Posts Tagged "spending"

February 2, 2012

Teen Play about Money is “Eye Opening!”

“Money Matters,” a play that opened last weekend in Cambridge, Mass., demonstrated the financial wit of its teenage actors at the same time that they – and the audience – embraced the complexities of money.

“Money Matters,” a play that opened last weekend in Cambridge, Mass., demonstrated the financial wit of its teenage actors at the same time that they – and the audience – embraced the complexities of money.

Credit versus debt, income differences among classmates, money and relationships, certificates of deposit, needs versus wants – this only scratches the surface of the subject matter in the Youth Underground theater production, which begins touring the Boston area in February.

The actors clearly were having fun, but their performance served as an educational tool that might be replicated. For example, the screenplay was based on the actors and other teenagers’ 80-some interviews of community residents about their financial viewpoints and mishaps. The stories generated ideas for the vignettes that were stitched into a screenplay.

“Very eye-opening!” audience member Cameron Netland, 16, said after the performance.

“I learned the difference between saving and spending and between debit and credit!” said Aaliyah Nathan, 14, who, wearing black suede boots to the performance, admitted a weakness for new shoes. …Learn More

January 24, 2012

Young Adults Adrift in E-Spending Ocean

Collectibles purchased online range from Russel Wright dinnerware (shown here) to songs and video. Source: backhomeagainvintage.

Credit cards and malls are so yesterday.

Young adults move easily among an array of online payment and shopping options unimaginable a decade ago: PayPal, Groupon, telephone bill payment, smartphone apps that pay for store purchases, online retailers galore, automatic bank payments, and online gift cards.

Technology is moving fast: Amazon recently released an app called “Flow” that will recognize a product — from a book to a jar of Nutella — and then send the price, user reviews and a “Buy It Now” option to your smartphone.

It’s time to take stock of how easy it has become to overspend and how difficult saving is for young adults weaned on e-transactions.

“When it doesn’t feel like money, people don’t treat it like money,” said Priya Raghubir, a professor at the New York University Stern School of Business, neatly summing up her 2008 paper, “Monopoly Money: The Effect on Payment Coupling and Form on Spending Behavior.”

It’s extremely hard for young adults to change their behavior, “because they aren’t used to any other way of paying,” said Raghubir, 48, who remembers the old paper-transaction days when cash was king and checks were reserved for the big purchases…Learn More

December 8, 2011

Calculate Holiday Budget: If You Dare

Take a hard look at your holiday spending. A credit counseling agency in Virginia says it shouldn’t exceed 1.5 percent of your annual income.

How’s your budget doing? Click here to use the holiday planning calculator, courtesy of Clearpoint Credit Counseling Solutions, a non-profit agency in Richmond, Virginia.

The budget tells you how much you can spend and then divvies it up among gifts, parties, travel, food, and donations. There sure is a lot to spend your money on!

December 6, 2011

United States of Credit

The holidays have arrived, and our credit cards are getting a workout. Sheldon Garon, author of “Beyond Our Means: Why America Spends While the World Saves” (November 2011), maintains that gift shopping isn’t only about giving – it’s our civic duty, we’re told.

Squared Away interviewed the Princeton University historian about world savings rates and America’s “democratization of credit.”

Q: Americans have tightened their belts. How does our current 4 percent savings rate compare with the rest of the world?

Garon: The Chinese save at extraordinary rates, about 26%. But that’s something that happens with Asian economies just as they’re taking off. The Japanese and Korean economies did that too. The really interesting place is continental Europe. . . . The United States should be going down in its savings rates, because we’re an aging society. But the Europeans should be going down even farther, because they have more rapidly aging societies and very low birth rates. But the German, French, Austrian and Belgian savings rates are around 10 percent – Sweden has gone up to 13%.

Garon: The Chinese save at extraordinary rates, about 26%. But that’s something that happens with Asian economies just as they’re taking off. The Japanese and Korean economies did that too. The really interesting place is continental Europe. . . . The United States should be going down in its savings rates, because we’re an aging society. But the Europeans should be going down even farther, because they have more rapidly aging societies and very low birth rates. But the German, French, Austrian and Belgian savings rates are around 10 percent – Sweden has gone up to 13%.

Q: How did debt become culturally acceptable here?

Garon: Before the 1920s, it was no honor to be indebted. When installment buying became popular in the 1920s, that was seen as an acceptable form of debt. But we reached a new stage in the early 1990s, when society considered you stupid if you didn’t take on more debt. Why would you save up for something if you could borrow so easily?

What do you think of Garon’s take on U.S. financial culture? Squared Away would like to hear your comments after you read the full interview. …Learn More

November 22, 2011

Game Highlights Tough Choices for Poor

In May, Squared Away’s very first post was about an eye-opening “game” in which players take on the role of someone who is poor. The player is assigned a job and a paycheck. Every financial decision ricochets through the monthly budget, often in unexpected ways. Lives, children, and work choices are affected – poverty even creates unique ethical decisions.

The game, Spent, is so powerful, because its creators interviewed clients of Urban Ministries of Durham in North Carolina, which operates a food pantry, clothing closet, and homeless shelter. A local advertising firm, McKinney, designed the game in conjunction with Urban Ministries.

Happy Thanksgiving.

To play Spent, click here.

To read more, click here.Learn More

November 1, 2011

Job Risk Dictates Rainy Day Fund Size

Financial planners have scrapped the old rules for emergency funds as the time it takes to find work has skyrocketed.

The U.S. economy picked up a little bit of steam, growing at a 2.5 percent annual rate in the third quarter. But economists expect the unemployment rate to remain stuck around 9 percent for many months.

To protect against a potential job loss, financial planners until recently advised clients to set enough cash aside to cover their expenses for three to six months. Today, six months is their starting point. And the amount of financial cushion should be based on each individual’s job security – the more risk, the bigger the emergency fund. It’s similar to the argument that an entrepreneur, for example, should balance his or her job risk by investing conservatively.

“I ask a lot about their job,” said Rand Spero, president of Street Smart Financial near Boston. “I say you need to be in a savings mode and it needs to increase substantially.”

To calculate an emergency fund, every household needs to know two things: how much fat they can cut out of their budget and how much they can expect to receive in unemployment benefits. Benefits typically cover up to half of the state’s average weekly wage. It now takes 10 months, on average, to find a new job.

Using six months as the baseline, several planners outlined the risks for various life circumstances: …Learn More

October 20, 2011

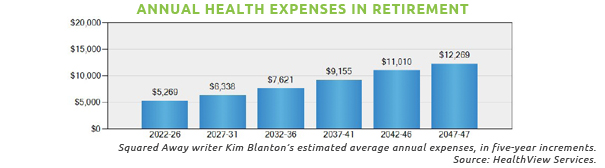

Calculate Your Retirement Health Costs

Mid- and late-career professionals staring into their futures, eyes glazed, often don’t have a clue how much their health care will cost them during retirement.

Few pre-retirees know how many holes exist in Medicare coverage. One MetLife survey this year found that 42 percent of pre-retirees age 56 to 65 believe, incorrectly, that their health coverage, Medicare or disability insurance will pay for their long-term care. Such knowledge gaps make it virtually impossible for most people to take a stab at tallying their total costs, out of pocket, for Medicare, Medigap, and private premiums and copayments over years of retirement.

Retiree healthcare is “the elephant on the table,” said Dan McGrath, vice president of HealthView Services outside Boston. The omission amounts to hundreds of thousands of dollars per retiree.

Calculators that estimate retiree health expenses are scarce, according to a 2008 AARP brief. But HealthView’s calculator, recently upgraded, estimates total out-of-pocket health expenses, which are tailored to an individual’s specific medical traits – diabetes, cholesterol, blood pressure etc. – and health habits – smoking, exercise etc.

Squared Away readers can obtain a free trial by emailing McGrath at dmcgrath@hvsfinancial.com. …Learn More