Posts Tagged "saving"

September 8, 2011

The Power of Compound Interest

Every entrant to the workforce should be subjected to the same questions posed to California undergraduates in a new experiment about how well people understand compound interest.

Better to show the math than to explain it. Franny and Zooey just started working. Franny immediately begins depositing $100 per month – $1,200 every year – into her new retirement account, which pays 10 percent interest annually. Zooey doesn’t start saving for 20 years, but he puts in $300 every month — $3,600 annually — and also earns 10 percent interest.

In 40 years, Franny retires with $584,222 in her account – more than double Zooey’s $226,809.

Asked to calculate these future savings on their own, 90 percent of the undergraduates had vastly underestimated the totals in the experiment by Craig McKenzie at University of California, San Diego and Michael Liersch at New York University. Yet, this mathematical calculation is central to the financial well-being of most Americans. In 2009, more than half of all households were at risk of not having sufficient assets to retire, according to Boston College’s Center for Retirement Research, which hosts this blog. …Learn More

July 28, 2011

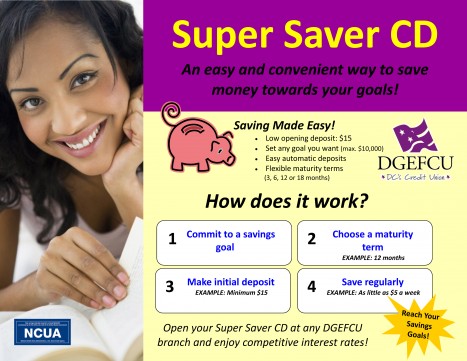

New Product Boosts Low-Income Saving

A Connecticut non-profit is testing a new product to help low-income people overcome their particular obstacles to saving money.

Innovations for Poverty Action is recruiting participants at the District Government Employees Federal Credit Union in Washington. The effort replicates a program already up and running in New York City.

The product’s name, Super Saver CD, is a bit of a misnomer. It is a hybrid of a bank certificate of deposit and a traditional savings account. Its low minimum deposit – $15 – removes a formidable obstacle for people who can’t afford to shell out $1,000 for a CD.

The product’s name, Super Saver CD, is a bit of a misnomer. It is a hybrid of a bank certificate of deposit and a traditional savings account. Its low minimum deposit – $15 – removes a formidable obstacle for people who can’t afford to shell out $1,000 for a CD.

Innovations for Poverty Action was founded by behavioral economist Dean Karlan at Yale University, and it designed the Super Saver CD to help people to act in their own interest and save. The human behavior that drives the product’s design is that people don’t always do what they say they’ll do. So the Super Saver CD requires that people commit to regular deposits. The idea is to encourage saving regularly, a little at a time, like a savings account. But once the money is put away, it can’t be touched – that’s where a CD-style commitment comes in.

Rosa Sorto, who irons linens at a Washington laundry service for hotels and hospitals, said the program appealed to her because she can put the money away and forget about it. …Learn More

July 28, 2011

Nudge to Save Doesn’t Work

The popular strategy of automatically enrolling people in savings plans didn’t work so well among low-income people.

Researchers found that when a tax preparation service slated 10 percent of filers’ tax refunds to purchase a savings bond, many balked and opted out of the program. The likely reason: they already had plans for how they were going to spend the windfall, including a pressing need to pay bills.

Automatic enrollment in 401(k)s, a strategy pioneered by behavioral economists, is gaining popularity in U.S. workplaces, largely because it works so well: a record 51 percent of U.S. employers used auto enrollment in 2010, according to Callan Associates, a benefits consultant.

Workers can still opt out, but employers have found that most of them remained in the 401(k) plan. This is due to inertia and also because employees know that saving for retirement is the right thing to do – they just needed a push.

But an experiment by economists at Swarthmore College and the University of Virginia, published recently by the National Bureau of Economic Research, “raises questions about the power of defaults.” …Learn More

July 26, 2011

The Bane of Financial Plans

There’s something about getting a will together, checking in on one’s retirement fund, or finally paying down that credit card that causes the procrastination gene to kick in.

In this recent video on CBS, Harvard behavioral economist David Laibson explains the reason for this tendency: “present bias.” Humans put more weight on the present than on the future, so it’s easier to delay the hard work until later. No surprise that’s true for financial tasks, which can be overwhelming, emotional, complex, or unpleasant.

“We humans have wonderful intentions about what we’re going to do,” he explains in this video. But when the time comes to do it, “We decide once again to push it further into the future.”

Laibson uses a simple example from a well-known 1980s experiment in which researchers asked people at Amsterdam workplaces whether they would want a healthy fruit snack, an indulgent chocolate bar, or potato chips next week. Most chose fruit.

On the day they were to receive the snack, the researchers said they lost the workers’ previous selection and asked them to pick again. The preferences flipped, and most chose chocolate.

Laibson goes on to apply the fruit/chocolate concept to financial decisions. The video was recorded last month, but the topic – human behavior – never gets old for Squared Away.Learn More

July 20, 2011

There’s an App for That Child!

Susan Beacham’s company has sold nearly one million of its piggy bank with four slots – for spending, saving, donating, and investing. She has now developed an iPhone application based on the iconic pig.

Children who use the clear blue piggy bank like to watch their money clink to the bottom of one of the four separate sections in the pig’s innards. Beacham has developed an entire curriculum around the four choices. The Money Savvy Pig has been adopted as a teaching tool by more than 200 Chicago public schools and by school systems in Seattle, North Dakota, Europe, and elsewhere.

The idea behind the game app, called “Savings Spree,” is the same: to help children “strengthen the muscle of choice and, therefore, their self-regulation and self-control,” said Beacham, chief executive of Money Savvy Generation Inc., a small, mission-driven company employing four people. …

June 30, 2011

The Big Freeze Immobilizes Boomers

“The Big Chill” was the iconic movie for baby boomers in their prime in 1983. Perhaps The Big Freeze is the best way to describe where we’ve ended up.

Two recent reports based on in-depth interviews with retirees and pre-retirees arrived at the same conclusion about how we are approaching the dreaded retirement: paralysis.

A report commissioned by Boston College’s Financial Security Project, which sponsors the Squared Away blog, found that the baby boomers and pre-retirees felt “immobilized in retirement planning efforts by a combination of practical and emotional factors.”

These emotions include fear and confusion about not having enough money, not knowing how much they’ll need, and not knowing how or where to get information or help.Learn More

June 14, 2011

Nature of Job is Key to Investing

Toronto finance professor Moshe Milevsky has written a new book, so this seemed like a good excuse to revisit his favorite question: are you a stock or a bond?

Milevsky believes financial advisors should ask their clients this question before making any asset-allocation decisions. If someone has a risky job, he argues – if they are a stock – then their portfolio should emphasize bonds.

“If a financial advisor says you have a lot of stocks [in your investment portfolio] and should buy bonds, the response should be, ‘My job is a bond,’ “ he said.

Milevsky is adding another layer to the risk formula usually promoted by financial planners, who typically advise clients to lower their risk as they age. Milevsky wants people to avoid the double jeopardy dramatized by Enron Corp. employees, who had high-risk jobs in energy speculation and put their money into high-risk stocks – even worse, they were Enron stocks.

In a recent interview, he rated a few professions on the stock-bond continuum to demonstrate how his theory works. …Learn More