Posts Tagged "young adults"

July 26, 2012

Student Loan Prevention: Part 1

It’s panic time! College-bound teenagers and their parents are excitedly touring colleges this summer, or they’re signing the dreaded Stafford loan documents to pay for college in the fall.

One thing is crystal clear in the emotional fog of this exhilarating rite of passage: parents and their teenagers both need to get serious about limiting their dependence on student loans. Squared Away asked several experts on financing a college education for their best tips on minimizing total borrowing for college.

Some of their debt-cutting strategies are difficult to swallow. But since 2005, student loans have shot up 55 percent, to $24,301 per student, for an undergraduate degree that has, as one financial adviser noted, become “ubiquitous.” Yet college places an unprecedented financial burden on parents also saving for retirement and on graduates when they get their first full-time jobs. Debt prevention also requires families to face head-on the emotional roadblocks to an affordable education.

Squared Away came up with 10 debt-prevention strategies. Here are the first five ideas, with five more scheduled for next Tuesday. Links to Web resources are also sprinkled throughout the article.

- Aid Deadlines Are Crucial

Buy a calendar and red marker and closely track every single deadline for merit or need-based aid – they’re different for each college under consideration.

“If I could give you one piece of advice that would be it,” said Lyssa Thaden, a financial education manager for American Student Assistance, which educates and counsels student-loan borrowers.

Thaden listed four common mistakes that cost parents dearly, requiring them to borrow more: …Learn More

June 14, 2012

Progress Stalls for Young Adults

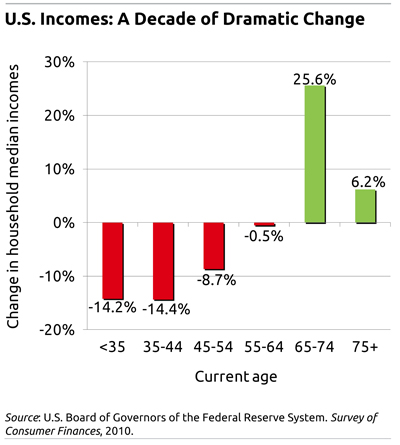

The promise of America is progress, but that progress stalled for the youngest generation: U.S. workers under age 45 earned dramatically less than workers who were that same age a decade ago, the Federal Reserve Board’s latest survey shows.

For Americans 35 through 44, the median household income – the income that falls in the middle of all earners – was $53,900 in 2010. That’s 14 percent less income than in 2001 when households in the 35-44 age bracket were earning $63,000, according to the Fed’s Survey of Consumer Finances released Monday. For young adults in the under-35 age bracket, median income fell to $35,100 in 2010, from $40,900 for that group in 2001.

The median income also declined, by nearly 9 percent, for Americans in their peak earning years, 45 through 54, to $61,000 in 2010 from $66,800 in 2001. [Incomes for all years are in current dollars.]

The sharp decline in real incomes, especially for young adults, occurred in a decade bracketed by the high-tech bubble of early 2000 and the jobless recovery of 2010 from the financial crisis. Without further analysis, it’s difficult to pinpoint precise explanations for the patterns. But the reasons vary depending on the age bracket being analyzed.

For the youngest workers, incomes may be lower if many are extending their college educations – high school and college graduates face the lowest level of employment ever recorded.

Learn More

June 5, 2012

College Loans: A Punitive System?

News emerging on several fronts points to what increasingly looks like a student-loan system stacked against young adults fresh out of college.

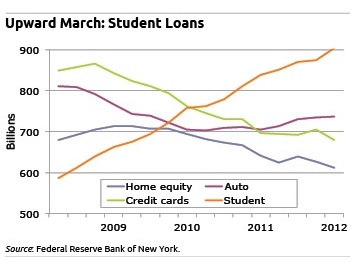

The Federal Reserve Bank of New York last week said college debt outstanding surged to a record $904 billion – the figure, from a new and improved Fed data set, was higher than had previously been thought. What was also noteworthy was that the central bank said a $300 billion spike in college debt since 2008 has occurred during a time other U.S. households slashed $1.5 trillion from their loan balances in a massive, post-recession belt tightening.

The Federal Reserve Bank of New York last week said college debt outstanding surged to a record $904 billion – the figure, from a new and improved Fed data set, was higher than had previously been thought. What was also noteworthy was that the central bank said a $300 billion spike in college debt since 2008 has occurred during a time other U.S. households slashed $1.5 trillion from their loan balances in a massive, post-recession belt tightening.

Student loan debt “continues to grow even as consumers reduce mortgage debt and credit card balances,” Fed senior economist Donghoon Lee said.

Washington is the first place to look for one Kafkaesque aspect of the college loan system. Politicians are engaged in brinksmanship over whether to allow the expiration of a temporary interest rate reduction for the Stafford Loan program put in place in 2007. This would cause the rate to double, returning to its previous level of 6.8 percent.

That’s a nice interest-rate spread for the federal government, which currently pays historic lows of about 1.5 percent on 10-year U.S. Treasury Bonds and 2.5 percent for 30 years. Even taking into account the sky-high default rate on student loans, is 6.8 percent a fair price for recent graduates to pay? …Learn More

May 8, 2012

Graduating in Era of Low Opportunity

Philip Seymour Hoffman playing the washed-up salesman, Willy Loman, in “Death of a Salesman,” is all the rage on Broadway. But when I saw the play recently, it was Biff who got me thinking about young adults today.

Philip Seymour Hoffman playing the washed-up salesman, Willy Loman, in “Death of a Salesman,” is all the rage on Broadway. But when I saw the play recently, it was Biff who got me thinking about young adults today.

In the Arthur Miller classic, Willy anguishes over son Biff’s failure to hold down a job in the city. But the irony is that Biff, played by Andrew Garfield, probably did very well for himself after leaving Brooklyn for Texas. I imagine he became an oil baron or wound up owning substantial real estate in downtown Houston.

Young people graduating from high school or college today don’t have the virtually unlimited opportunity that existed in the 1940s when Miller wrote the play: the personal drive to find a job and establish a career is not enough anymore. Young graduates who sign up for unpaid internships and double up on college degrees are well aware of this.

Last year, 54 percent of adults ages 18 to 24 were employed – that was the lowest level since the government started tracking the data, in 1948 – according to a February report by the Pew Research Center. Despite an improving job market, it was only 55 percent in March. Job creation – 115,000 were added in April – is below the pace that will open up meaningful opportunity for young people. …Learn More

April 2, 2012

Young Adults Face Unique Money Issues

Many young adults right out of college are planning career moves or marriage – while grappling with complex financial issues.

Student loans weigh them down. And despite the improving job market, it’s still tough to find a job. Wages and salaries for those who are employed are stagnant in many industries. Thanks to the proliferating opportunities for e-shopping, young adults also face more temptations to buy than any previous generation.

“I feel like I’m definitely in the lion’s den,” said Eric Bell, who, at 28, is trying to get his financial education website for 20-somethings, YoBucko, off the ground. A former private banker, he is also looking for a job in his field, paying off student loans, and cheering on his girlfriend in her attempt to buy her first home.

Below are a few previous Squared Away posts written with young adults in mind. A link is provided at the end of each article’s title, or you can join the conversation on Facebook.

- Young Adults Adrift in E-Spending Ocean

PayPal, Groupon, smartphone apps that pay for store purchases, online retailers galore – technology has made shopping a breeze. Young adults unfamiliar with the old-fashioned cash economy may not realize how damaging electronic commerce can be to their budgets. …

February 13, 2012

Will Saying “I Do” Affect Your Saving?

The single-married divide is dramatic: single adults between the ages of 22 and 35 are far less likely to have retirement savings accounts than are married people their age.

This difference, which is most pronounced for women but also true for men, highlights a conflict between two mega-trends. The number of single Americans has surged to nearly 100 million – 43 percent of the adult population. Yet they are less likely to save at a time that all young Americans face greater responsibility for funding their own retirement than any prior generation.

About 22 percent of single women have employer-sponsored retirement accounts, compared with 44 percent of married women. For single men, only 28 percent have employer accounts, while 44 percent of married men do, according to a February paper in the Journal of Marriage and Family by researchers at the Social Security Administration (SSA).

“By highlighting the link between marriage and retirement savings in young adulthood, our analysis identifies an often-overlooked economic outcome related to marriage,” SSA researchers Melissa Knoll, Christopher Tamborini, and Kevin Whitman write. Data for their sample of 3,894 people came from the Federal Reserve’s Survey of Consumer Finances in 2001, 2004, and 2007.Learn More

January 24, 2012

Young Adults Adrift in E-Spending Ocean

Collectibles purchased online range from Russel Wright dinnerware (shown here) to songs and video. Source: backhomeagainvintage.

Credit cards and malls are so yesterday.

Young adults move easily among an array of online payment and shopping options unimaginable a decade ago: PayPal, Groupon, telephone bill payment, smartphone apps that pay for store purchases, online retailers galore, automatic bank payments, and online gift cards.

Technology is moving fast: Amazon recently released an app called “Flow” that will recognize a product — from a book to a jar of Nutella — and then send the price, user reviews and a “Buy It Now” option to your smartphone.

It’s time to take stock of how easy it has become to overspend and how difficult saving is for young adults weaned on e-transactions.

“When it doesn’t feel like money, people don’t treat it like money,” said Priya Raghubir, a professor at the New York University Stern School of Business, neatly summing up her 2008 paper, “Monopoly Money: The Effect on Payment Coupling and Form on Spending Behavior.”

It’s extremely hard for young adults to change their behavior, “because they aren’t used to any other way of paying,” said Raghubir, 48, who remembers the old paper-transaction days when cash was king and checks were reserved for the big purchases…Learn More