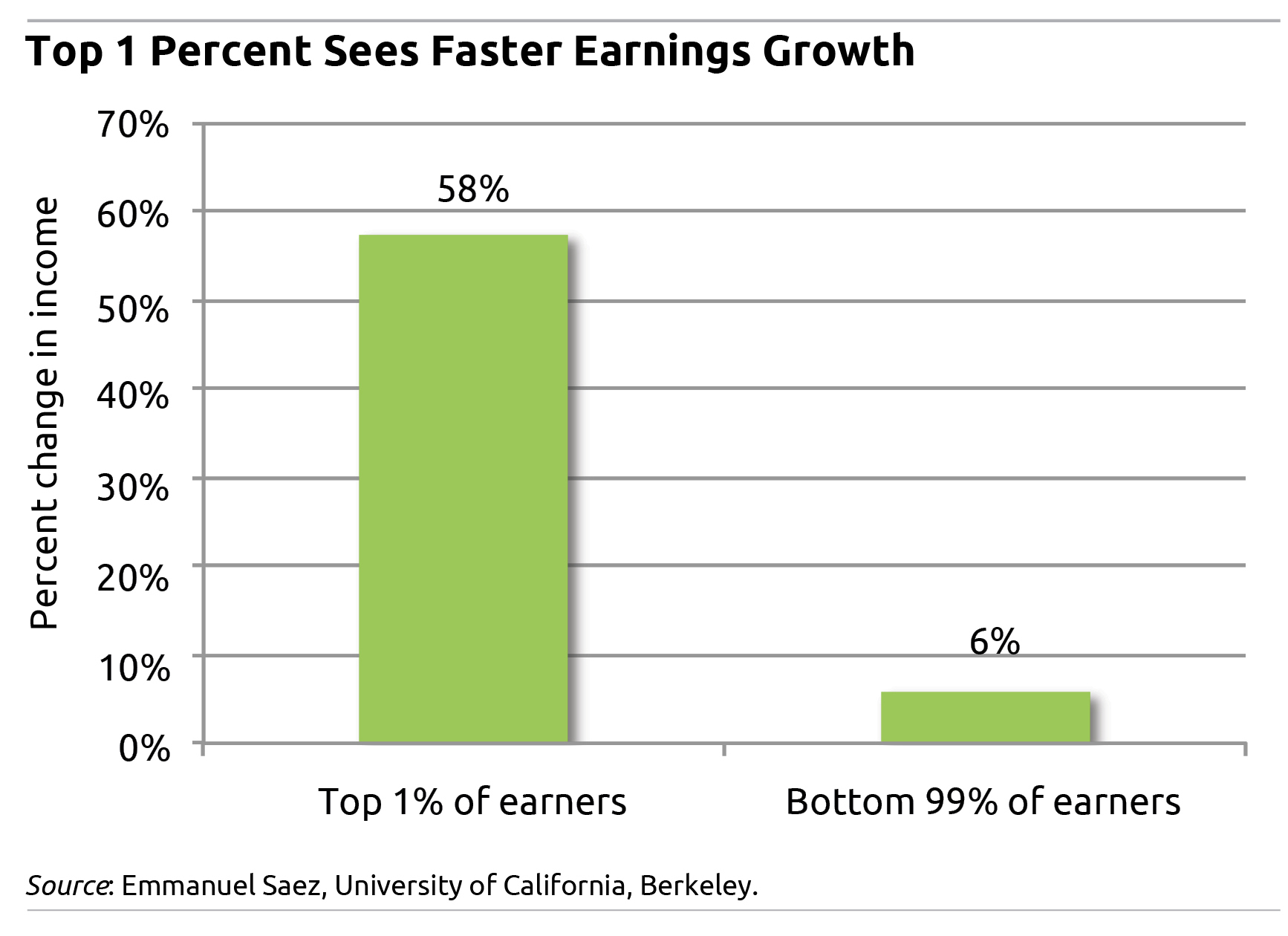

U.S. inequality can be measured two ways – by wealth or by earnings. Either way, most working Americans are losing out.

It’s the 1920s again for the richest 1 percent of Americans, and a recent analysis of the wealth gap illustrates why they’re able to live like the fictional Jay Gatsby, portrayed by Leonardo DiCaprio in the new movie, “The Great Gatsby.”

The value of their wealth rises and falls with the stock market. But since the 1960s, they have consistently held 33 percent to 39 percent of the wealth owned by all Americans, including their stock, mansions, commercial real estate, and businesses, according to economist Edward Wolff at New York University. In 2010, the last year examined by Wolff, the richest 1 percent’s share was 35 percent – that was before the Dow flew past 15,000.

The U.S. wealth gap is enormous, partly because most Americans have little wealth to speak of. Most people instead gauge their financial well-being by the size of their paychecks, and income inequality is rising sharply.

Between 1993 and 2011, the earnings of the top 1 percent of U.S. earners grew by nearly 58 percent, after adjusting for inflation. Earnings include salaries, bonuses, stock options, dividends, and capital gains on stock portfolios. That far outpaced the 6 percent rise for the rest of U.S. workers during the same 18-year period, according to a new analysis by economist Emmanuel Saez at the University of California, Berkeley. …Learn More

Between 1993 and 2011, the earnings of the top 1 percent of U.S. earners grew by nearly 58 percent, after adjusting for inflation. Earnings include salaries, bonuses, stock options, dividends, and capital gains on stock portfolios. That far outpaced the 6 percent rise for the rest of U.S. workers during the same 18-year period, according to a new analysis by economist Emmanuel Saez at the University of California, Berkeley. …Learn More

May 28, 2013

Aussie Employer Mandate Fuels Saving

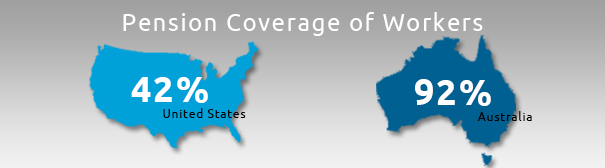

Consider this: 92 percent of Australian workers have 401(k)-style plans, while less than half of Americans have any kind of pension coverage on their current job.

This yawning disparity exists, because the Australian government requires employers to contribute 9 percent of each worker’s earnings to a personal account, which participants invest much like a 401(k). Under reforms to Australia’s system, employer contributions will rise gradually until 2020 – to 12 percent.

Even though Aussie employers are mandated to make the contributions, economists argue, the money ultimately comes from workers – through lower wages. But U.S. workers, left on their own, have proved to be poor savers, and the fact remains that putting the onus on employers to ensure that retirees have something in savings is working better than our catch-as-catch-can system.

“Australia has been extremely effective in achieving key goals of any retirement income system,” concluded a new report by the Center for Retirement Research, which supports this blog. …Learn More

May 21, 2013

Few Boomers Catch Up on 401(k) Saving

Only 13 percent of older workers take advantage of the “catch-up” contributions to their retirement accounts permitted by the IRS for anyone over 50, according to new data provided by Fidelity Investments.

This is hardly surprising, since prior research has estimated that only about 10 percent of all workers are contributing the maximum $17,500 per year that everyone, regardless of age, is allowed to contribute under IRS guidelines for 2013. Since the vast majority never reach that cap, the “catch-up” 401(k) contribution enacted to encourage people to save more when they hit their 50th birthday – an additional $5,500 per year – is largely irrelevant to them.

But the catch-up contribution data, which Fidelity culled from its 401(k) client database representing some 12 million workers, are yet another reminder of a fundamental problem with the U.S. retirement system: Americans simply are not saving enough to ensure their financial security in old age.

In short, members of the Me Generation don’t seem to be doing a great job of taking care of Me. …Learn More

April 30, 2013

Translating Savings to Retirement Income

Determining how much money one will need in retirement is a mathematically and psychologically daunting task for many Americans. But new research has landed on a deceptively simple strategy for prodding workers to save.

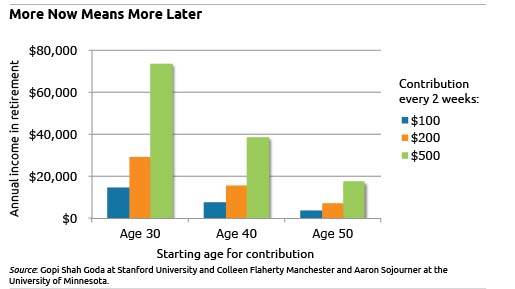

Employees in an experiment at the University of Minnesota saved more for retirement after researchers provided them with a personalized chart with information similar to that shown below. Each employee’s chart translated a $100, $200, or $500 contribution, made every other week, into the amount of income each of these contributions would generate annually once they retired. If they saved more, they could see that it translated to more retirement income.

“We think people may have a hard time making that translation from an accumulation of wealth to an income flow,” said researcher Colleen Flaherty Manchester. “They’re used to the flow because that’s what they get every month or week in their paycheck.”

The income projections, she said, are “completing the circle for them to make it clear.” …Learn More

April 23, 2013

Financial Boot Camp Helps Army Enlisted

A U.S. Army requirement that newly enlisted men and women complete an ambitious personal finance course is having some impressive results.

At a time when financial education is increasingly being criticized as an ineffective way to raise Americans’ low saving rate, an 8-hour course held on 13 Army bases is significantly boosting how much military personnel are saving for their retirement – among both big and small savers. They also trimmed their debts.

The strong results, described in a new study by William Skimmyhorn, an assistant professor at the U.S. Military Academy at West Point, are also sending a ripple through the financial literacy community.

“The reason this study is so interesting is because it’s so unusual,” said Harvard University’s Brigitte Madrian, co-director of the household finance working group for the National Bureau of Economic Research. “There aren’t a lot of other scientific studies one can point to” that show empirically that financial education can improve an individual’s well-being, she said. …Learn More