Posts Tagged "young adults"

March 20, 2014

Money Habits Set Millennials Apart

Millennials, now in their 20s or early 30s, are ethnically more diverse and better educated than any previous generation. They also demonstrate different financial behaviors that may partly reflect new trends in society and in technology.

Millennials’ financial struggles are a natural consequence of being new entrants to the labor force. Two-thirds of them earn less than $50,000 annually, and they are more likely than Generation X (now mostly in their 40s) to spend more than they earn, according to the FINRA Investor Education Foundation’s newly released survey of some 25,000 adults of all ages.

But FINRA’s survey provides clues to the financial habits that may set Millennials apart from previous generations:

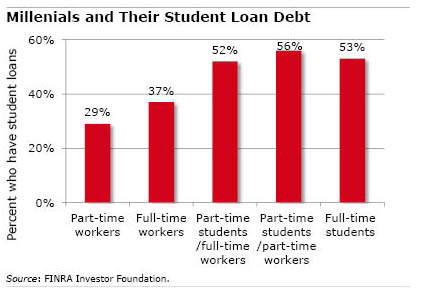

- More than one in three has taken on debt for college. The share rises to half of Millennials who are either full-time or part-time students.

- Millennials are slightly more likely than prior generations to be offered financial education and to participate in it. Millennial men have higher financial literacy than their female peers, but this gender gap has shrunk from prior generations. This improvement still might not offset the greater need for financial capability, due to their higher student debt levels. …

March 11, 2014

Students Take Charge of College Loans

Tatiana Andrade (standing), an ambassador for American Student Assistance, hosts a Jeopardy match to educate classmates about their student debt.

College students usually plan on repaying their loans after graduation, when they’ve landed a full-time job. Freshman Tatiana Andrade is making payments while she’s still in school.

Andrade is already $14,500 in debt. She’s on track to owe some $60,000 when she completes her four-year degree at Stonehill College outside Boston, even though her parents are sharing the cost. To chip away at her debt, she pays off between $100 and $150 per month from her earnings in a part-time job.

Andrade is among a slim but growing minority of students and recent graduates becoming proactive to get control of their student debt – before it controls them. She advises classmates to do the same as Stonehill College’s ambassador for the non-profit American Student Assistance (ASA), which has a program and website – SALT – aimed at educating and counseling students on strategies to minimize how much they borrow and to manage their loan payments.

Making loan payments today minimizes the total amount she’ll pay in the future for three reasons. Loans paid immediately carry a lower interest rate than loans that permit her to defer payment until after graduation. She’s cutting down the total amount she’ll have to pay back after graduation. She said she also avoided a loan-origination fee required on deferred loans equal to 4 percent of the loan.

“Every dollar counts,” she said. Waiting until graduation “is the worst thing you can do.” …Learn More

January 30, 2014

TV’s “Shameless” Takes on 401(k)s

In this video clip from “Shameless,” young adults may relate to Fiona’s reaction to “the 401(k) talk” by a manager who pops into Fiona’s cubicle.

This popular television dramedy, “Shameless,” is about the dysfunctional Gallagher family of Chicago, and oldest daughter Fiona (played by Emmy Rossum) does what she can to keep things together. But how to cope with the 500-page 401(k) binder her manager drops on her desk with a thud?

It’s been rare that 401(k)s are mentioned on television. So, why have retirement savings accounts entered our popular culture?Learn More

January 9, 2014

iPad Shoppers: More Likely to Buy?

A new study out of Boston College finds that e-shopping for products while grasping an iPad increases the feeling of ownership of that product – and may make you more likely to buy it.

The findings expand on a financial behavior issue explored in a popular Squared Away blog post about how the Internet has made it much easier to shop – and spend money. The new research distinguishes among the various technologies available to online shoppers and finds that the urge to buy may be even stronger when holding a touch screen device than when using a laptop or desktop computer.

The way this works is that the tactile experience of holding a product – whether taking it off the store rack or grasping the device that’s displaying it – imbues some sense of ownership, making it harder to give it up and resist buying it.

Here is an edited excerpt of an article explaining the research; the article appeared in Chronicle, a publication for Boston College faculty and staff. …Learn More

December 19, 2013

Readers’ Favorite Stories in 2013

The blog posts that attracted the most readers this year provide a window into what’s on their minds. The 2013 articles shown below were the most popular, based on unique page views by Squared Away readers.

We’ll return Jan. 2 with more coverage of financial behavior. Please click here to begin receiving our once-per-week alerts with the week’s headlines – and happy holidays!

To find each article, links are provided at the end of the headlines:

An historical perspective on the U.S. money culture:

Oldest Americans are Lucky Generation

More Carrying Debt into Retirement

The financial challenges facing our youngest workers:

Retirement Tougher for Boomer Children

Student Loans = No House, No New Car

Help with your imminent retirement:

Reverse Mortgages Get No Respect …Learn More

December 10, 2013

Compare Your Retirement to Peers

How are your retirement plans going? If you’re a conservative Generation Y investor, are you in the mainstream? Baby boomers, how many in your generation are planning to retire at the same age you do?

Compare yourself with your peers in this cool interactive quiz developed by the Boston mutual fund company, Fidelity Investments.

Click here to check it out.

As you answer each question, you can compare yourself with your peer group’s answer to that same question, based on a prior survey for Fidelity by the polling company, Gfk. Your peer group is determined by your income and your generation – baby boomer, Generation X and Generation Y. Fidelity also provides useful information and tips with each question. …Learn More

November 14, 2013

Will Millennials Be Ready to Retire?

As he logged on to his online 401(k) retirement account, Jordan Tirone, a 25-year-old insurance underwriter, explained the mental accounting behind his 5 percent contribution.

He pays $300 a month to live with his mother so he can pay off student loans. Nevertheless, a regular paycheck from his Hartford, Conn., employer is finally giving him some financial stability. “I’m feeling like I’m gaining some traction,” he said.

Spontaneously, he clicks his mouse and increases his contribution to 6 percent of his salary.

Although it can be difficult to focus on a retirement that is still 40 years away, many young adults like Tirone try very hard to save. But are they doing enough? A lot of evidence suggests they’re not, either because they can’t afford to, refuse to, or don’t know what to do.

Adults in their 20s and early 30s, in a recent survey of 401(k) participants by Brightwork Partners LLC, predicted they would have to rely on their personal savings for half of their income in retirement.

Adults in their 20s and early 30s, in a recent survey of 401(k) participants by Brightwork Partners LLC, predicted they would have to rely on their personal savings for half of their income in retirement.

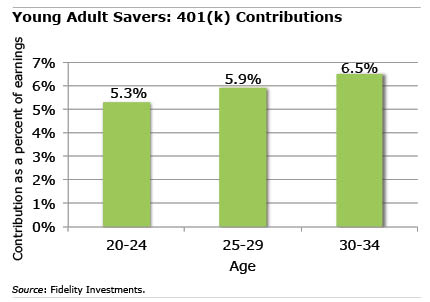

Their 401(k) contributions don’t square with their expectations. Data on retirement plans administered by Fidelity Investments show that adults in their late 20s contribute 5.9 percent to their 401(k)s; by their early 30s, that increases to 6.5 percent.

But a typical 25-year-old who wants to retire at age 67 should contribute anywhere from 10 percent to 12 percent of his pay, according to various estimates. … Learn More