Posts Tagged "young adults"

July 31, 2014

Graduates Struggle for Autonomy

If buying a house or having children were once hallmarks of being a grown-up, something more basic marks a successful transition to adulthood today: financial self-sufficiency.

Only half of more than 1,000 freshmen who entered the University of Arizona in 2007 and were tracked over time by researchers Joyce Serido and Soyeon Shim were employed full-time in 2013. And only half of these full-time workers, ranging in age from 23 to 26 years old, supported themselves without help from family members.

These young adults, mostly graduated, overwhelmingly said that achieving financial independence was critical, according to Serido and Shim’s new report, “Life After College: Drivers for Young Adult Success.” But achieving independence has been difficult due to unprecedented borrowing for college and a post-Great Recession job market that’s been described as “bleak” for young adults.

While the economy certainly poses hurdles, the report concludes that too many young adults fail to take responsibility for their personal finances. Recent graduates were grouped into three levels of financial behavior: high-functioning, rebounding, and struggling. Which one is you or your child? …Learn More

July 8, 2014

Millennials and Money: Women Trail Men

Millennial women may have higher expectations about their financial prospects than their baby-boomer mothers.

But Millennial women, just like their mothers, are earning less than their male counterparts and saving less for retirement.

The vast majority of single and married men and women, ages 22 through 33, said they recognize the need to save, whether as a defense against economic uncertainty or in response to the onus on each U.S. worker to prepare for his or her own retirement.

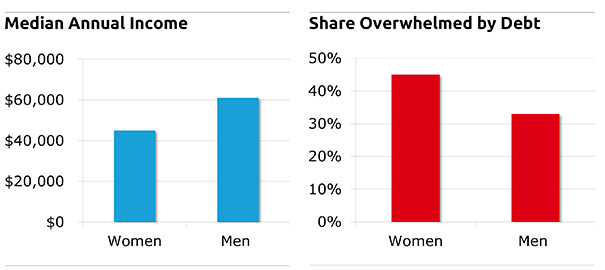

A major reason cited for not saving is “not having enough money to save right now.” This is especially germane for women: for example, the median annual income for Millennial women is $45,000, while their male counterparts earn $61,000.

Women, on the other hand, would make wiser choices about what they’d do with a $5,000 windfall: they’d be less likely than men to spend the windfall and more likely to save it or use it to pay down debt.

Harris Poll conducted the nationally representative online survey of 1,600 Millennial households for Wells Fargo. In addition to single Millennials, married and single mothers were also surveyed, and child-rearing responsibilities likely reduced the incomes reported by women.

Nevertheless, Millennial women trail their male peers in five financial benchmarks shown below:

May 27, 2014

Attending College if Your Parents Didn’t

Education has historically been the most powerful way for children of the U.S. working class to brighten their futures. But as the cost of college rises, they must climb taller and taller mountains to attend.

The ideal for college – an ideal still pursued by students whose parents can afford it – is to attend full-time and focus on one thing: their studies. But five untraditional students who were profiled in a new documentary say they must juggle their multiple pressing priorities:

- Work, sometimes full-time, to support themselves or help support parents or siblings.

- Maintain a high grade point average after poor high school preparation.

- Inadequate financial aid packages and parents who are unable to help.

- Parents who may not understand the college financial aid process.

- Complexities of transferring credits from a community college to a four-year institution.

Like many untraditional students, Sharon Flores is the first generation in her family to attend college. This top high school student and daughter of a single mother explains her struggle to attend King’s College in Pennsylvania in the documentary, “Redefining Access for the 21st Century Student,” which was produced by the Institute for Higher Education Policy in Washington. …Learn More

May 22, 2014

1 in 3 Late in Paying Student Debt

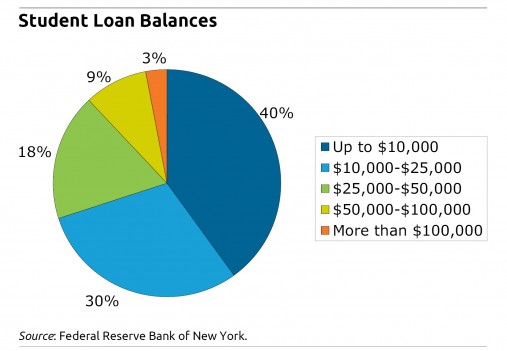

About one in three Americans trying to pay down their student loans is 90 days or more late on their payments, according to a new report by the Federal Reserve Bank of New York.

This is up sharply from a decade ago, when one in five people in repayment was that far behind.

The Federal Reserve estimates that 31% was the “effective” delinquency rate in 2012; it applies only to people who have actively been in repayment. The bank said this rate is a more accurate measure of the problem than the widely reported rate for 90-day delinquencies – 17 percent – which includes all borrowers, including current students and those who’ve been granted some type of loan payment deferral.

The report, “Measuring Student Debt and Its Performance,” provides more evidence that college debt is a major financial burden for a growing numbers of Americans. Between 2004 and 2012,  the number of people borrowing for college has nearly doubled to about 39 million, and the total debt outstanding has nearly tripled to $1 trillion and now exceeds the nation’s credit card debt.

the number of people borrowing for college has nearly doubled to about 39 million, and the total debt outstanding has nearly tripled to $1 trillion and now exceeds the nation’s credit card debt.

Delinquencies, by any measure, are higher for student debt than for any other type of U.S. consumer debt, including credit cards. The pace of delinquencies is also accelerating, according to the Federal Reserve.

Other trends highlighted in its report include: …Learn More

April 29, 2014

Pay Gap: Depends on Woman’s Age

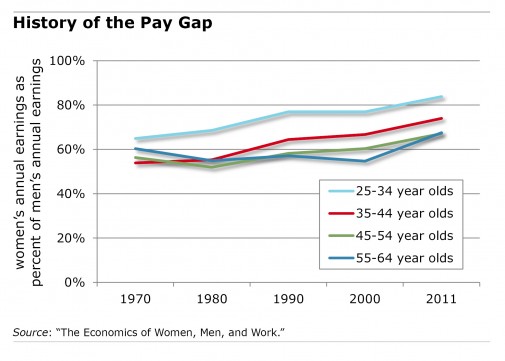

The earnings gap between working men and women has narrowed somewhat over time, but it’s considerably wider for older women.

Women who are now on the cusp of retirement and working full-time earn 67.5 cents for every dollar men their age earn – or 8 cents more than working women who were the same age (in their late 50s and early 60s) during the 1970s.

Women who are now on the cusp of retirement and working full-time earn 67.5 cents for every dollar men their age earn – or 8 cents more than working women who were the same age (in their late 50s and early 60s) during the 1970s.

For younger women, the pay gap persists but things are brighter. Women in their late 20s and early 30s today earn 84 cents for every dollar a young man earns. That’s a 20 cent gain over women who were their age back in 1970.

These are among the myriad statistics documenting the history of the pay gap in the new (7th) edition of the economics textbook, “Economics of Women, Men, and Work.”

The pay gap affects women’s ability to save, buy a house, and invest. There are several explanations for why younger women have made more progress, relative to men, say the textbooks’ authors, Francine Blau, Anne Winkler, and Marianne Ferber: …

Learn More

April 17, 2014

Social Security 101

As a young adult starting my career in Chicago in the 1980s, I didn’t have a clue how Social Security worked or why money was being taken out of my scrawny paycheck.

But trust me on this: the Social Security retirement program becomes a lot more interesting to workers as they age and their retirement horizon comes into sharp focus. It affects just about every American – and most of us pay into it.

It is not only the bedrock of retirement for millions of Americans and their spouses, but it’s also a source of income for their survivors, including children, and workers who become disabled.

In this video, officials from the U.S. Social Security Administration explain what its programs do and why they matter. Learn More

March 27, 2014

Post Recession: Strugglers vs Thrivers

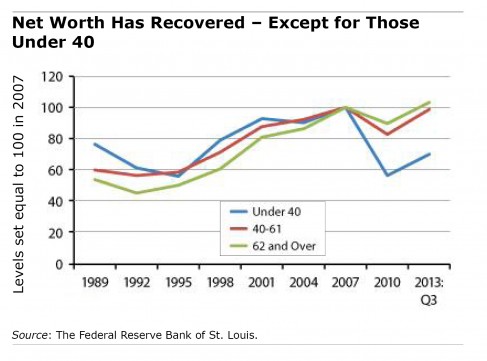

The Federal Reserve Bank of St. Louis, based on its analysis of data from the Survey of Consumer Finances, estimates that the recession has ended for only about one-quarter of the U.S. population – the thrivers, who have paid down their debts and restored their savings. That would leave three out of four Americans who are still struggling. Squared Away interviewed Ray Boshara, director of the Center for Household Financial Stability at the bank; Bill Emmons, senior economic adviser; and Bryan Noeth, policy analyst, for their insights into why most Americans’ net worth – their assets minus debts – hasn’t recovered.

Q: You distinguish “thrivers” from “strugglers.” Who are these two groups?

Boshara: The thrivers versus strugglers construct is a simple way to make the point that some demographically defined groups are doing better, on average, than others in terms of net worth – what you save, own, and owe, or your entire balance sheet. We found that age, race, ethnicity and education levels are pretty strong predictors of who lost wealth and who’s recovered wealth over the past few years, as well as over a longer period of time.

Q: Describe the typical thrivers.

Emmons: Whites and Asians with a college degree who are over 40 – that’s the typical thriver. Remember, this is a construct, and it’s not 100 percent foolproof. But you would tend to say these groups are more likely to have outcomes consistent with recovering.

Q: How about the typical strugglers?

Emmons: By age – they’re younger – and they’re African-American or Latino. They also do not have a college degree, and they have too much debt. They’re the other three-fourths of the population. They are not holding enough liquid assets, so they’re just one paycheck away from a crisis. They do not have a diversified portfolio and aren’t benefitting from the stock market gains. They’ve got too much in the house, which has declined in value.

Q: What have you learned about young adults and their wealth – or lack of it?

Q: What have you learned about young adults and their wealth – or lack of it?

Emmons: It jumps off the page in our analysis: It doesn’t matter if you’re white or college educated. If you’re young, you’re vulnerable, and you’ve made the same portfolio mistakes as people with less education: low levels of liquid assets, too much in the house, an issue that is related to portfolio diversification, and more leverage. …Learn More