Posts Tagged "young adults"

July 18, 2013

Amid Recovery, Part-Time Jobs Still High

One segment of the U.S. labor force sheds light on the continuing struggle to find work: part-time employees who want a full-time job but can’t find one.

One segment of the U.S. labor force sheds light on the continuing struggle to find work: part-time employees who want a full-time job but can’t find one.

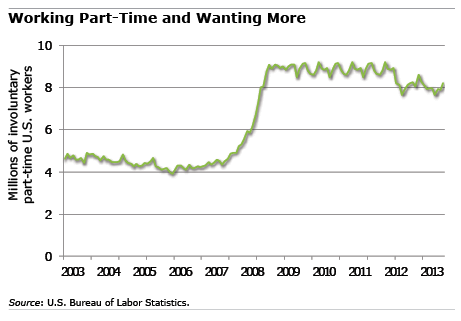

The U.S. unemployment rate has drifted down during the economic recovery. But the number of people the Department of Labor calls “involuntary part-time” roughly doubled during the recession to 8 million and still remains stuck at this much higher level.

Millions of Americans work part-time because they want to, but this involuntary part-time workforce is one more gauge of the slack labor market and lingering pain three years after the Great Recession officially ended. The Labor Department counts part-timers as involuntary if they can’t find a full-time job or if they work part-time for economic reasons, say a construction worker who doesn’t have enough projects to keep busy. …Learn More

July 2, 2013

Readers Call Gen-X to Action

A recent blog article, “Retirement Tougher for Boomer Children,” did not elicit much sympathy for Generation X.

Many readers who commented expressed a sentiment something like this: Yes, things are tougher for young adults. So deal with it.

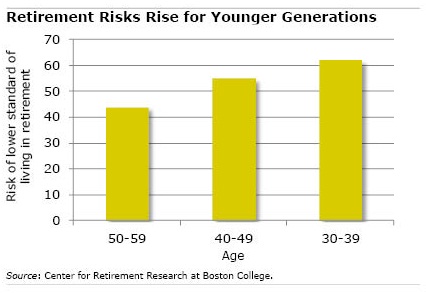

Members of Generation X, as well as Millennials, are largely on their own with their 401(k)s, in contrast to their parents and grandparents who may’ve had a guaranteed pension at work. But the evidence indicates young adults are not preparing for retirement: well over half of 30- and 40-somethings are on financial path to a lower standard of living once they retire, according to an analysis cited in the article.

They need to find “the discipline to save for retirement through all the means available,” said a Squared Away reader named Paul. …Learn More

June 13, 2013

Retirement Tougher for Boomer Children

The financial media (including this blog) inundate baby boomers with articles cajoling, coddling, and counseling them about their every retirement concern.

But members of the Me Generation might want to focus on their children: retirement is likely to be an even greater financial challenge for Generation X, now in their 30s and 40s.

Economists at the Center for Retirement Research, which supports this blog, recently produced this striking prediction: three out of five Americans in their 30s and well over half of those in their 40s are at risk of experiencing a decline in their standard of living after they retire.

Economists at the Center for Retirement Research, which supports this blog, recently produced this striking prediction: three out of five Americans in their 30s and well over half of those in their 40s are at risk of experiencing a decline in their standard of living after they retire.

This compares with 44 percent of baby boomers.

The reasons for Generation X’s poorer prospects are due to long-term trends like the rise of 401(k)s and less generous Social Security benefits for future generations. …Learn More

June 6, 2013

Nobel Winners Are Unsure Investors

A Los Angeles Times reporter once called up several Nobel laureates in economics to ask how they invest their retirement savings.

One of the economists was Daniel Kahneman, a 2002 Nobel Prize winner who would become more famous after writing “Thinking, Fast and Slow” about the difference between fast, intuitive decision-making and slow, deliberative thinking. Kahneman admitted to the reporter that he does not think fast or slow about his retirement savings – he just doesn’t think about it.

Kahneman’s confession in the 2005 article seems even more relevant in today’s 401(k) world. Americans are realizing the investment decisions imposed on them by their employers may be too complex for mere mortals. For example, three out of four U.S. workers in a 2011 Prudential survey said they find 401(k) investing confusing.

Readers might take comfort in learning that even some of the world’s great mathematical minds have admitted to wrestling with the same issues they do: How do I invest my 401(k)? Should I take some risk? How about international stocks?

Here are the Nobel laureates remarks, excerpted from the article, “Experts Are at a Loss on Investing,” by Peter Gosselin, formerly of The Los Angeles Times:

Harry M. Markowitz, 1990 Nobel Prize:

Harry M. Markowitz won the Nobel Prize in economics as the father of “modern portfolio theory,” the idea that people shouldn’t put all of their eggs in one basket, but should diversify their investments.

However, when it came to his own retirement investments, Markowitz practiced only a rudimentary version of what he preached. He split most of his money down the middle, put half in a stock fund and the other half in a conservative, low-interest investment. …Learn More

May 23, 2013

Student Loans = No House, No New Car

Here’s what Will Flannigan, 26, would rather do with the $401.58 he pays on his student loans every month.

• Save.

• Buy a house: the mortgage payment on a house he looked at was the same as his rent, but renovating or fixing anything would be unaffordable.

• Replace his 2006 Ford Focus – it’s red but he calls it a “lemon.”

• Buy new clothes – thrift shops are standard.

• Eat dinner out at someplace other than a fast food restaurant.

Flannigan is getting married in August – to a woman who pays about $250 per month for her college loans.

Flannigan is getting married in August – to a woman who pays about $250 per month for her college loans.

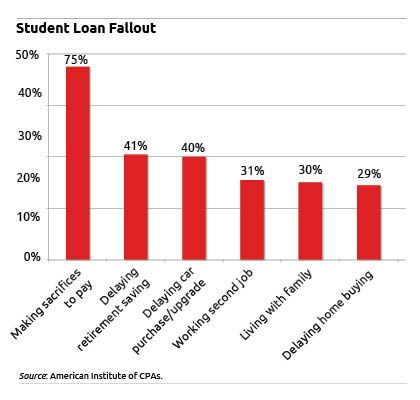

Three out of four people now paying off student debt – whether graduates or their parents – are just like Flannigan: they’re delaying important life goals in order to make their payments, according to a new survey by Harris Interactive sponsored by the American Institute of CPAs (AICPA). About 40 percent also said they have delayed saving for retirement or buying a car, to name just two deferred goals.

This survey, which was random and based on telephone interviews, illustrates the reason behind the growing concern among financial advisers, 20- and 30-somethings, and their parents that paying for a college education has become a burden with financial implications for years, even decades.

“It’s indentured servitude – that’s what it is,” said Flannigan, a Kent State graduate (2010), whose loan payments equal one-quarter of his salary as the online editor of Farm and Dairy, in Salem, Ohio, near Youngstown. Payoff horizon for his $62,000 loans: more than 25 years, according to his loan documents, he said….Learn More

April 25, 2013

Student Debt Binge: How Will It End?

This recent Huffington Post headline captured the march of shocking data about our growing societal burden: “12 Student Loan Debt Numbers That Will Blow Your Mind.”

Here’s a sample:

- The student debt balance has hit $1 trillion and is still rising – it is now exceeded only by mortgage balances, according to the Federal Reserve Bank of New York;

- Student debt is held by 26 percent of households headed by someone between the ages of 35 and 44, and 44 percent of under-35 households, and it’s concentrated in poorer households, according to the Pew Research Center;

- 80 percent of bankruptcy lawyers said student loans were driving more clients through their doors for relief.

It remains unclear where this era of student debt is taking society. Sure, college graduates will bring in another $1 million in earnings over a lifetime. But anyone who’s thought about it can’t help worrying this nationwide borrowing binge may end badly.

To help those grappling with how to pay for the fall semester, feeling the emotional fallout of debt, or trying to understand the larger issues, Squared Away pulled together some relevant blog posts published over the past 18 months.

Click “Learn More” below to read more. …Learn More

April 18, 2013

To Live Cheaply, See the World

Adam Shepard estimates that it cost him $19,420.68 to circumnavigate the globe from October 2011 through September 2012.

It was a budget tour filled with simple pleasures and wild adventures for the failed professional basketball player and successful book author. He helped poor children in Honduras, hugged a koala in Perth, rode an elephant in Thailand, bungee jumped in Slovakia, and hung out in lots of places with Ivana, whom he met while traveling and later married (she brought only $12,000, so he paid for the food).

If he’d kept his bartending job in Raleigh, North Carolina, his car, and apartment, he estimates he would’ve easily spent more than $20,000 during that same year.

“If you wonder whether an odyssey like mine is financially realistic for you, I answer with a resounding yes,” he writes encouragingly in his new e-book, “One Year Lived,” which is being published today.

You’d have to read it to find out how he did it – and how energetic someone has to be to pull off an escapade through 17 countries. Shepard’s book is a strong reminder to those of us who burrow at our desks day after day that, as the saying goes, there’s more to life than money. …

Learn More