Posts Tagged "young adults"

August 13, 2015

Retirement: a Priority for Millennials?

Saving for retirement is more crucial for Millennials than for any prior generation. Data are emerging that reveal how they’re doing.

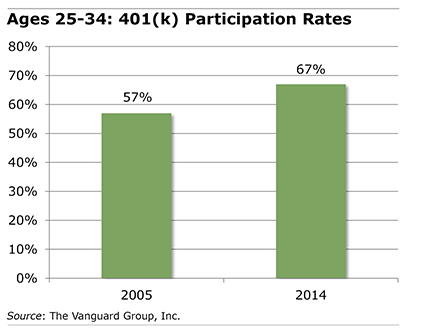

Vanguard’s 2014 data from its large 401(k) client base shows that 67 percent of young adults between 25 and 34 who are covered by an employer plan are saving – this is well above a decade ago.

Vanguard’s 2014 data from its large 401(k) client base shows that 67 percent of young adults between 25 and 34 who are covered by an employer plan are saving – this is well above a decade ago.

A survey recently by the Transamerica Center for Retirement Studies found evidence that this generation makes retirement a priority: a majority of working adults in their 20s and early 30s – now the largest single demographic group in the U.S. labor force – view retirement benefits as “a major factor in their decision on whether to accept a future job offer.”

This indicates that Millennials are getting the message, said Catherine Collinson, president of the Transamerica Center for Retirement Studies.

The growth of automatic enrollment in 401(k) plans “has helped pull young people and non-participants into the plans,” Collinson said, “but I also believe it’s also due to heightened levels of awareness.” …Learn More

July 21, 2015

Saving Is a Lot Like Yoga

Young people in the noon yoga classes here at Boston College bend, twist, or flatten themselves more easily than their much older classmates.

But older people are better savers – 50-year-olds save at more than double the rate of 40-year-olds – and perhaps yoga can explain how this happens.

In yoga, one doesn’t immediately balance into Warrior III without toppling over or find the upper-body strength for the Crow pose shown above. It takes practice to build the balance, strength, focus, or flexibility that each pose requires. Only with time do these pretzel-like configurations become less painful and more convincing. Poorly executed poses, practiced and repeatedly improved, are the only path to perfection.

Like yoga, saving is also a practice. …Learn More

July 7, 2015

College Debt = Student Stress

It’s hardly surprising that debt causes stress, but this condition seems rampant among the college crowd.

A new study in the Journal of Financial Therapy finds that nearly three out of four students feel stressed about their personal finances, and student loans are a big reason.

In 2012, the average graduating senior owed $29,400. Student debt has already been shown to be a barrier to homeownership and a cause of bankruptcy among young adults. Paying back the loans is also very difficult when borrowers don’t graduate and earn less in their jobs. Add stress to the host of issues that accompany borrowing for college.

Students who have debt or expect to be in debt after college – whether college loans, credit cards, or car loans – are “significantly more likely to report financial stress” than students who did not have any debt, the study reported. …Learn More

July 2, 2015

Top Blog Topics: Financial Ed, Retirement

It’s customary every six months for Squared Away to round up our readers’ favorite blogs. The following were your top picks during the first six months of 2015, based on an analysis of online page views.

To stay current on blog posts in the future, click here to join a once-weekly mailing list featuring the week’s headlines on Squared Away.

Retirement is a perennial favorite among readers. But the top 10 list below also includes blogs about financial education and knowledge of the U.S. retirement system, longevity, and the hardships specifically faced by older workers: …Learn More

June 18, 2015

Planning for a Centenarian’s Life

Americans have been labeled everything from the Greatest Generation to Generations X, Y, and Z. Are you ready for the Centenarian Generation?

The number of 100-years-olds has roughly doubled over the past two decades to more than 67,000 – mostly women – and the U.S. Census Bureau predicts it will double again by 2030. Just think about the implication of living for a century: retirement at, say, 65 means 35 years of leisure.

This is unappealing to some, unaffordable to many, and it impacts us all.

“We’ve added these extra years of life so fast that culture hasn’t had a chance to catch up,” Laura Carstensen, director of Stanford University’s Center on Longevity, said during a panel discussion at a recent Milken Institute Global Conference in Los Angeles. The best use for a additional 20 or 30 years of life isn’t, she said, “just to make old age longer.”

Granted, the Milken panelists – all privileged and accomplished baby boomers – are removed from the financial and other challenges facing most older Americans. But they have thought deeply about longevity and its consequences.

The following is a summary of their musings on how we might adjust to the coming cultural tilt toward aging:

- Young people need to be more engaged in the issue of increasing U.S. life expectancy, because it will affect Generation Z far more than it has today’s older population. To engage his son’s interest in the topic, Paul Irving, chairman of the Milken Institute’s Center for the Future of Aging, said he introduced the concept of 80-year marriages. “That started a conversation,” he said. …Learn More

June 11, 2015

Get a Truly Free Credit Report

These federal government resources should be helpful to Squared Away readers ranging in age from 20 to 70:

Free credit report: Young adults in particular may not be aware they’re entitled to a free credit report from one of the major credit rating agencies. To ensure the report truly is free, click and follow the links to an outside source recommended by the Federal Trade Commission. To file a paper request or ask for a report by telephone, try the federal Consumer Financial Protection Bureau’s website.

New U.S. Social Security Administration blog: The agency started a new blog last month to provide important benefit information under various programs. Here’s a sample of three useful articles on the blog:

- Replace dog-eared Medicare cards online via your individual Social Security account. If you don’t have an online account, get one here.

- See one example of the large increases in pension benefits that come with delaying when one claims benefits. …

June 9, 2015

Student Debt Burdens Non-Grads More

The share of college students who must borrow to pay for their education has surged over the past decade. Average borrowing per student is also much higher than it was in 2004, though there’s evidence it might now be in decline.

The share of college students who must borrow to pay for their education has surged over the past decade. Average borrowing per student is also much higher than it was in 2004, though there’s evidence it might now be in decline.

Only now is serious research trickling in about the personal financial fallout from the nation’s $1 trillion-plus in student debt outstanding. But one new study reaches an interesting conclusion about the burden of student debt: it “is much greater among non-completers than among those who obtain a college degree.” One reason is that they can’t expect to earn the higher income that a degree confers on a graduate.

The study – part of an edited volume published by the W.E. Upjohn Institute for Employment Research, “Student Loans and the Dynamics of Debt” – gauged the debt’s impact on various measures of personal financial stability, including the likelihoods of filing for bankruptcy protection and buying a house.

The researchers first analyzed a broad sample of U.S. households over age 29, controlling for income and other demographic characteristics. They found some negative impact as student debt levels rise, but this effect was “not particularly strong.”

However, there was a large impact on the financial stability of a subgroup of borrowers who had not completed their degrees. The personal finances of these “non-completers,” as the study called them, are “particularly susceptible to being burdened by student debt.”…Learn More