Posts Tagged "Social Security"

September 17, 2019

Readers Debate Retirement Issues

It’s always interesting to see which Squared Away blogs get the strongest reaction from our readers. The June blog, “Husbands Ignore Future Widows’ Needs,” was one of them.

Some readers felt that the results of the study described in the article don’t match up with their experiences. The researchers determined that husbands often are not sensitive to the fact that if they sign up for Social Security in their early 60s, they could be locking in a smaller survivor benefit one day for their widows.

“The elderly couples with whom I do retirement planning are typically very conscious of each other’s needs,” said a critic named Jerry.

But financial planner Kathleen Rehl has the opposite experience when working with couples. “Most couples hadn’t previously known their options and ramifications of those choices,” she said. “Such an important planning concept.”

The blog was based on a study conducted for the Retirement and Disability Research Consortium – consortium studies by researchers around the country are featured regularly on Squared Away.

Here are other 2019 articles about the consortium’s research on various retirement and labor market issues that readers weighed in on: …Learn More

September 5, 2019

Social Security: the ‘Break-even’ Debate

Our recent blog post about the merits of delaying Social Security to improve one’s retirement outlook sparked a raft of comments, pro and con.

In the example in the article, a 65-year-old who is slated to receive $12,000 a year from Social Security could, by waiting until 66 to sign up for benefits, get $12,860 a year instead. By comparison, it would cost quite a bit more – about $13,500 – to buy an equivalent, inflation-adjusted annuity in the private insurance market that pays that additional $860 a year.

The strategy of delaying Social Security “is the best deal in town,” said a retirement expert quoted in the article.

Aaron Smith, a reader, doesn’t agree. “It will take 14 years to make that ($12,000) up. Sorry but I’ll take the $12k when I’m in my early 60s and can actually enjoy it,” he said in a comment on the blog.

Smith is making what is known as the “break-even” argument, which is behind a lot of people’s decisions about when to start collecting their Social Security.

But other readers point out that the decision isn’t a simple win-loss calculation. The benefit of getting a few extra dollars in each Social Security check – between 7 and 8 percent for each year they delay – is that it would help retirees pay their bills month after month.

This is a critical consideration for people who won’t have enough income from Social Security and savings to maintain their current standard of living after they stop working – and 44 percent of workers between 50 and 59 are at risk of falling short of that goal.

One big advantage of Social Security is that it’s effectively an annuity, because it provides insurance against the risk of living a long time. So the larger check that comes with delaying also “lasts the rest of your life,” said Chuck Miller, another reader. …Learn More

September 3, 2019

Second Careers Late in Life Extend Work

Moving into a new job late in life involves some big tradeoffs.

What do older people look for when considering a change? Work that they enjoy, fewer hours, more flexibility, and less stress. What could they be giving up? Pensions, employer health insurance, some pay, and even prestige.

Faced with such consequential tradeoffs, many older people who move into second careers are making “strategic decisions to trade earnings for flexibility,” concluded a review of past studies examining the prevalence and nature of late-life career changes.

The authors, who conducted the study for the University of Michigan’s Retirement and Disability Research Center, define a second career as a substantial change in an older worker’s full-time occupation or industry. They also stress that second careers involve retraining and a substantial time commitment – a minimum of five years.

The advantage of second careers is that they provide a way for people in their late 40s, 50s, or early 60s who might be facing burnout or who have physically taxing jobs to extend their careers by finding more satisfying or enjoyable work.

Here’s what the authors learned from the patchwork of research examining late-life job changes:

People who are highly motivated are more likely to voluntarily leave one job to pursue more education or a position in a completely different field, one study found. But older workers who are under pressure to leave an employer tend to make less dramatic changes.

One seminal study, by the Urban Institute, that followed people over time estimated that 27 percent of full-time workers in their early 50s at some point moved into a new occupation – say from a lawyer to a university lecturer. However, the research review concluded that second careers are more common than that, because the Urban Institute did not consider another way people transition to a new career: making a big change within an occupation – say from a critical care to neonatal nurse. “Unretiring” is also an avenue for moving into a second career.

What is clear from the existing studies is that older workers’ job changes may involve financial sacrifices, mainly in the form of lower pay or a significant loss of employer health insurance. But they generally get something in return: more flexibility. …Learn More

August 13, 2019

Fewer Contingent Workers Seek SSDI

The vast majority of so-called contingent workers – think Lyft drivers, AirBnB hosts, independent contractors, consultants, and freelancers – have built up the work history necessary to apply for federal disability benefits if they become injured.

The 86 percent coverage rate for contingent workers in their 50s and early 60s is less than the 92 percent for regular workers – but not by much.

Despite their relatively high rates of eligibility, however, older contingent workers are significantly less likely to end up on Social Security Disability Insurance (SSDI) than similar workers in traditional jobs, according to a new study by the Center for Retirement Research.

This finding is mainly driven by contingent workers’ lower application rates for SSDI. Applications are lower even for people with the physical, cognitive or emotional conditions that the government explicitly lists as SSDI-eligible.

“Even the contingent workers who need SSDI the most are less likely to apply for and be awarded benefits,” the researchers said.

They offer a couple reasons for the lower application rates. One reason might be that contingent workers would get less in their disability checks than workers with traditional jobs receive, because the benefits are based on earnings – and contingent workers earn an average $592 per month less than other workers.

A more compelling explanation is that they simply lack access to the natural avenues for learning about the program’s existence and their potential eligibility: unions, fellow employees, and a traditional employment arrangement. For example, private-sector employers often require people on their payrolls to apply for federal SSDI before receiving the company’s disability coverage. Contingent workers outside of this kind of arrangement are rarely covered by any employee benefits, let alone private disability insurance. …Learn More

August 1, 2019

A Proposal to Fill Your Retirement Gap

David and Debra S. both had successful careers. In analyzing their retirement finances, the couple agreed that he should wait until age 70 to start his Social Security in order to get the largest monthly benefit.

But he wanted to sell his business at age 69 and retire then, so the North Carolina couple used their savings to cover some expenses over the next year.

Waiting until 70 – the latest claiming age under Social Security’s rules – accomplished two things. In addition to ensuring David gets the maximum benefit, waiting guaranteed that Debra, who retired a few years ago, at 62, would receive the maximum survivor benefit if David were to die first.

Other baby boomers might want to consider using this strategy. As this blog frequently reminds readers, each additional year that someone waits to sign up for Social Security adds an average 7 percent to 8 percent to their annual benefit – and these yearly increments spill over into the survivor benefit.

Delaying Social Security is “the best deal in town,” said Steve Sass at the Center for Retirement Research, in a report that proposes baby boomers use the strategy to improve their retirement finances.

Here’s the rationale. Say, an individual wants a larger benefit. Instead of collecting $12,000 a year at age 65, he can wait until 66, which would increase his Social Security income to $12,860 a year, adjusted for inflation, with the increase passed along to his wife after his death (if his benefit is larger than his working wife’s own benefit). The cost of that additional Social Security income is the $12,000 the couple would have to withdraw from savings to pay their expenses while they delayed for that one year.

Social Security is essentially an annuity with inflation protection – and the payments last as long as a retiree does. So the $12,000 cost of increasing his Social Security benefit can be compared with cost of purchasing an equivalent, inflation-indexed annuity in the private insurance market. An equivalent insurance company annuity for a 65-year-old man, which begins paying immediately and includes a survivor benefit, would cost about $13,500. …Learn More

July 16, 2019

Spotlight on Our Research, Aug. 1-2

Topics for this year’s Retirement and Disability Research Consortium meeting include the opioid crisis, retirement wealth inequality over several decades, trends in Social Security’s disability program, and the impacts of payday loans, college debt, and mortgages on household finances.

Researchers from around the country will present their findings at the annual meeting in Washington, D.C. Anyone with an interest in retirement and disability policy is welcome. Registration will be open through Monday, July 29. For those unable to attend, the event will be live-streamed. The agenda lists all of the studies.

Here are a few:

- Why are 401(k)/IRA Balances Substantially Below Potential?

- The Impacts of Payday Loan Use on the Financial Well-being of OASDI and SSI Beneficiaries

- The Causes and Consequences of State Variation in Healthcare Spending for Individuals with Disabilities

- Forecasting Survival by Socioeconomic Status and Implications for Social Security Benefits

- What is the Extent of Opioid Use among Disability Applicants? …

July 11, 2019

Video: Retirement Prep 101

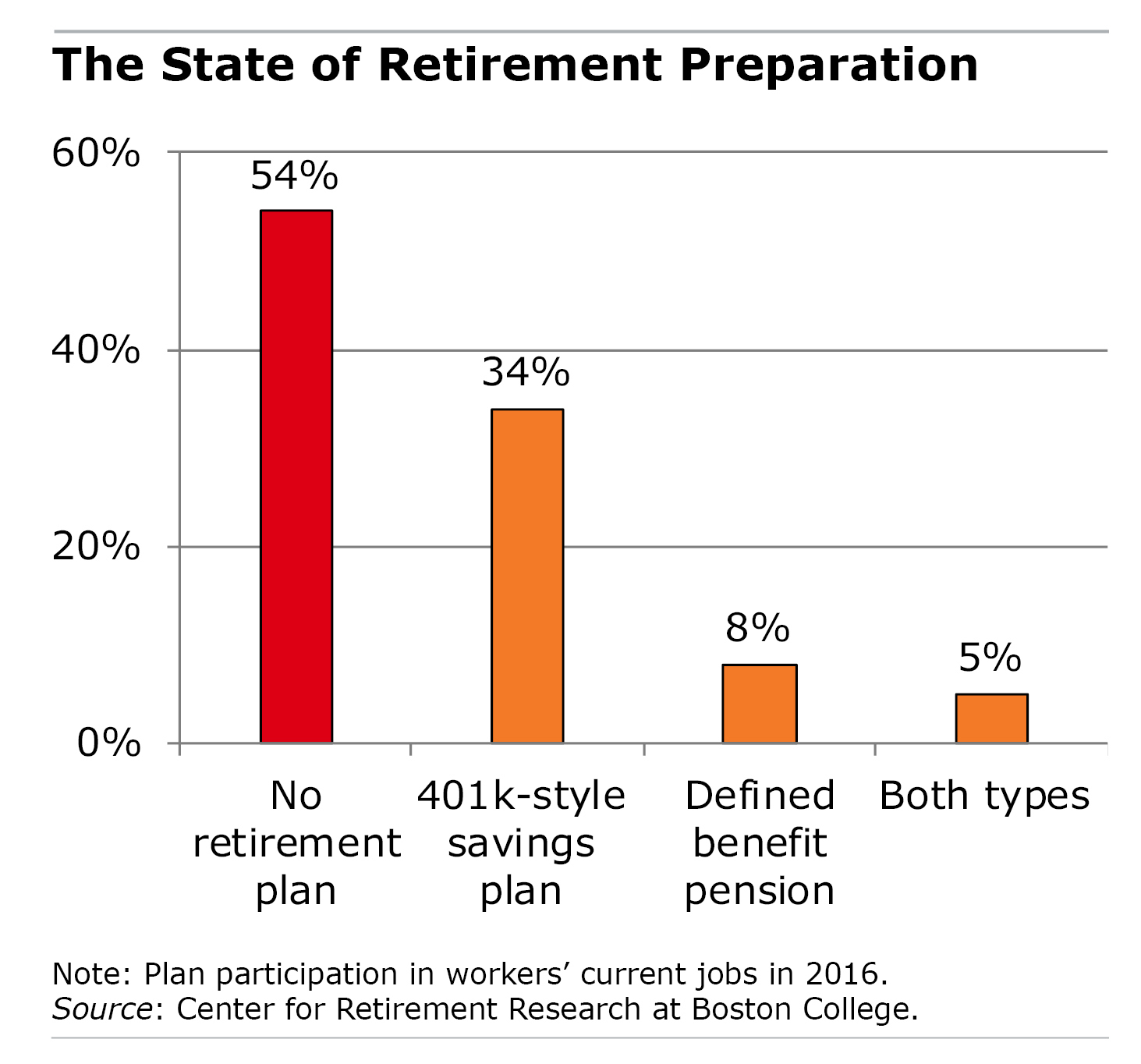

Half of the workers who have an employer retirement plan haven’t saved enough to ensure they can retire comfortably.

This 17-minute video might be just the ticket for them.

Kevin Bracker, a finance professor at Pittsburg State University in Kansas, presents a solid retirement strategy to workers with limited resources who need to get smart about saving and investing.

While not exactly a lively speaker, Bracker explains the most important concepts clearly – why starting to save early is important, why index funds are often better than actively managed investments, the difference between Roth and traditional IRAs, etc.

Some of his figures are somewhat different than the data generated by the Center for Retirement Research, which sponsors this blog. But both agree on this: the retirement outlook is worrisome.

Some of his figures are somewhat different than the data generated by the Center for Retirement Research, which sponsors this blog. But both agree on this: the retirement outlook is worrisome.

The Center estimates that the typical baby boomer household who has an employer 401(k) and is approaching retirement age has only $135,000 in its 401(k)s and IRAs combined. That translates to about $600 a month in retirement.

Future generations who follow Bracker’s basic rules should be better off when they get old. …Learn More