Posts Tagged "spending"

August 7, 2012

Gilded Age: Pride in Excess

The flaunting of wealth that marked the Gilded Age is difficult to grasp. Forbes reports there are currently 425 U.S. billionaires, the most in any country. They tend to live in cocoons, flinching when the media write about their vast homes or other trappings of wealth.

But Newport Rhode Island’s Gilded Age mansions were built for the express purpose of showcasing the unprecedented fortunes accumulated during the new industrial age. Summer residents paraded in their finery during afternoon carriage rides and held lavish parties for hundreds – sometimes thousands – on the grounds of their seaside homes, which replicated the castles that wealthy Americans saw during their European vacations. [On Aug. 16-19, The Preservation Society of Newport will host a weekend of carriage rides.]

Enjoy this photo tour of The Breakers and Marble House! Newport’s most spectacular homes were built by two grandsons of the steamship and railroad magnate “Commodore” Cornelius Vanderbilt.

Arial View of The Breakers, Newport, Rhode Island:

Cornelius Vanderbilt II introduced his “summer cottage” to high society with a 1895 debutante party for daughter Gertrude, officially putting his $75 million fortune on grand display. …Learn More

July 12, 2012

How Can Debt Enhance Self-Esteem?

The media went crazy last month over research determining that debt – whether college loans or credit cards – is a major source of self-esteem for young adults.

Judging by the tone of these articles, the reporters were so flabbergasted that they didn’t think to ask the logical follow-up question: Why? Credit cards aren’t inherently bad, though they can get people who abuse them in trouble. But equating self-esteem with debt seems to turn the notion of financial judgment on its head.

So Squared Away consulted therapist Dave Jetson and financial planner Rick Kahler, both of Rapids City, South Dakota. They often work together with clients on their financial issues but offered different explanations for this puzzling phenomenon.

Because debt is increasingly required to get a college education, Kahler said it may benefit from the glow of what an education represents. Debt has become a mark of being “smart enough to get through college.”

Jetson sees a dramatic cultural shift that is influencing today’s young adults. This shift coincides with shrinking economic opportunity for many college graduates. …

Learn More

June 21, 2012

Set Priorities to Limit Travel Spending

The world seems like a small place for young adults, thanks to college internships abroad, the Web, and some boomer parents who took their children to Paris as effortlessly as 1950s parents hit the road in a Chevrolet.

While surveys have predicted that Americans plan to spend more on their 2012 vacations than they did last summer, that may not apply to young globetrotters on a budget.

In this 2010 video, Matt Gross, a free-lance travel writer for The New York Times, provides great advice that never gets stale for young adults with far-flung travel horizons. Gross’s tips amount to more than money savers – he puts forth a travel-spending philosophy:

Learn More

June 12, 2012

Couple Reach Across Financial Divide

Meet Shannan Schmitt, 40: She cannot resist $200 Via Spiga pumps, hickory hardwood floors, or the fancy soaps and gourmet goodies at the farmers market where she likes shopping with her toddler son.

Meet Shannan Schmitt, 40: She cannot resist $200 Via Spiga pumps, hickory hardwood floors, or the fancy soaps and gourmet goodies at the farmers market where she likes shopping with her toddler son.

Meet her husband, Randy Nauman, 36. His penny-pinching ways are dictated by the numbers and his bachelor’s degree in finance. Her Internet shopping drives him to distraction.

“Opposites attract,” said their financial coach, Kelley Long.

Married five years, the Cincinnati couple’s willingness to discuss their finances publicly, for this article, is rare. But their marital discord over money is not: A recent survey found that the typical American couple argues about money three times a week, and past academic research has found that the more couples argue about money the greater is their risk of divorce.

Nauman said money “is the biggest issue,” and he worries it may be severe enough to jeopardize their marriage. “It leads into other stressful situations and arguments that don’t need to happen,” he said.

But Long, who owns KCL Financial Coaching in Chicago (formerly Cincinnati), said Schmitt and Nauman are like other couples who marry at a later age. “It’s harder to combine your finances if you’ve already had a chance to establish your financial habits” before getting married, she said.Learn More

May 22, 2012

New Financial Tools Backed by Research

The Center for Retirement Research at Boston College has created a prototype personal finance website with tools and information on topics ranging from how to reduce spending or refinance a mortgage to the best way to draw down savings during retirement.

The website offers a comprehensive set of tools backed by impartial academic research – not sales pitches. Individuals can use each calculator, “Learn More” lesson, or “How To” guide individually or as the building blocks for an overall financial plan, which they can construct in a step-by-step process that begins on the homepage.

The website, also called Squared Away, was created by the Financial Security Project (FSP), a financial education initiative of the Center. It was funded (also like this blog) by the Social Security Administration.

The Center plans to distribute the site through various organizations, such as credit counselors, financial planners, employers, credit unions, and non-profits involved in helping low-income people build up their savings.

The website is still in the “beta” phase and will be improved over the coming months. We invite readers to try out the tools and comment on them by clicking “Learn More” below. All comments – good and bad – are welcome.Learn More

May 3, 2012

Read That Social Security Statement!

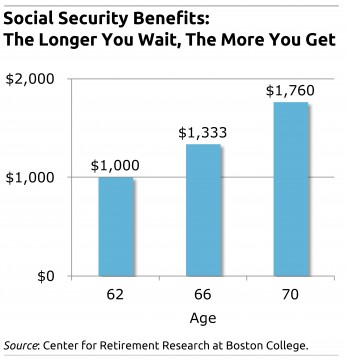

This week, the federal government put every worker’s Social Security statement online. But while most people look at their statements, research shows that more than one in three misses this major point: the longer one waits to file, the larger the monthly retirement check will be.

We’re talking big numbers: someone eligible to receive $1,000 a month at the popular retirement age of 62 can get $1,333 by waiting until 66 and $1,760 by waiting until 70. Of course, one’s health, financial resources, and life events may make filing later difficult or impossible. But getting the information is critical to making a smart decision, which plays a major role in one’s financial well-being in retirement.

We’re talking big numbers: someone eligible to receive $1,000 a month at the popular retirement age of 62 can get $1,333 by waiting until 66 and $1,760 by waiting until 70. Of course, one’s health, financial resources, and life events may make filing later difficult or impossible. But getting the information is critical to making a smart decision, which plays a major role in one’s financial well-being in retirement.

The Social Security Administration (SSA) put the statements online after creating a minor news flap last year when it stopped sending them via snail mail to workers. In February, SSA resumed the mailings to Americans age 60 and older. (Full disclosure: SSA funds this blog through the Center for Retirement Research at Boston College.)

Back to the point: The statements are now easily available on ssa.gov to individuals willing to provide some personal data – the site verifies the personal data they enter online against information held by the credit scoring company, Experian.

Here are a few other things about Social Security that might surprise you. According to various research papers that seek to understand how Americans view their benefits: …Learn More

April 19, 2012

Middle Schools Vie in Video Contest

The Massachusetts Financial Education Collaborative (MFEC) had one big reason for targeting its video contest to middle school kids: advertising.

“Hey, you gotta have a cell phone. You gotta have these jeans. The contest seemed like a great way to bring awareness” to the issue of kids and our consumer culture, said Andrea Wrenn, mother of five, education consultant, and the MFEC volunteer who oversees the contest.

Two Massachusetts middle schools submitted videos exploring kid consumerism in the first year of MFEC’s contest: the Norwell Middle School and the Hill View Montessori Charter Public School in Haverhill.

Squared Away encourages readers to support the new effort by clicking here to vote for your favorite video! The voting deadline is April 27.

The contest is among the creative ways communities are encouraging children and teenagers to learn about the money issues they deal with – a play recently staged by Cambridge high school students was another.Learn More